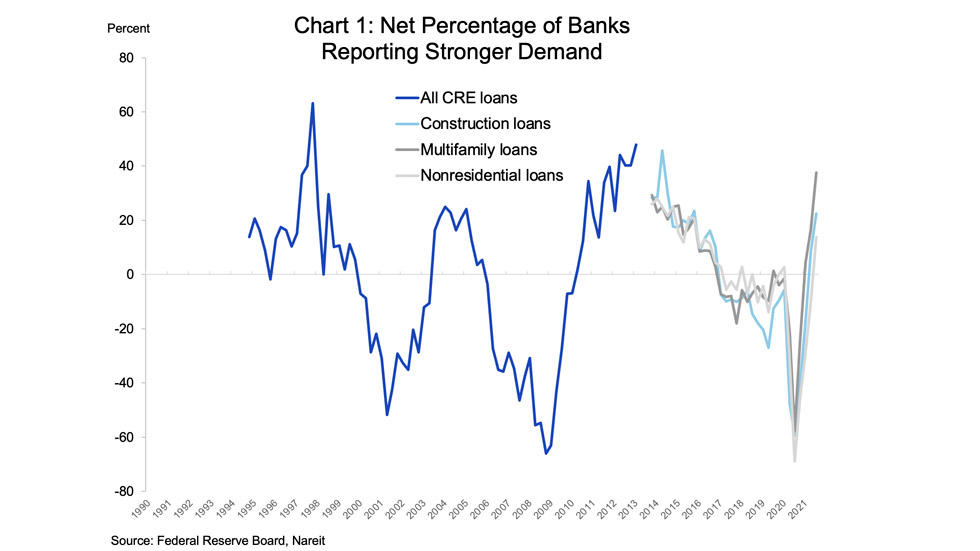

The Federal Reserve’s Senior Loan Officer Survey for August 2021 indicates that conditions in commercial real estate markets are improving. Banks reported stronger demand for commercial construction loans, loans for multifamily properties, and other loans secured by nonresidential real estate. Stronger demand for real estate loans generally reflects better conditions in the property markets, and often signals higher transactions volumes and higher prices, and increasing construction.

There had been some weakening of demand for CRE loans even prior to the pandemic, as the survey responses for loan demand were negative from early 2017. Demand for multifamily loans began to rise in the first quarter of this year, and in the current survey 37.5% of banks (on net) reported stronger demand, the highest figure since the Fed began asking separate questions for loan types in 2013. Construction lending turned positive in the second quarter, but nonresidential lending only began to increase in the latest survey.

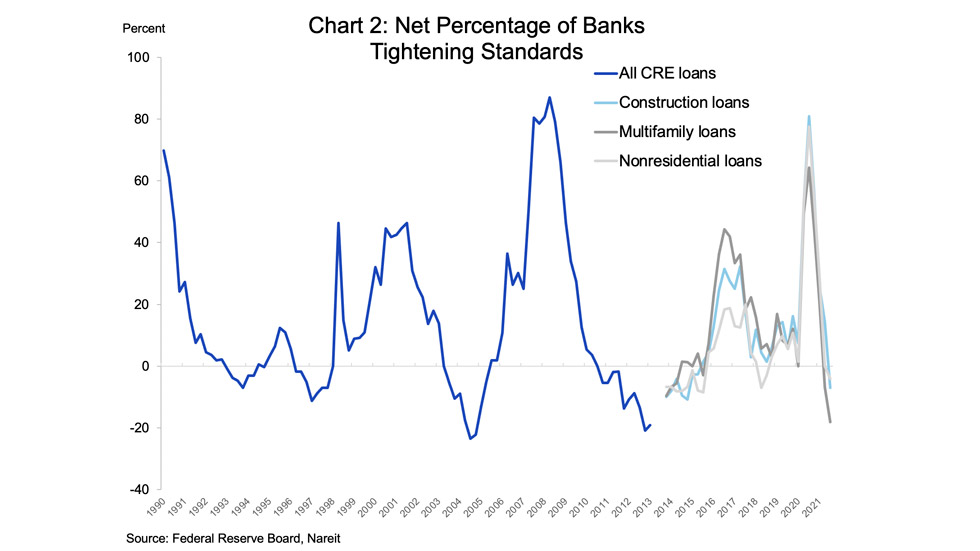

Banks reported that they have stopped tightening lending standards and began to ease lending terms on all types of commercial real estate loans. Banks tighten lending terms when the real estate market is weakening and default risks are rising, but ease standards when the market strengthens. The banks had not reported any easing of lending terms since 2015.

These survey results are yet another indication that the reopening of the economy is generating greater demand for all types of commercial real estate. Although recent increases in the Delta variant of the COVID-19 virus have raised some concerns about the pace of the reopening, nearly all indicators point to a stronger market for commercial real estate and REITs over the next few years.