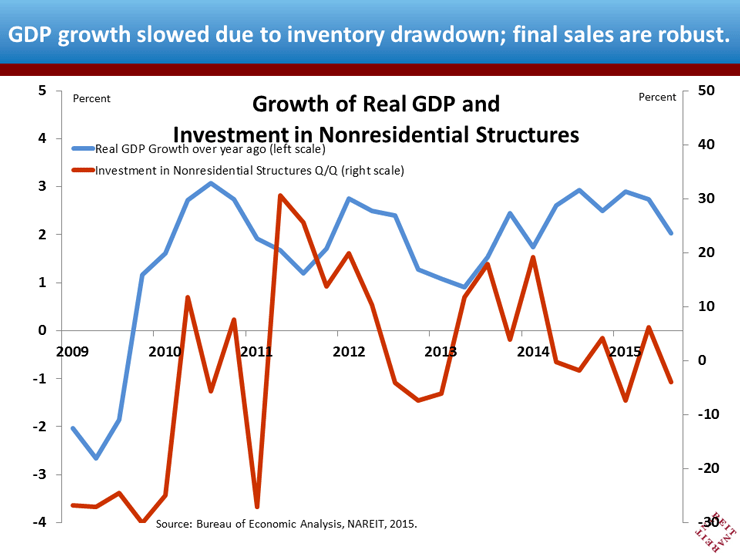

Real GDP growth took a dive in the third quarter, to a 1.5% annual rate (first chart shows change over year ago; we consider figures in the high 2’s to be healthy enough for continued gains in the commercial property sector). The details, though, aren’t alarming, as a drawdown in the volatile inventory component accounted for nearly all of the slowing. Consumer spending stayed on pace, with a 3.2% annualized growth, suggesting that households haven’t been fazed by any of the financial market gyrations.

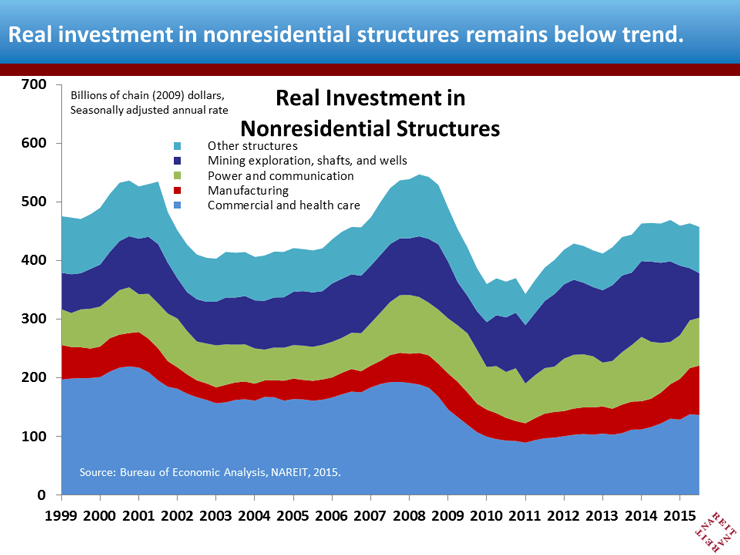

One sector in GDP that is particularly important for the outlook for commercial real estate is investment in nonresidential structures (NRS). New construction, adjusted for price changes, is still well below pre-crisis trends. The light pipeline of new building deliveries has been a strong factor contributing to falling vacancy rates and rising rents.

In the third quarter, however, investment in NRS fell at a 4.0% annual rate (red line on first chart). This is worth a bit of investigation, as CAPX in this category has declined 4 of the past 6 quarters. Is this a red flag for the commercial property sector?

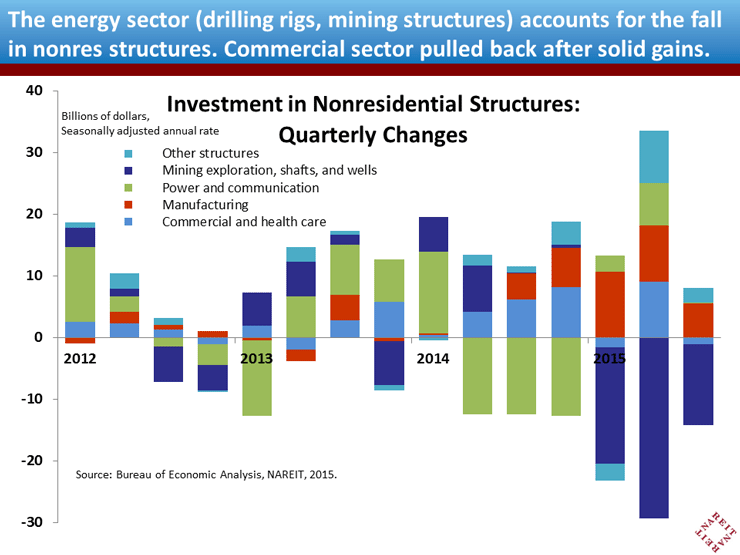

The final chart shows some detail on NRS investment. A falloff in energy exploration is driving the declines, as total NRS includes oil drilling structures and mining, which have decreased sharply with the drop in energy prices. Construction of commercial buildings and health care facilities pulled back a bit in Q3, as it did in Q1, but these small declines came amidst other solid increases in prior quarters. These recent trends confirm that developers still see a positive environment for new construction.

In sum, despite the weak headline number, the GDP figures show solid spending by consumers and other core sectors… all part of the recipe for sustained recovery for REITs and commercial real estate.