In the early stages of the pandemic, retail was one of the hardest hit sectors, with stores closed due to government orders and consumers wary about shopping in-person. The retail sector was hit by store closures and bankruptcies which led to an increase in retail vacancies. While retail REIT FFO has risen substantially from its low point in 2020, it remained 5.8% below its level from the fourth quarter of 2019 in the third quarter of 2021.

Throughout the latter part of 2020 and through 2021, new businesses have been forming rapidly, especially in the retail sector. This may prove to be beneficial for retail REITs as they continue their pandemic recovery in the next year as new businesses form and sign leases, occupying vacancies in malls and shopping centers.

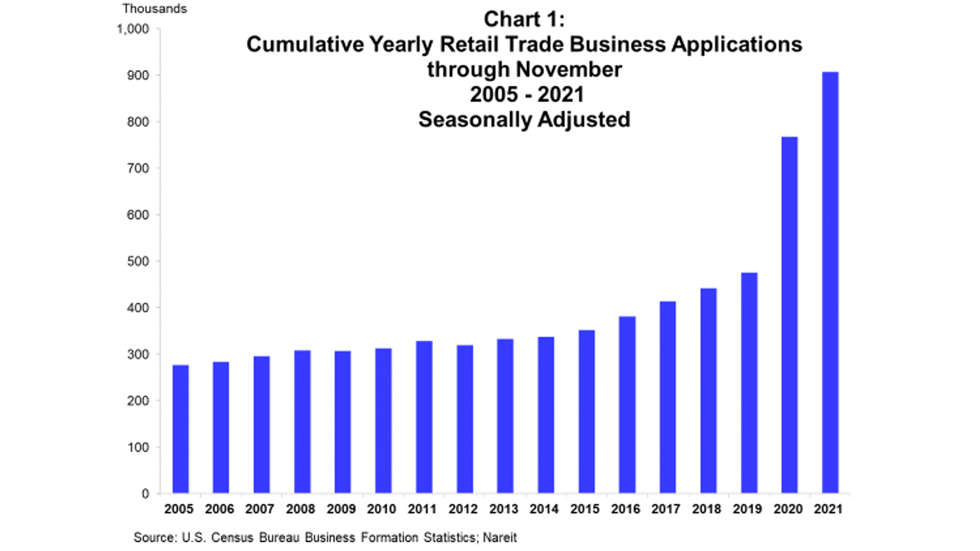

The U.S. Census Bureau’s Business Formation Statistics data through November 2021 are shown in Chart 1. There have been more new business applications in 2021 than there have been at this point in the year for any other year on record.

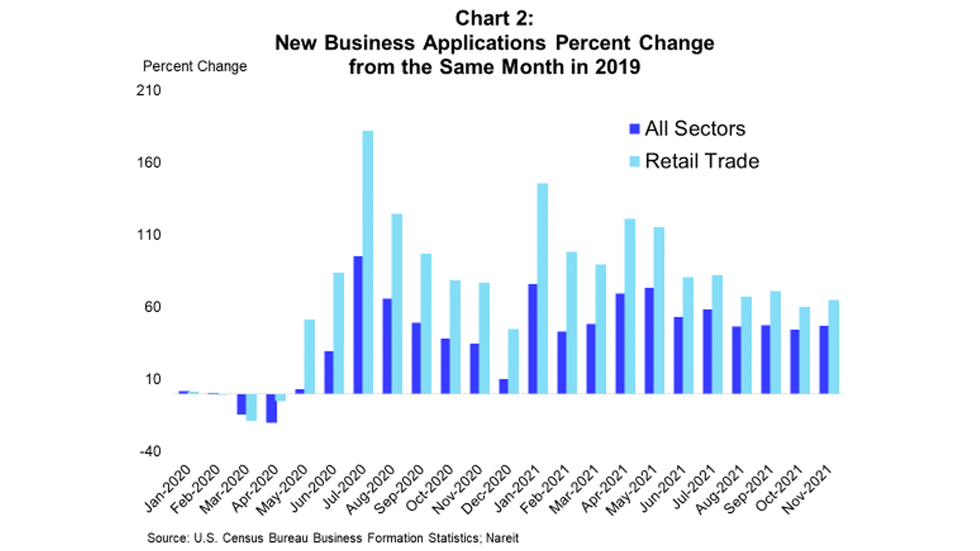

Business applications for the retail trade sector in particular are highly elevated from pre-Covid. As shown in Chart 2, new business applications began rising midway through 2020 and have remained at elevated levels compared to prior years. Applications for the retail trade sector have grown at an even higher rate. The average increase in monthly business applications for all sectors from January 2020 – November 2021 compared to the same month in 2019 was 39.4% while the average increase for retail trade applications in the same time period was 74.7%.

For the retail trade sector specifically, 2021 has had the highest total number of business applications (906,828) compared to January – November of any other year. While the monthly numbers of new applications are below their peak from July 2020 and are trending slightly downward, the levels remain highly elevated above the monthly trends for previous years.

As retail REITs continue their recovery in 2022, the increased number of business applications in the sector is a positive sign for new leases to be signed, lowering the vacancies in malls and shopping centers, and contributing to higher earnings.