Inflation has been mild for several years, but things have started to change: the Bureau of Labor Statistics reported on July 12 that the Consumer Price Index had increased for the sixth month in a row. Over the last half-year the CPI has increased at an annualized rate of 4.5 percent. That’s a far cry from the peak of more than 14 percent during the late 1970s and early 1980s, but it’s enough for investors not only to take notice but also to think about adjusting their portfolios to protect against a decline in purchasing power.

Ask anybody which investments “hedge” against inflation, and real estate is one of the three that pretty much everybody will identify, along with commodities and inflation-linked bonds (TIPS). That makes sense: the idea is that when prices increase generally, property owners generally can increase their rents too. Still, the investment management industry is chock-full of stories that make perfect sense but haven’t been tested by looking at actual data. (Think, for example, of several of the most damaging myths including “the illiquidity premium,” “the hedge fund manager’s secret strategy,” or “the private equity manager’s operational improvements,” each of which has been debunked empirically.)

So let’s use some actual data to test the idea of inflation protection from REITs, commodities, and TIPS. First, though, let’s avoid the most common mistake that people make when analyzing inflation protection: computing correlations. Is a high correlation with the inflation rate a good thing? Well, no—at least it’s not enough. Imagine an asset whose monthly returns are guaranteed to equal the inflation rate minus two percentage points. That asset will have a correlation of exactly 100 percent with inflation—but will it protect your purchasing power? No, it is a guarantee that you will lose money in real terms.

The reason people make the mistake of computing correlation coefficients is that they start with the notion of an “inflation hedge,” and if you’re literally setting up a hedge then the correlation coefficient is an important piece of input data. Nobody, though—not even the largest and most sophisticated investors—literally hedges against inflation. A high correlation means that the asset’s returns are higher when inflation is higher and lower when inflation is lower: the first part of that is fine but not enough, while the second part is bad! So let’s throw away the notion of “inflation hedging” and think about what investors really want and need: an asset whose returns can be expected to exceed the inflation rate even when inflation is relatively high.

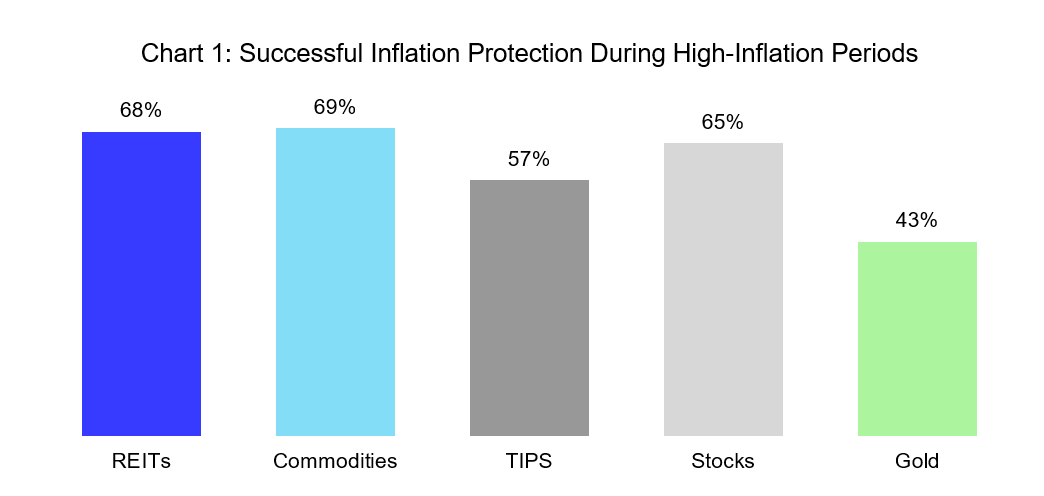

In other words, investors need a high batting average: when inflation is high, they need an asset whose returns have a high probability of being even higher. Chart 1 shows exactly that. I define “high-inflation periods” as those six-month periods when inflation has been higher than 1.51 percent (3.04 percent annualized), which is the median since the beginning of 1978. (I would love to go back earlier than the beginning of 1978, but that’s the earliest date for which I have investment returns on gold, which is sometimes thought of as a protection against inflation.)

What Chart 1 shows is that the returns on commodities have exceeded the inflation rate during 69 percent of the six-month periods when inflation was relatively high; REITs have achieved the same success during 68 percent of high-inflation periods; stocks have done so with 65 percent success; TIPS have protected purchasing power with a somewhat disappointing success rate of 57 percent; and gold has performed worse than a coin flip with an inflation-protection success rate of just 43 percent. That provides empirical support for the notion that commodities and real estate (REITs) provide solid inflation protection—that is, they are “natural inflation hedges,” in common parlance.

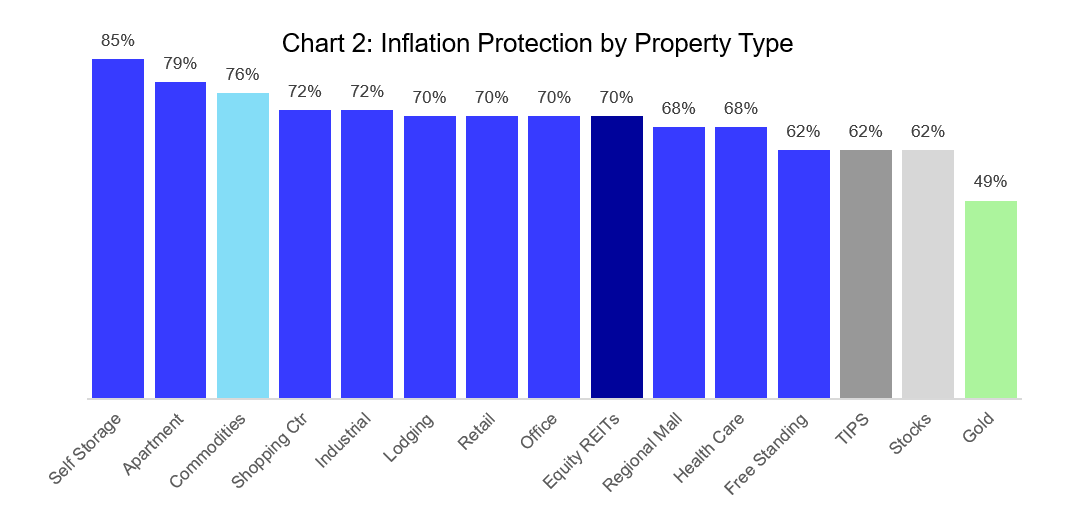

Chart 2 takes the analysis one step further, looking at inflation protection by property type. Data on returns by property type go back only to the beginning of 1994, so we have to be more careful in drawing conclusions, but Chart 2 provides empirical support for another story that makes sense: that property owners have a greater ability to keep up with inflation if their lease rents can be re-set frequently, as with self-storage and apartment properties.

I hope this analysis will help you make investment decisions to help protect your purchasing power, but there’s more that you should consider before doing so. In my next market commentary I’ll point out the biggest risk associated with inflation: the risk of guessing wrong. Hint: that risk is greatest if you’re thinking about investing in commodities.

There are several important caveats to my analysis. First, the “modern REIT era” started only in the early 1990s, whereas the last period of truly high U.S. inflation ended some 10 years earlier; it’s not clear whether that matters, but it’s worth keeping in mind. Second, for commodities my analysis uses the S&P GSCI, an index that gives especially heavy weight to energy commodities; separate analysis for a somewhat shorter time period suggests that non-energy commodities are significantly less dependable at providing inflation protection, so if you’re investing in commodities in line with a different commodity index (such as the Dow Jones UBS) then the success rates shown here for commodities probably overstate what you should expect. Finally, as I noted already, my analysis starts at the beginning of 1978—and at the beginning of 1994 for Chart 2—because that’s as far back as the data are available (although I can go back to the beginning of 1972 if I jettison gold).

Details: REIT total returns come from the FTSE Nareit U.S. Real Estate index series, stocks from the S&P 500 Stock Index, and commodities and gold from the S&P GSCI. For TIPS I used the Bloomberg Barclays TIPS index, with monthly returns back-filled by Ibbotson Associates for months prior to December 1997. I use the U.S. city average all-item CPI, not seasonally adjusted. I’ve used various definitions for “high-inflation periods,” and the numbers change but the qualitative results don’t. If you have any questions or comments, please drop me a note at bcase@nareit.com.