With inflation remaining at 40-year highs, interest rates escalating, and economic growth contracting, the U.S. economy is in a precarious state. Worried about risks to investment performance, these conditions are a source of consternation for some real estate investors. While no guarantee of future results, an examination of historical performance reveals that, on average, real estate has enjoyed solid total returns across different inflation, interest rate, and economic growth regimes with REITs consistently outperforming their private market counterparts.

Real Estate Performance & Inflation

With significant rates of inflation absent for three decades, the return of high inflation has become a source of investor anxiety. Analyses using long time horizons show that real estate has acted as, at least, a partial inflation hedge, but studies based on shorter time periods are less clear. As a result, some investors are concerned how real estate may fare in this unfamiliar environment.

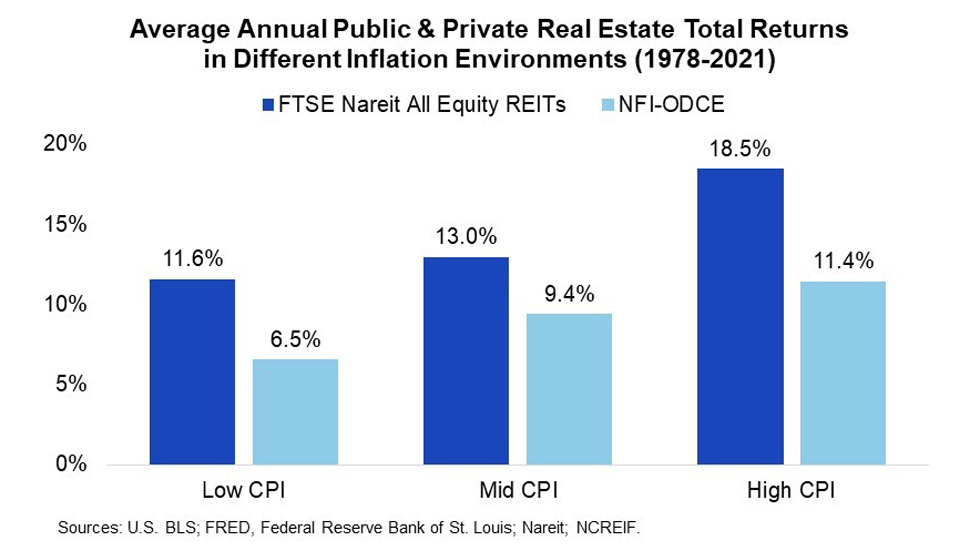

The chart above displays average annual total returns for public and private real estate in different inflation environments for the calendar years from 1978 to 2021. The FTSE Nareit All Equity REITs Index and the NCREIF Fund Index—Open End Diversified Core Equity (NFI–ODCE) are utilized to measure public and private real estate performance, respectively. The rate of inflation is measured by the annual (calendar year) percentage change in the Consumer Price Index for All Urban Consumers: All Items in U.S. City Average (CPI). Three inflation groups are created using quartiles. Rates for the low (first quartile) inflation group range from -0.4% to 1.9%. They range from 2.1% to 3.8% for the mid (second and third quartiles) CPI category and exceed 4.1% for the high (fourth quartile) group.

2021 marked the return of high inflation. For the first time in 30 years, the U.S. inflation rate fell into the high CPI group. (Note that inflation has continued its upward trajectory into 2022, but this analysis focuses on calendar year measures.) While this may be unsettling for some investors, historical data show that real estate has performed well across a variety of inflationary environments. Consistent with the view of real estate as an inflation hedge, on average, both public and private real estate total returns have increased with higher inflation regimes. REITs have also outperformed their private market counterparts across all three inflation cohorts.

Real Estate Performance & Interest Rates

Interest rate increases worry real estate investors. Their fears are rooted in the view that rising interest rates will result in rising cap rates and, all else equal, declining property values. This belief oversimplifies reality. Cap rates do not move in lockstep with interest rates. They are influenced by a variety of additional factors, including fundamentals, capital flows, and investor risk appetite.

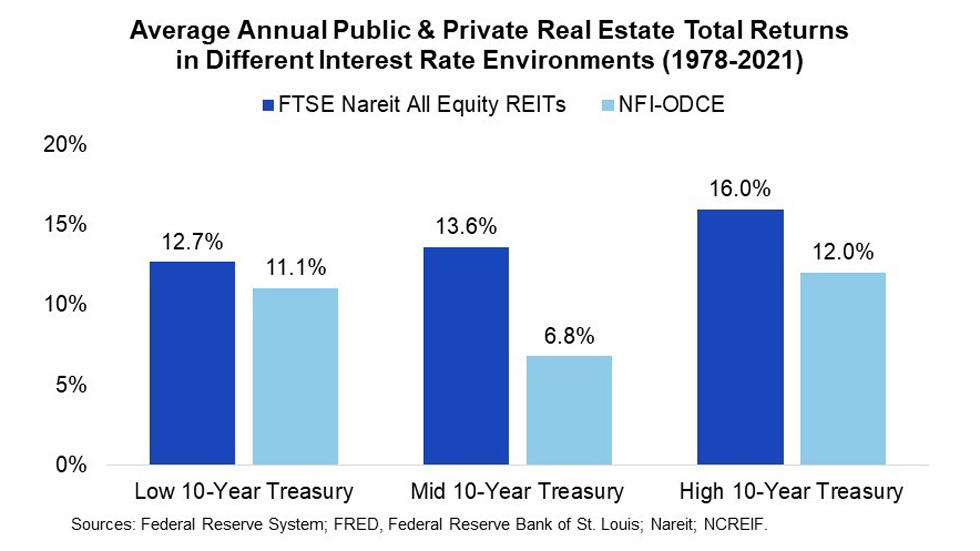

The chart above exhibits average annual total returns for public and private real estate in different interest rate environments for the calendar years from 1978 to 2021. Interest rates are measured by the Market Yield on U.S. 10-Year Treasury Securities Constant Maturity, Quoted on an Investment Basis. Three interest rate groups are created using quartiles of annual (calendar year) data. The upper yield threshold for the low (first quartile) 10-year Treasury group is 3.1%; it is 8.4% for the mid (second and third quartiles) cohort. The high interest rate grouping includes the fourth quartile 10-year Treasury yields.

The 10-year Treasury yield is an important indicator of the economic outlook. Increasing (declining) yields tend to signal an improving (weakening) economic outlook. On average, real estate has performed well in different interest rate environments. Moving from the low to high 10-year Treasury yield groupings, REITs experienced progressively higher average annual total returns. They also bested private real estate market performance in each cohort. For investors concerned about interest rate changes, it is important to note that factors exist that have the potential to offset property value declines. They include existing cap rate spreads, future property operational performance, underwriting exit assumptions, and time.

Real Estate Performance & Economic Growth

With real GDP growth faltering in the first half of 2022 and the Bloomberg consensus forecast survey placing the odds for a recession in the next 12 months at 60% (as of October 2022), the U.S. economy is in a precarious state. Given that economic growth is a driver of property performance, the current climate poses potential risks for future real estate performance.

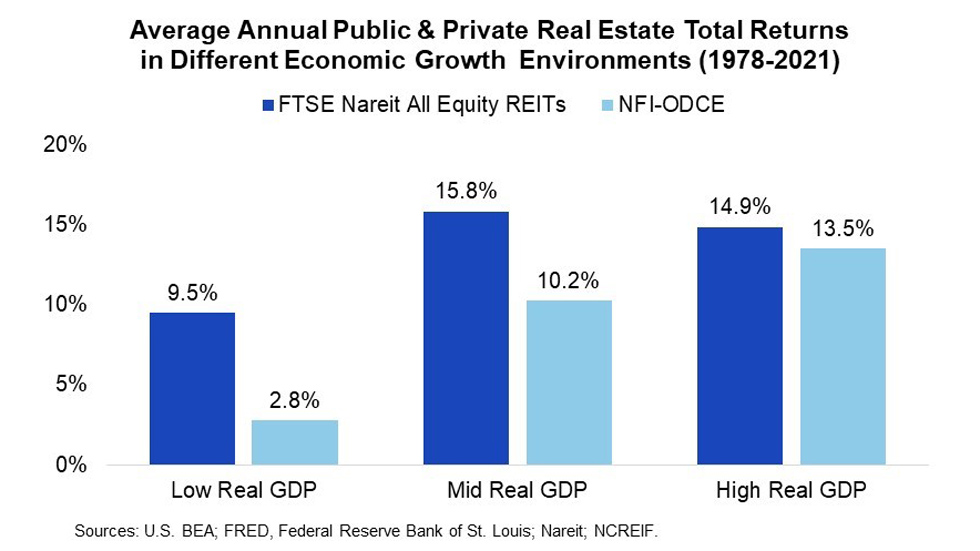

The chart below shows average annual total returns for public and private real estate in different economic growth environments for the calendar years from 1978 to 2021. U.S. economic growth is measured by the annual (calendar year) percentage change in real Gross Domestic Product (GDP). Three groups are created for economic growth using quartiles. Rates for the low (first quartile) and mid (second and third quartiles) real GDP groups range from -2.8% to 1.8% and 1.9% to 3.9%, respectively. They top 4.0% in the high (fourth quartile) economic growth category.

Historically, real estate average annual total returns have generally tended to be higher in stronger economic climates. REITs have also maintained a performance edge across the real GDP cohorts. Recent contractions in the economy have made some property investors increasingly concerned about downside risk. Interestingly, limiting observations in the analysis to only include years with negative real GDP growth results in average annual total returns for public and private real estate of 20.9% and -1.9%, respectively.