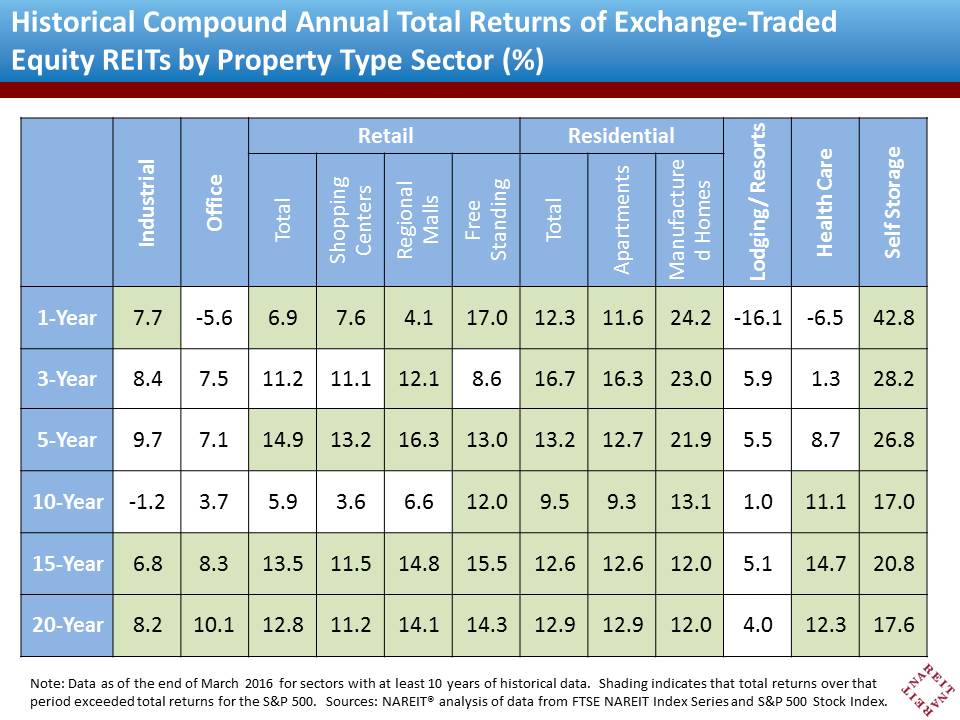

As an asset class, stock exchange-traded equity real estate has provided higher returns than other public equity investments over most significant historical periods. For example, the total returns of the FTSE NAREIT All Equity REITs index have outpaced total returns of the S&P 500 Stock Index over the 15-, 20-, 25-, 30-, 35-, and 40-year periods ending March 31, 2016. We have a more limited history on the performance of Equity REITs by property type, with data available only since the beginning of 1994. As the table below shows, however, the outperformance by exchange-traded Equity REITs has not been limited to just a small set of property types:

Residential REITs, including both the apartment and manufactured homes subsectors, have outperformed the S&P 500 over every historical period shown: one year (as of March 31), three years, five years, 10 years, 15 years and 20 years. So have self storage REITs, with total returns averaging 17.6 percent in the past 20 years, more than double the 8.0 percent average of the S&P 500. During a time horizon of even just 20 years, that kind of outperformance is powerful: An initial investment of $10,000 at the end of March 1996 would have increased (ignoring fees) to just $46,410 at the end of March 2016 if invested according to the S&P 500, but would have grown more than 10 times to a total balance of $112,741 if invested in residential REITs and would have ballooned more than 25 times to total wealth of $255,687 if invested in self storage REITs.

Every subsector of retail REITs has outperformed the S&P 500 over the past one-, five-, 15-, and 20-year periods. Regional mall REITs have also outperformed during the past three years (even though it was a strong period for the overall stock market, with the S&P 500 earning 11.8 percent per year), while free standing retail REITs have outperformed in the past 10 years (12.0 percent per year, compared with just 7.0 percent per year for the S&P 500). Like residential REITs, an initial investment of $10,000 in retail REITs at the end of March 1996 would have grown more than 10 times to $111,305 at the end of March 2016.

Office and industrial REITs have outperformed in the long run, beating the S&P 500 in the last 15 years and 20 years, but have underperformed over the past three years, five years and 10 years. Industrial REITs, however, have also outpaced the S&P 500 during the past year. Health care REITs have similarly outperformed in the long run, beating the S&P 500 in the last 10 years, 15 years and 20 years, but have underperformed in the past one year, three years and five years.