The game-on, game-off nature of tariff actions has introduced uncertainty into the U.S. financial and economic markets. The 10-year Treasury yield has experienced considerable volatility in 2025, reaching a peak of 4.9% in mid-January and a low of 3.9% in early April. At the end of April, it was 4.2%. Concerns about an economic downturn have also become elevated. As of April, the Bloomberg consensus forecast survey placed the odds of a U.S. recession within the next 12 months at 45%; an increase of 15% over the prior month.

In an environment that lacks clarity, many property investors are considering how commercial real estate (CRE) may fare under new, and changing, tariff policies. Recent tariff actions and equity REIT property sector total returns can provide a framework to glean insights into the impact of tariffs on CRE.

With the announcement of reciprocal tariffs on April 2, total returns across all 13 equity REIT sectors declined. Performances then rebounded across all these sectors with the limited temporary suspension of higher reciprocal rates on April 9. The net effects of these return movements through April 30 varied widely across sectors, but were generally negative.

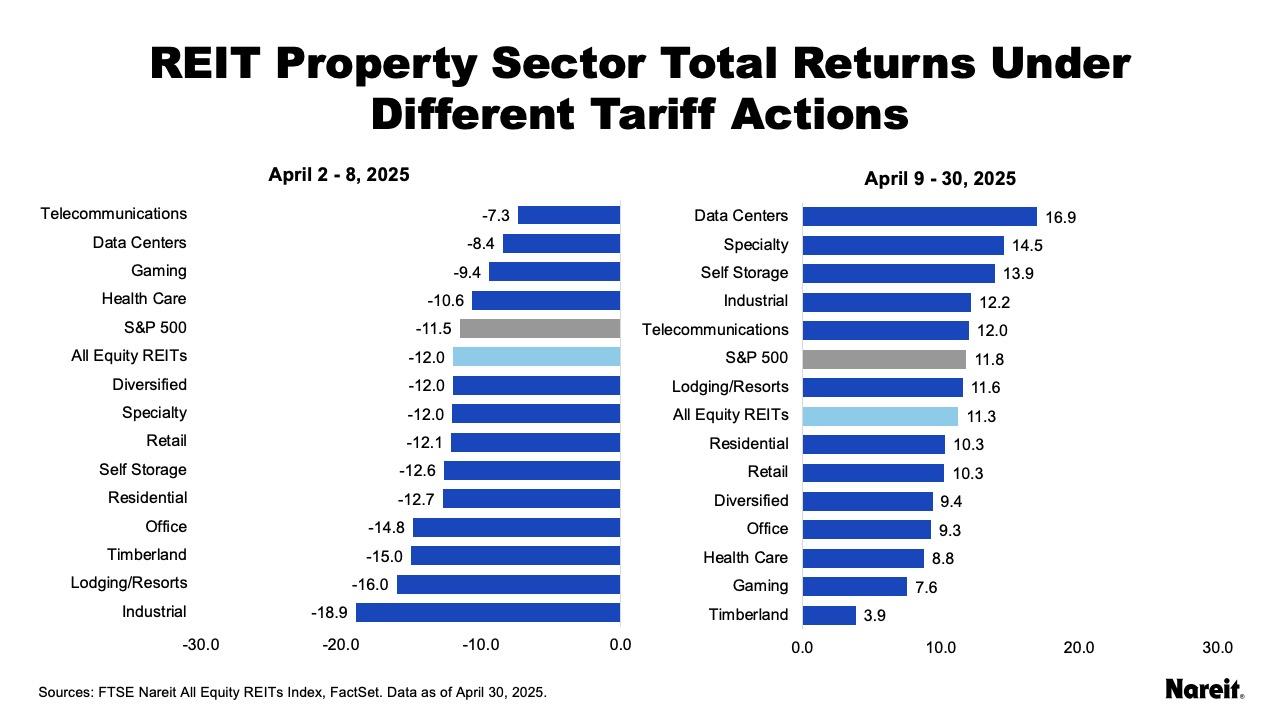

The charts above display total returns for the 13 equity REIT property sectors, as well as the FTSE Nareit All Equity REITs and S&P 500 indices, from April 2-8 and April 9-30. The first and second periods highlight market reactions to the reciprocal tariffs announcement and the limited temporary reprieve from higher reciprocal rates, respectively.

Total returns from April 2-8 showed that announced reciprocal tariffs had adverse impacts across all 13 REIT property sectors, but the severity of the declines varied widely. Industrial suffered the greatest drop at -18.9%. It was followed by lodging/resorts at -16.0%, and then timberland at -15.0%. Telecommunications and data centers had the most modest falloffs at -7.3% and -8.4%, respectively. Performance declines across many sectors may not appear to be immediately intuitive, but likely reflect potential effects stemming from an economic downturn.

After the temporary pause of higher reciprocal rates, performance for each of the REIT sectors bounced back. From April 9-30, the data centers and specialty sectors posted the largest total return gains of 16.9% and 14.5%, respectively. Timberland had the lowest uptick; it was 3.9%. Unfortunately, sector gains generally did not entirely offset their initial declines.

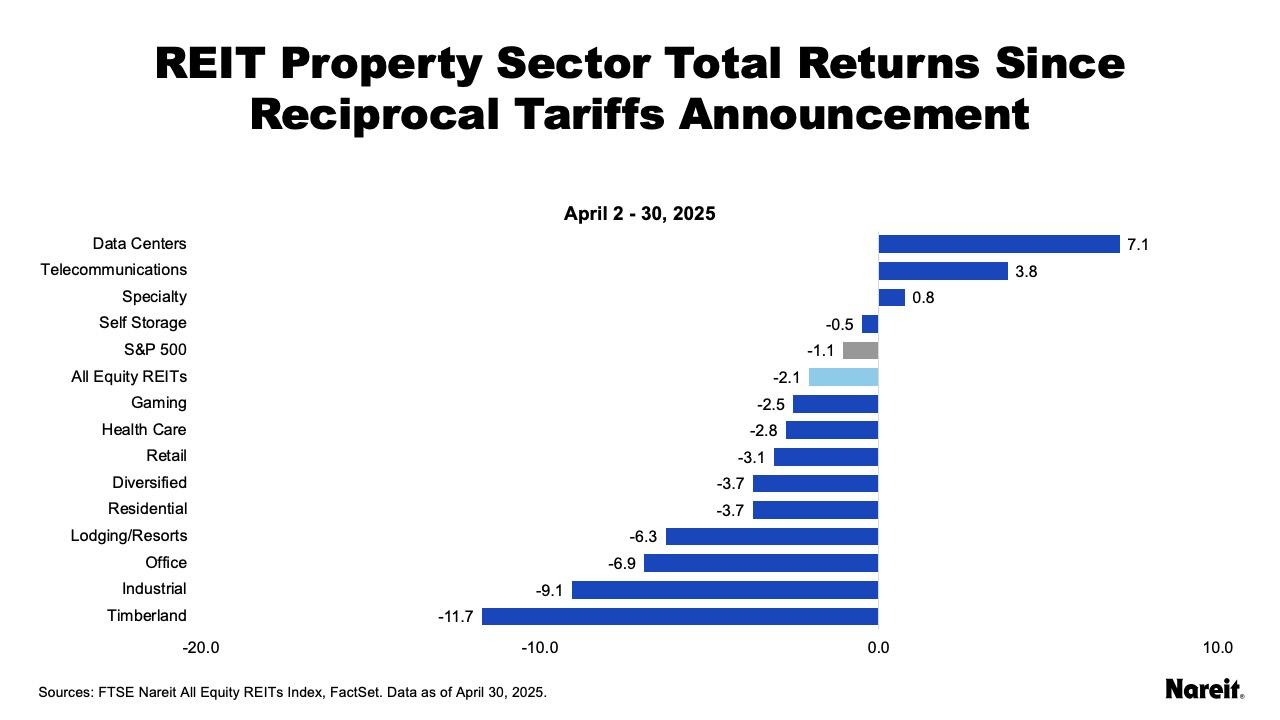

The chart above presents total returns for the 13 equity REIT property sectors, as well as the FTSE Nareit All Equity REITs and S&P 500 indices, from April 2-30.

The net effects of the reciprocal tariffs announcement and the subsequent pause on higher reciprocal rates have generally been negative for REIT sector performances. The three sectors that posted positive gains since April 2 were data centers (7.1%), telecommunications (3.8%), and specialty (0.8%). The weakest performing sector was timberland (-11.7%); it was followed by industrial (-9.1%), and then office (-6.9%). While performances across sectors varied widely, total returns for the FTSE Nareit All Equity REITs Index declined by just 2.1% since the reciprocal tariffs announcement.

New tariff policies have elevated economic uncertainty and financial market volatility. These forces have created headwinds for investment performance. Even with solid property operations and strong balance sheets, REITs have not been immune from these challenges. Recent acts related to reciprocal tariffs have generally had a net negative impact on REIT total returns, but performances across REIT property sectors varied considerably. Future tariff actions are likely to continue to influence REIT investment performance.