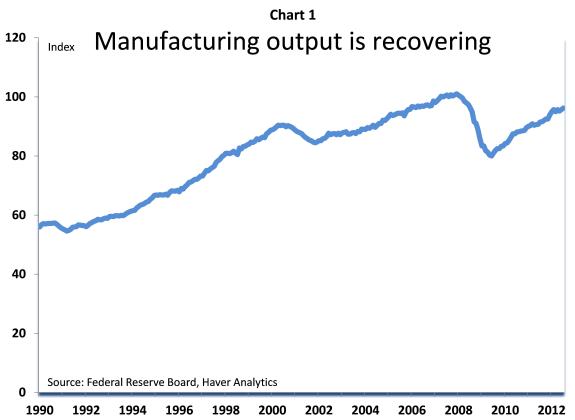

The manufacturing and industrial sector has had a choppy recovery around a rising trend:

- Manufacturing production rose 0.5 percent in July and is 5.0 percent above a year ago;

- Output is still 5 percent below its pre-recession peak (Chart 1);

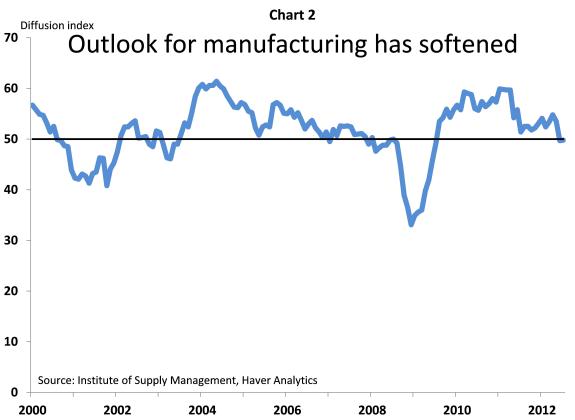

- The outlook has softened with the weakening global economy: debt crisis in Europe and the U.S. “fiscal cliff” (Chart 2);

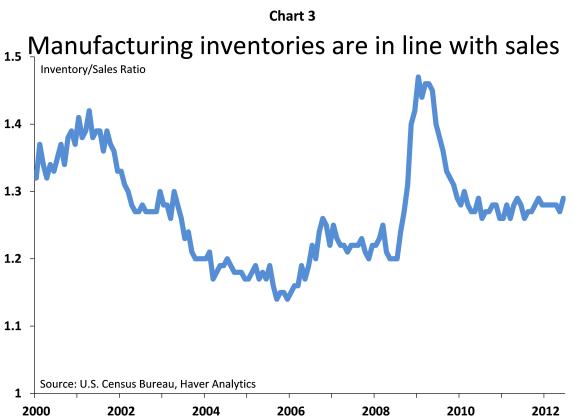

- But the economic fundamentals for manufacturing remain firm; for example, there is no inventory overhang, as they are in line with sales (Chart 3);

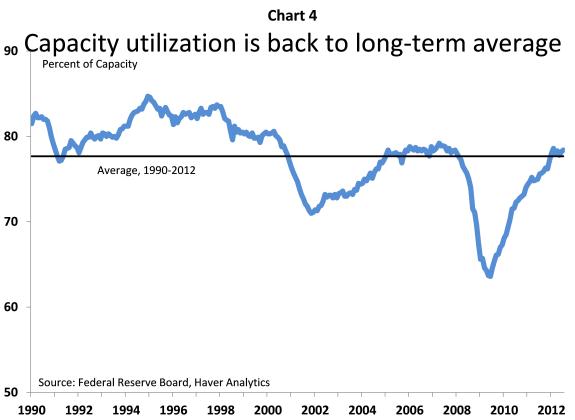

- Capacity utilization is back to long-term trends (Chart 4). Future increases in production will require more CAPX, which will support overall GDP growth;

Industrial properties saw further improvement in Q2:

- Occupancy rates rose, but rent growth decelerated;

- The supply pipeline of new development is growing. New supply should not be a problem if the U.S. economic recovery regains momentum later this year and early next year, as we expect, but poses some risks to the sector should the macroeconomic slowdown be more severe or longer-lasting.