Budget issues are likely to slow economic growth relative to baseline... but what's happening to the baseline?

Two issues have dominated recent economic headlines: the impact on consumers of the increase in payroll taxes that took effect at the beginning of the year, and the likely effects of an $85 billion cut to federal spending due to sequestration, should the Administration and Congress fail to reach a last-minute budget deal.

The cumulative effect of these fiscal changes is likely to be important, reducing GDP growth by one to two percentage points relative to the baseline outlook. There has been little discussion, however, of how that baseline may be moving.

The recent economic news outside of federal budget issues has been marked by upside surprises, suggesting that the baseline in fact has been moving up:

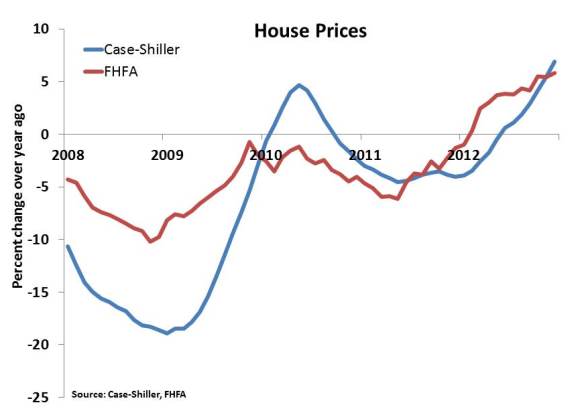

- Housing market. Home sales have firmed, and pending home sales jumped in January, pointing to a further acceleration in sales in 2013; inventories of homes for sale are low, and many metro areas can be described as a “seller’s market” for the first time in years; home prices are recovering (Chart 1)

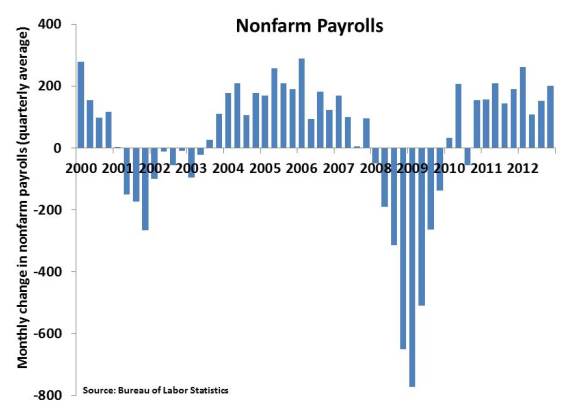

- Labor markets. Job growth accelerated late last year to a 200,000+ pace. While this is not yet strong enough to reduce the unemployment rate significantly, hiring regained momentum in the second half of 2012 (Chart 2). Initial jobless claims are trending down, and recently moved to the lowest level since before the financial crisis.

- GDP trends. Overall GDP growth stalled in 2012:Q4, to a 0.1 percent annualized pace, according to the most recent estimate. A drop in national defense spending subtracted 1.3 percentage points from GDP growth, however, and inventory investment took off another 1.5 ppts. Outside of these pieces, which are best viewed as transitory and not indicative of future prospects, private final sales growth firmed to nearly 3 percent in late 2012.

- Business investment. Real business spending on equipment and software rose at a double-digit pace in Q4, and construction of commercial buildings firmed as well. More recent data on orders for durable goods excluding the volatile transportation equipment sector rose nearly 2 percent in January. These reports indicate that the business sector is gaining momentum.

- Consumer confidence. There are several surveys of consumer confidence, all of which have been buffeted by concerns about the fiscal cliff and sequestration. Even so, confidence has been resilient, suggesting that improvements in job markets and the housing markets are offsetting some of the negative impact of the federal budget issues.

The take-away from these recent reports covering most of the economy — housing markets, labor markets, business investment, consumer confidence — is that the underlying momentum for economic growth has been moving up in recent months. The current federal spending issues are likely to restrain growth a bit, but there is an unmistakable sense that the economic baseline is gaining traction.