As the economy begins to recover from the COVID-19 pandemic, worries about inflation are beginning to surface in the press and among investors. REITs provide natural protection against inflation. Real estate rents and values tend to increase when prices do, due in part to the fact that many leases are tied to inflation. This supports REIT dividend growth and provides a reliable stream of income even during inflationary periods.

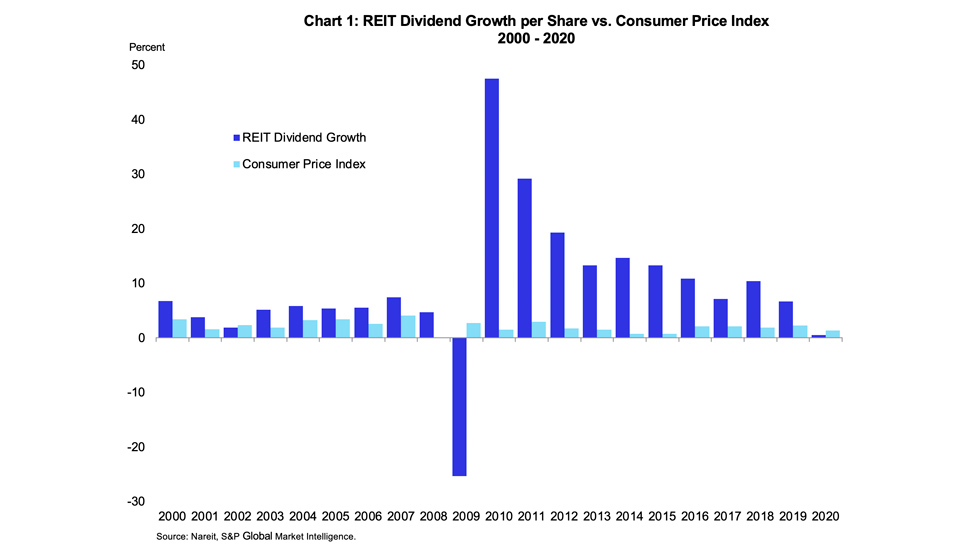

A practical way of measuring the inflation protection provided by REITs is to directly compare REIT dividend growth per share with inflation. In all but three of the last 20 years, REITs' dividend increases have outpaced inflation as measured by the Consumer Price Index. Chart 1 shows the history of market cap weighted average dividend growth per share compared to the annual inflation rate. In 2002, dividend growth failed to edge out inflation by just half a percentage point, and dividend growth fell below inflation after the financial crisis in 2009, when dividends dropped. Most recently, cuts in dividends in 2020 did cause dividend growth to fall less than a percentage point shy of inflation. Over the twenty-year period, average annual growth for dividends per share 9.4% (or 8.4% compounded) compared to only 2.1% (2.0% compounded) for consumer prices.

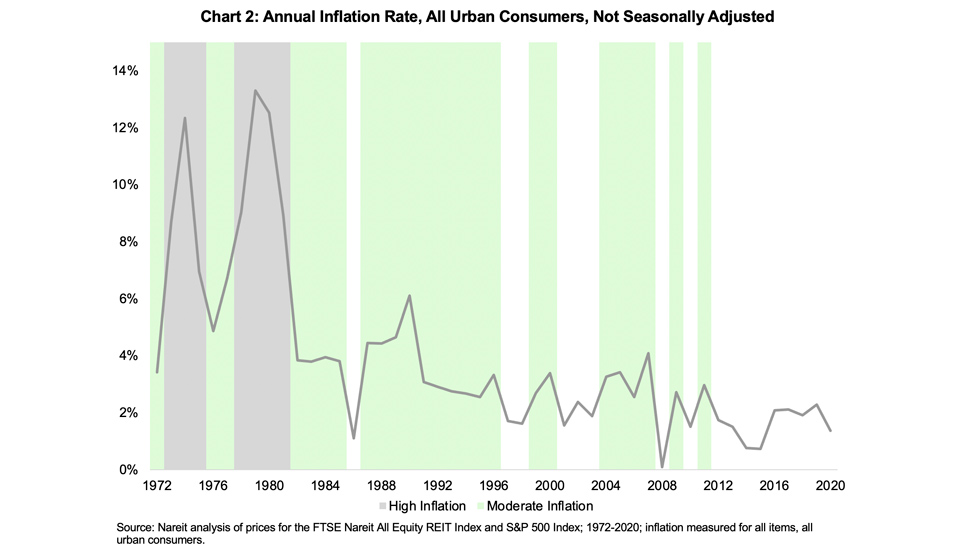

One of the difficulties in assessing REITs’ performance during periods of high inflation is that there haven’t been any such periods since the 1980s, before the modern REIT era. The U.S. had periods of high inflation in the 1970s and 80s when it was as high as 13% annually, but since 1990, the inflation rate has rarely gone much over 3%. Looking at the historical inflation rate since REITs’ inception in 1972, as shown in Chart 2, the U.S. has had two periods of high inflation, and several periods of moderate or low inflation. High inflation is defined as greater than one standard deviation from the time period’s average of 3.9%, greater than 6.9%. Moderate inflation is between 6.9% and 2.5% (based on the Federal Reserve target), and low inflation is below 2.5%.

Inflation is unlikely to return to the double-digit rates experienced in the 1970s for several reasons. First, the economy “ran hot” for most of the 1960s as spending on both domestic programs and the Vietnam War pushed GDP beyond potential, but it took more than half a decade for these pressures to translate into rising inflation. Today’s fiscal stimulus is aimed at helping the economy recover from well below its potential, and many of the stimulus measures will have ended before this stimulus can push the economy to the degree of overheating seen in the 1960s.

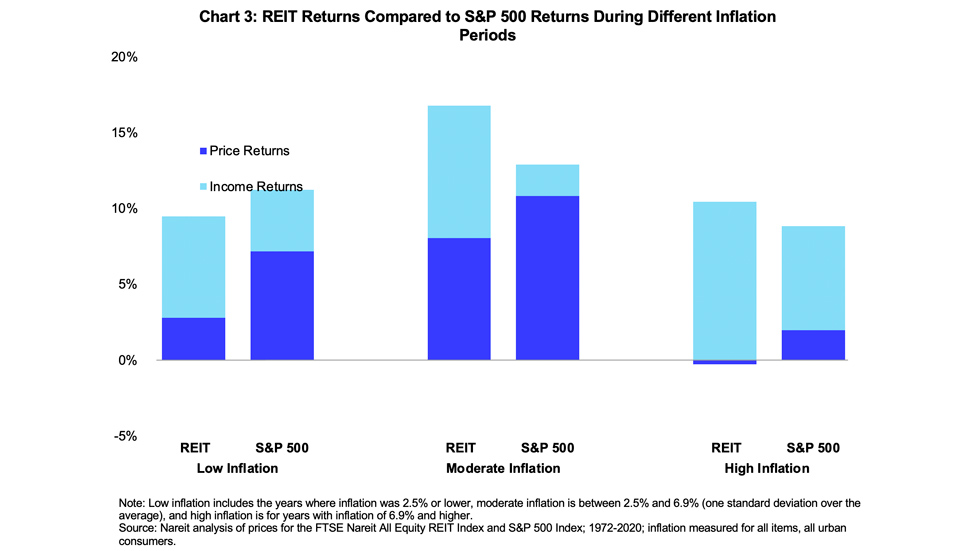

Chart 3 compares the performance of equity REITs and the S&P 500 in these three periods as demonstrated in Chart 2. In the high inflation periods, strong income returns offset falling REIT prices, and REITs outperformed the S&P 500 by 1.3 percentage points during these periods. In periods of moderate inflation, REIT dividends more than compensated for the higher price returns on the S&P, leading total returns on REITs to exceed the S&P by 3.9 percentage points. In periods of low inflation, REIT returns fall below the S&P 500 as the income portion does not make up for superior price returns on the S&P 500.

Inflation may not return to historical highs, but even moderate levels of inflation could affect investment returns. REITs are real assets, and the values of the properties they own will tend to rise if overall price levels increase, and lease payments will tend to rise if inflation picks up. These characteristics of REIT investments will help protect investor returns against even moderate levels of inflation as the economy accelerates.