Disappointing job news contrasts with improving multifamily housing trends.

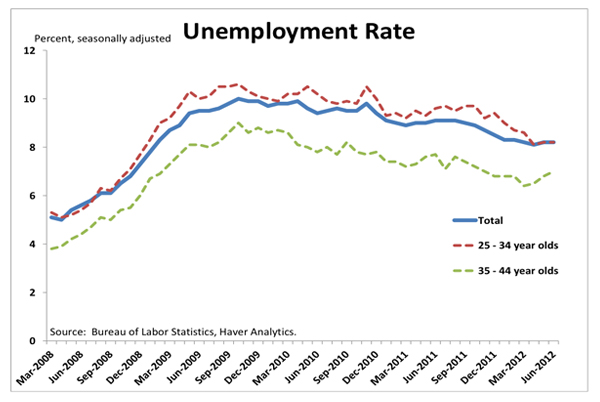

- There was no silver lining in the June employment report, which showed net gains of 80,000 and the unemployment rate unchanged at 8.2 percent. Job growth in the second quarter averaged 75,000 per month, half the pace in 2011 and well below the 225,000 in Q1.

- Young workers are still struggling. Unemployment rates among 35 – 44 year olds rose to 7.0 percent in June, from 6.8 percent in May and a recent low of 6.4 percent in March, while the unemployment rate of 25 – 34 year olds was unchanged at 8.2 percent. These young adults generate most of the new demand for rental apartments, and the outlook for multifamily housing is strongly influenced by their job prospects.

- Yet the apartment sector continues to improve. Apartment vacancy rates fell another 20 bps in the second quarter, according to Reis, Inc., while rent growth accelerated. The contrast between the gloomy job market for young adults and rising occupancy reflects a huge pent-up demand for apartments. NAREIT estimates a “shadow demand” of 3 million or more households that “doubled up” during the financial crisis. While the recent slowdown in hiring and overall economic activity will no doubt impact the apartment sector’s outlook, current trends despite the strong headwinds from the job market and macroeconomy confirm the strength of the fundamental forces driving the rental market.