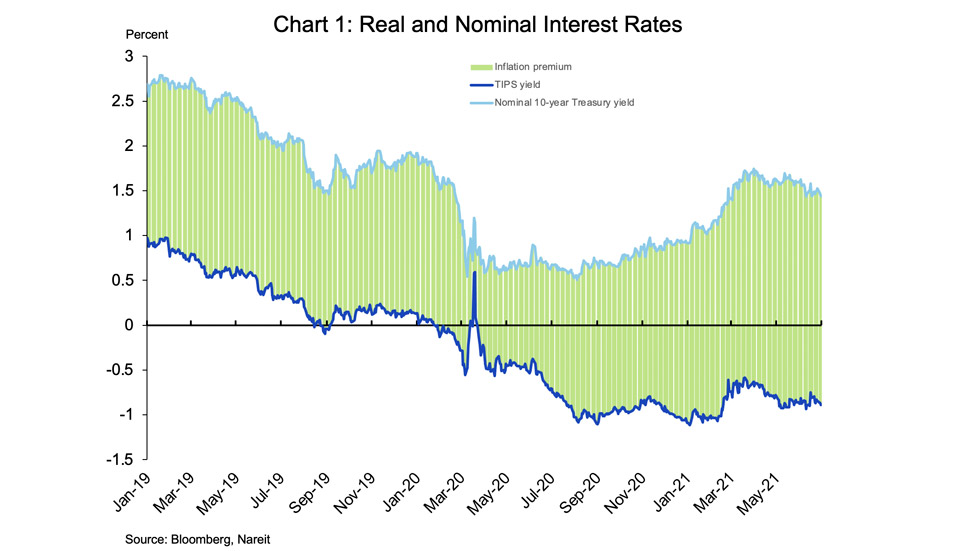

The pandemic and subsequent recovery have changed the outlook for both interest rates and inflation. Last year as the pandemic caused the global economy to shut down, both nominal and real interest rates (that is, inflation-protected, or TIPS) on U.S. Treasury securities declined significantly (light blue and dark blue lines in chart 1). Real interest rates in the U.S TIPS market have been negative since early 2020, and in a stable range between negative 50 basis points and negative 1.00% for most of this time.

Nominal interest rates rose steadily over the past year, especially after the announcement of successful test results for vaccines for COVID-19 last November. The yield on the 10-year Treasury note rose from 0.76% in early November 2020 to reach a high of 1.74% in March 2021.

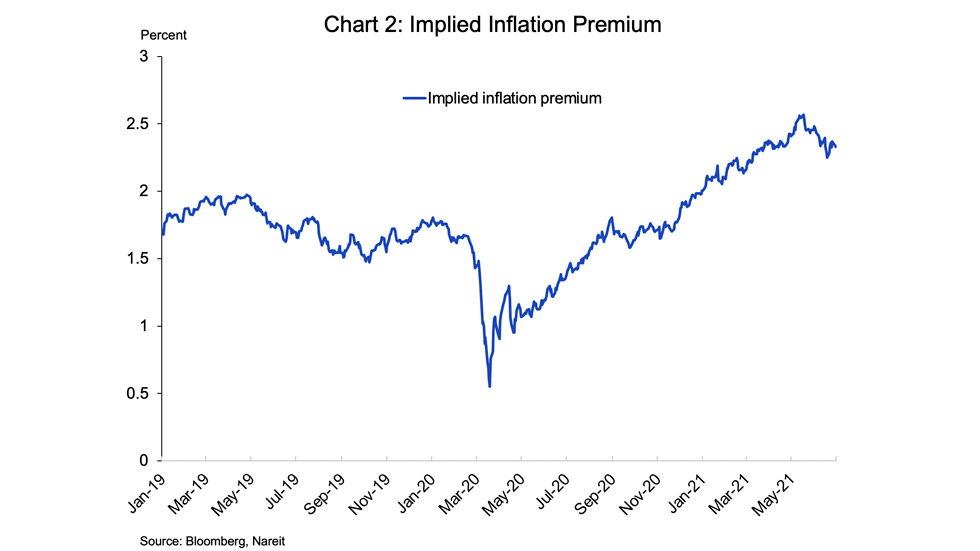

The increase in nominal interest rates while real interest rates were stable was due to an increase in future inflation expected by financial market participants. This inflation premium is plotted as the green area between the nominal and real interest rates; for easier viewing, the implied inflation expectation is also plotted separately in chart 2.

Inflation expectations have backed off a bit in recent weeks. The yield on the 10-year Treasury note has declined 30 bps from its pandemic high to 1.44%, reversing nearly one-third of the increase in recent months. Nearly all of this decline has been due to lower expectations for future inflation rates.

There is still considerable uncertainty about the course of the economy over the next year or two, of course, and financial market participants do expect inflation to be above the trends prior to and during the pandemic. Nevertheless, the recent pullback in nominal yields and inflation expectations suggests that interest rates will remain low, helping to maintain attractive financial market conditions for commercial real estate and REITs.