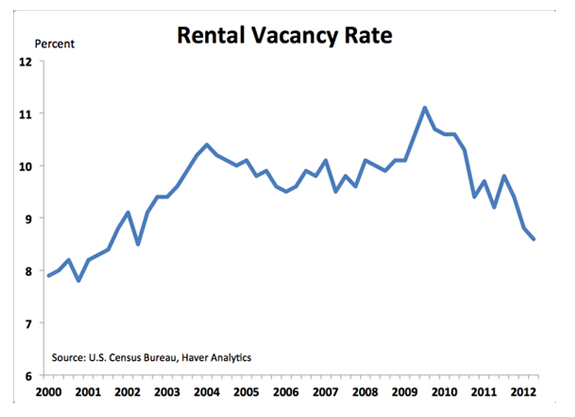

The fundamentals for multifamily residential sector continue to improve in the second quarter, as rental vacancy rates fell to the lowest level in a decade.

- The rental vacancy rate declined 20 bps, to 8.6 percent, compared to a peak above 11 percent in 2009 (Chart 1).

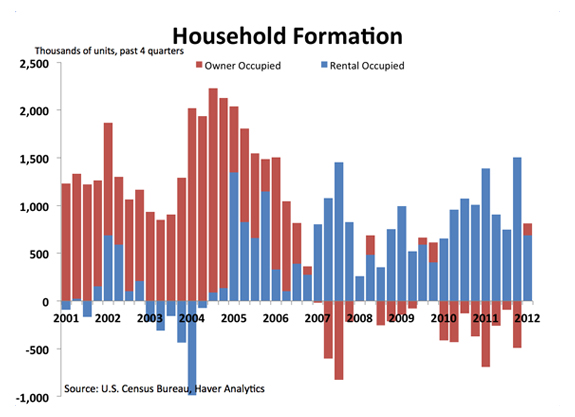

- New demand for living space is flowing almost entirely into rental units (Chart 2).

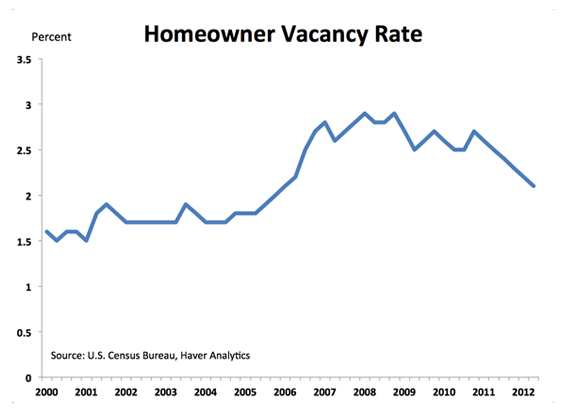

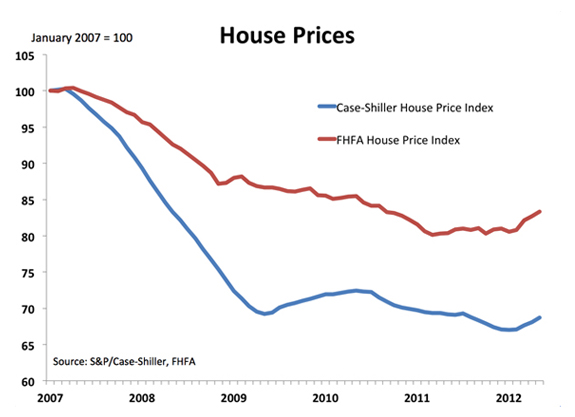

- Demand for rental units remains strong even as the homeowner market begins to stabilize. For example, the homeowner vacancy rate has fallen nearly a full percentage point from its peak (Chart 3) and housing prices have turned up in recent months (Chart 4).