Making timely comparisons between publicly traded REITs and private real estate is difficult because of reporting lags by private real estate. REIT shares react in real time to market conditions while changes to private real estate valuations are only reported as properties are valued—typically through an appraisal process on an annual or less frequent basis, or, even more infrequently, through a transaction. However, research has shown that REITs and private real estate are highly correlated, and REITs tend to outperform private real estate.

Looking at returns through the pandemic, REITs have outperformed private real estate property and fund indexes through the fourth quarter of 2021 and have an annual increase of 41.3% in 2021 compared to 22.2% for private real estate.

Ultimately, the real estate assets underlying REITs and private real estate are substantially the same. CEM Benchmarking Inc’s latest report shows that removing reporting lags from private real estate dramatically increases the correlation between publicly traded REITs and private real estate. The study also confirms that net average returns by REITs were higher than private real estate from 1998 through 2019. Research by Thomas R. Arnold, David C. Ling, and Andy Naranjo shows the same outperformance using a different measure of private real estate. These studies use long time-horizons to allow reported private real estate valuations to fully adjust to market conditions.

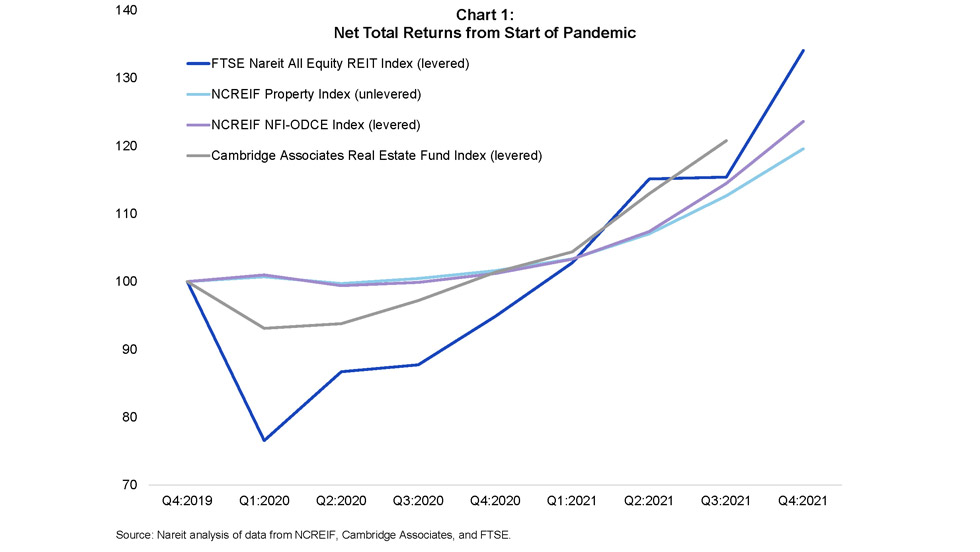

Chart 1 is an early look at the relative performance of REITs and private real estate during the pandemic with indexed returns for the FTSE Nareit All Equity REITs Index, two National Council of Real Estate Investment Fiduciaries (NCREIF) indexes, and Cambridge Associates’ Real Estate Fund Index (which only has data through the third quarter of 2021). The chart demonstrates the lagged and smoothed nature of private real estate returns with market conditions for commercial real estate sectors realized over time by private valuations compared to contemporaneously for REITs.

Both NCREIF indexes show a rise in returns for the first quarter of 2020, despite wide-spread business closures, followed by a decline and then a modest recovery. Alternatively, REITs experienced a severe initial downturn followed by a robust recovery. Overall, REITs are up 34.1% from the end of 2019 through the end of 2021 and posted a 41.3% annual return in 2021. NPI is up 19.6% from 2019 through year-end 2021, and ODCE is up 23.6% with 2021 annual returns of 17.7% and 22.2%, respectively.

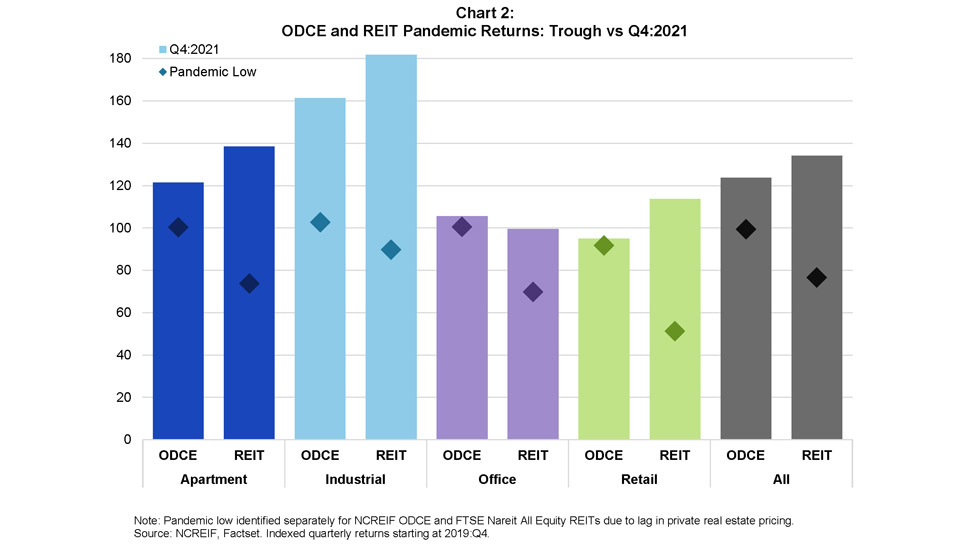

Chart 2 compares returns indexed from year-end 2019 for the property sectors to year-end 2021. Because of private real estate’s lag, the pandemic low for each series corresponds to a different quarter. The biggest difference in property sector returns is in office, where ODCE returns had mostly increases throughout the pandemic—never falling below the year-end 2019 level and up 5.5% in 2021. Office REIT returns fell 30.2% and ended 2021 still down 50 basis points. It appears that private real estate may not be pricing in pandemic declines in office demand. Retail had the largest drop in returns for both REITs and ODCE, falling 48.7% for REITs but only 8.3% for ODCE. However, retail REITs recovered much more than ODCE retail properties, finishing 2021 up 13.7% from 2019 compared to 5.0% for ODCE. This pattern holds for apartment and industrial where REITs experienced a larger decline and a more robust recovery.