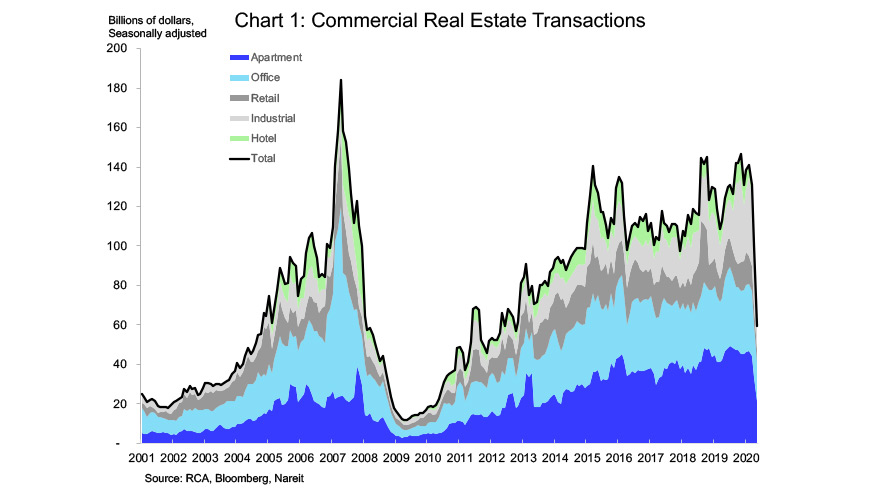

Commercial real estate markets have been in lockdown along with the rest of the country. The most visible sign of this lockdown is the collapse of sales transactions, which fell sharply as social distancing rules went into effect. Total sales transactions in May were down 55% from their pace last December, after adjusting for normal seasonal variations.

The decline in sales was greatest in hotels, down 85% from December, and least among office properties, down 41% over this period. Apartment, retail and industrial property markets saw sales decline 50% to 60%.

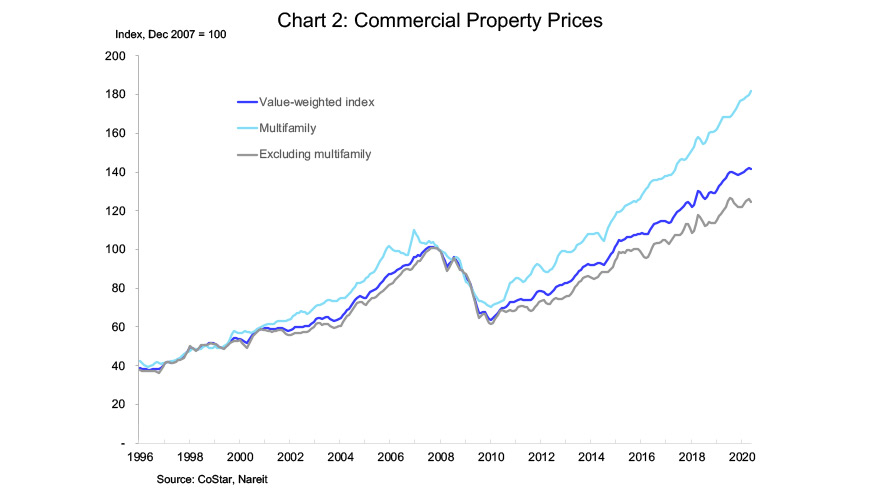

Property prices, however, have not (yet) shown much effect from the shutdown, according to the CoStar value-weighted commercial repeat sales index, which edged down 0.1% in May. Valuations remained above their year-ago level, with the overall index up 3.6% over the past 12 months. Prices of multifamily properties were 8.2% above year-ago, while properties excluding multifamily were 2.0% higher.

This price index may not yet fully reflect the impact of the crisis on valuations, however, given the extremely low transactions volumes on which the most recent monthly readings are based. In addition, the methodology used to estimate a repeat transactions index tends to smooth the values for recent prices, especially when transactions volumes are low. Over the next few months it is likely that sales volumes will stage a partial recovery as restrictions on business activities are eased, and it would not be surprising to see a decline in reported valuations as this occurs.

On the other hand, weak sales activity during a lockdown need not translate into falling prices. For example, sales of existing homes declined 17.8% in April and another 9.7% in May, according to the National Association of Realtors. Prices, however, edged higher despite the dropoff in sales, reflecting continued strong underlying demand for homes—the sales fell simply because social distancing requirements prevented buyers, sellers, and brokers from completing transactions. Indeed, sales activity is already on the rebound with a 44.3% jump in contracts signed in May.

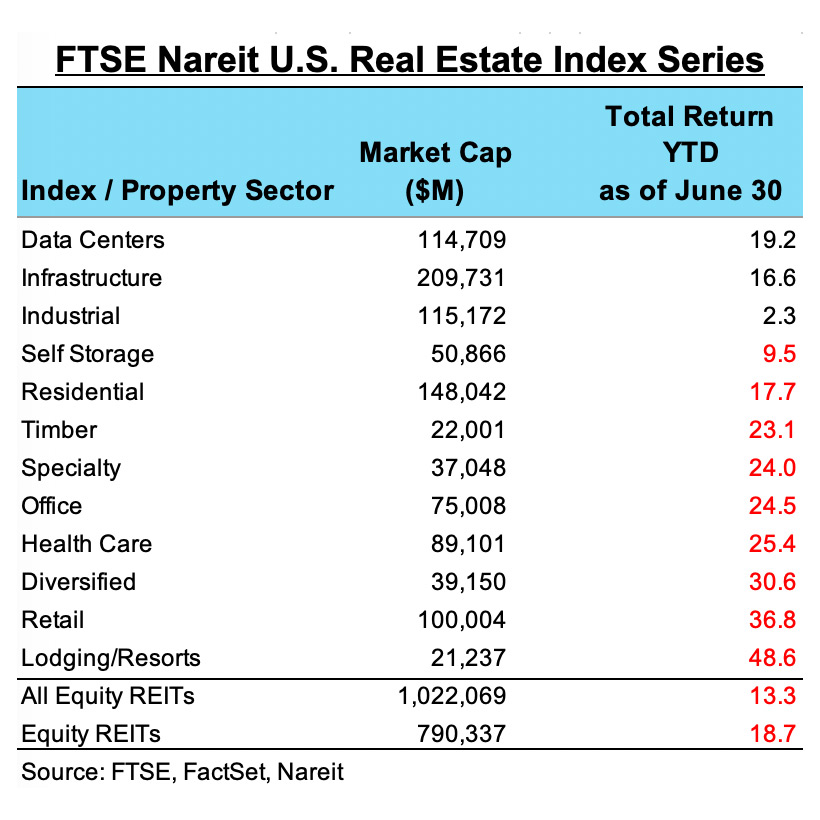

REIT share prices respond quickly to news, unlike the price index in chart 2 above, and often provide a valuable signal about future trends in real estate valuations. Indeed, total returns in the first half of this year show that investors expect the medium- and long-term impacts of the crisis to be in line with the changes outlined above. Retail and lodging/resorts have experienced the largest declines year-to-date through June 30, with total returns of -36.8% and -48.6%, respectively. Several other property sectors posted more moderate declines, including office, residential (largely apartments but also manufactured homes and single family rental), self storage, and other sectors not discussed separately above. The sectors linked to the digital economy—data centers, infrastructure, and industrial—all recorded gains during the first half of the year.

The longer-term impact on commercial property prices will depend on how the various types of commercial real estate are used as the immediate health crisis fades. Here our crystal ball gets cloudy, as there is no modern precedent for an economic shock like the pandemic. One can, however, make a few general observations about the possible impact on various property types.

- The hotel and lodging sector appears to face a prolonged period of deeply depressed business and vacation travel, at least until a vaccine can be developed and implemented. Property prices for hotels are likely to be significantly lower in the medium-term future.

- The retail sector also faces a negative shock to demand, as the covid crisis has accelerated the changes due to the growth of online shopping that have been underway for several years. Property prices are likely to be weak in the retail sector as a result of excess supply. There are already reports that some malls or other retail properties may be converted to other uses—logistics facilities or apartments, for example—to remove some of the excess supply.

Other property types, however, may not experience such a dramatic reduction in demand, and property prices may be more resilient.

- The crisis will have both negative impacts and, possibly, positive impacts on the demand for office space. The success of work-from-home arrangements may lead employers to consider reducing their longer-term space needs. On the other hand, the past decade saw an increase in density, with less office space per employee and greater use of common work areas. The need for social distancing will likely lead to a reversal of some of this trend toward density, resulting in increased space per worker in the future. Offices also face challenges with elevators, pantries and other common areas, and public transportation to crowded downtown locations. This may result in a shift in demand away from central business districts in major cities towards suburban office parks or mid-sized or smaller cities. The bottom-line impact of all these forces on prices of office properties will be complex.

- Apartment markets will still face strong demand given the shortages of housing in most major cities when the pandemic hit. There may be shifts in regional patterns of demand from downtown and close-in suburbs to more remote locations, though, if more permanent work-from-home arrangements allow employees to live farther from the office.

There are several clear winners in commercial real estate from the changes brought about by social distancing during the pandemic.

- Industrial properties, which are increasingly dominated by logistics facilities to deliver goods bought on the internet, are experiencing an acceleration of demand on top of the past half-decade of rapid growth. Industrial properties had low vacancies and rapid rent growth and price growth even prior to the pandemic. Future demand will likely sustain these favorable trends.

- Data centers and infrastructure, two of the more recent additions to the REIT universe, provide the electronic backbone for cloud computing and voice and data communications. With the boom in business meetings taking place on Zoom and other activity being conducted online, prices of these assets will likely rise further.