Bickering between the United States and China has threatened to turn into a full-blown trade war, as leaders of each country have ratcheted up tariffs on imports from the other country. Analysts fear that the impact on companies with global operations could be harsh if such brinksmanship does not lead to an agreement at the negotiating table. On May 13th, following a deterioration in rhetoric on trade negotiations over the weekend, the S&P 500 fell 2.4 percent.

REITs, in contrast to many firms in the S&P 500, have low exposures to import and export markets, as their business is driven by domestic commercial real estate markets. This domestic focus has sheltered REITs to a certain extent from the trade war risk. For example, as global equity markets posted their largest decline in four months on May 13, the FTSE Nareit All Equity REITs index was unchanged at the close. This subdued response of REITs to developments outside of the United States helps reduce risks in diversified portfolios that otherwise would be more vulnerable to global events.

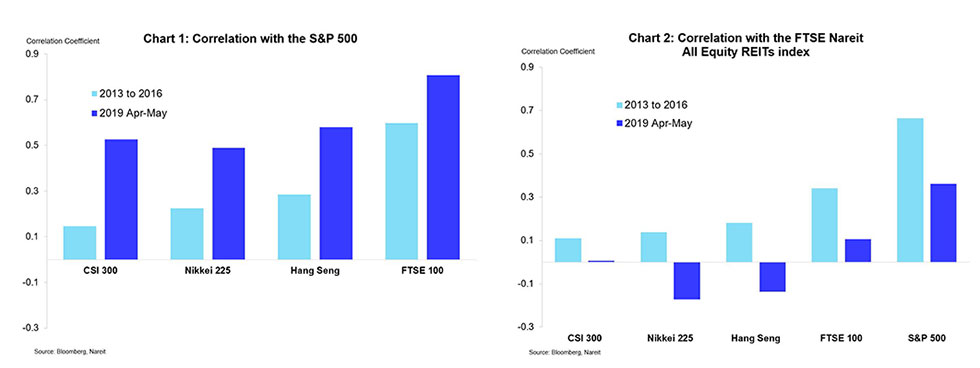

This diversification benefit of REITs is not just a one-day phenomenon, however, but holds over longer time periods as well. The following two charts display how the S&P 500 has become more highly correlated with overseas stock markets, especially those in Asia, as the trade disputes heated up, while REITs have become less sensitive to foreign markets. The correlation of daily returns on the S&P 500 to the CSI 300 Index in China rose from 15 percent during a baseline period from 2013 through 2016, to 53 percent from April 1 through May 10. The co-movements with other Asian markets also rose sharply, as the correlation of the S&P 500 with the Japan’s Nikkei 225 increased from 22 percent during the earlier period, to 58 percent in recent weeks, and the correlation with Hong Kong’s Hang Seng Index jumped from 29 percent to 49 percent. Correlations with the FTSE 100 were already relatively high, at 60 percent during the baseline period, and moved higher to 81 percent in recent weeks.

REITs, in contrast, have become less correlated with global markets over this period. The correlation of daily returns on the FTSE Nareit All Equity REITs Index with the China CSI 300 Index was a relatively low 9 percent over the earlier period, but fell to essentially zero from April through mid-May. REIT correlations with the Nikkei and Hang Seng indices went from low levels in prior years, to a negative response in recent weeks. REITs also saw a decline in correlations with the FTSE 100 and S&P 500 during this period.

This lower exposure to overseas events has helped contribute to outperformance by REITs in 2019. Year-to-date through May 13, REITs have delivered a total return of 17.4 percent, some 400 basis points ahead of the 13.4 percent total return on the S&P 500. Holding REITs in a diversified portfolio can help shield investors from certain risks during times of market volatility and trade wars.