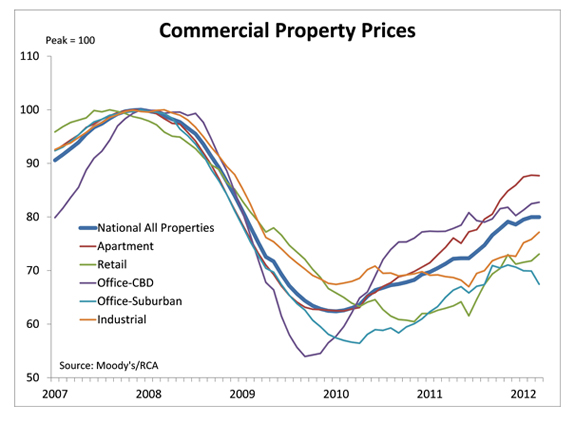

Commercial property prices were flat in March. The recovery in commercial property prices paused after having regained nearly half the decline that occurred during the financial crisis.

- Apartment prices edged down 0.1 percent in March. Prices rose 18.0 percent over the prior 12 months, outpacing other commercial property sectors, and have recovered two-thirds of the peak-to-trough decline;

- CBD office prices moved higher with a 0.3 percent increase, while prices of suburban office fell 3.5 percent. CBD office markets have recovered 62.5 percent of the peak-to-trough decline, versus 25.2 percent for suburban markets;

- Retail turned up 1.7 percent in March after having declined in December and posting weak gains in January and February;

- Industrial accelerated with a 1.7 percent increase in March, bringing the 12-month change into the double-digits for the first time since 2007.