As the market adjusts to the COVID-19 pandemic, it’s important to keep in mind some of the lessons from the global financial crisis (GFC)—in this case, the lead/lag relationship between REITs and unlisted (or private) real estate. REIT share prices react in real time to market conditions while shocks to private real estate valuations are revealed over time as a result of reporting lags. Nevertheless, the true value of an asset remains the same irrespective of whether it is owned by a listed REIT or a real estate fund. Thus, REIT returns today anticipate changes in private real estate returns by several months to over a year.

REIT share prices are available on a second by second basis and these share prices reflect market valuations of the enterprises and their properties. Valuations of private investments in real estate, however, are calculated and communicated to investors at different points in time, typically based on appraisals and sometimes based on transactions. Appraisals are only an estimate themselves of an expected market value of a property and are known to have significant errors versus transaction prices. Appraisals may not be updated on a timely basis, and appraisers may not have fully absorbed changes in the current property markets. There are significant lags in reporting these updated valuations.

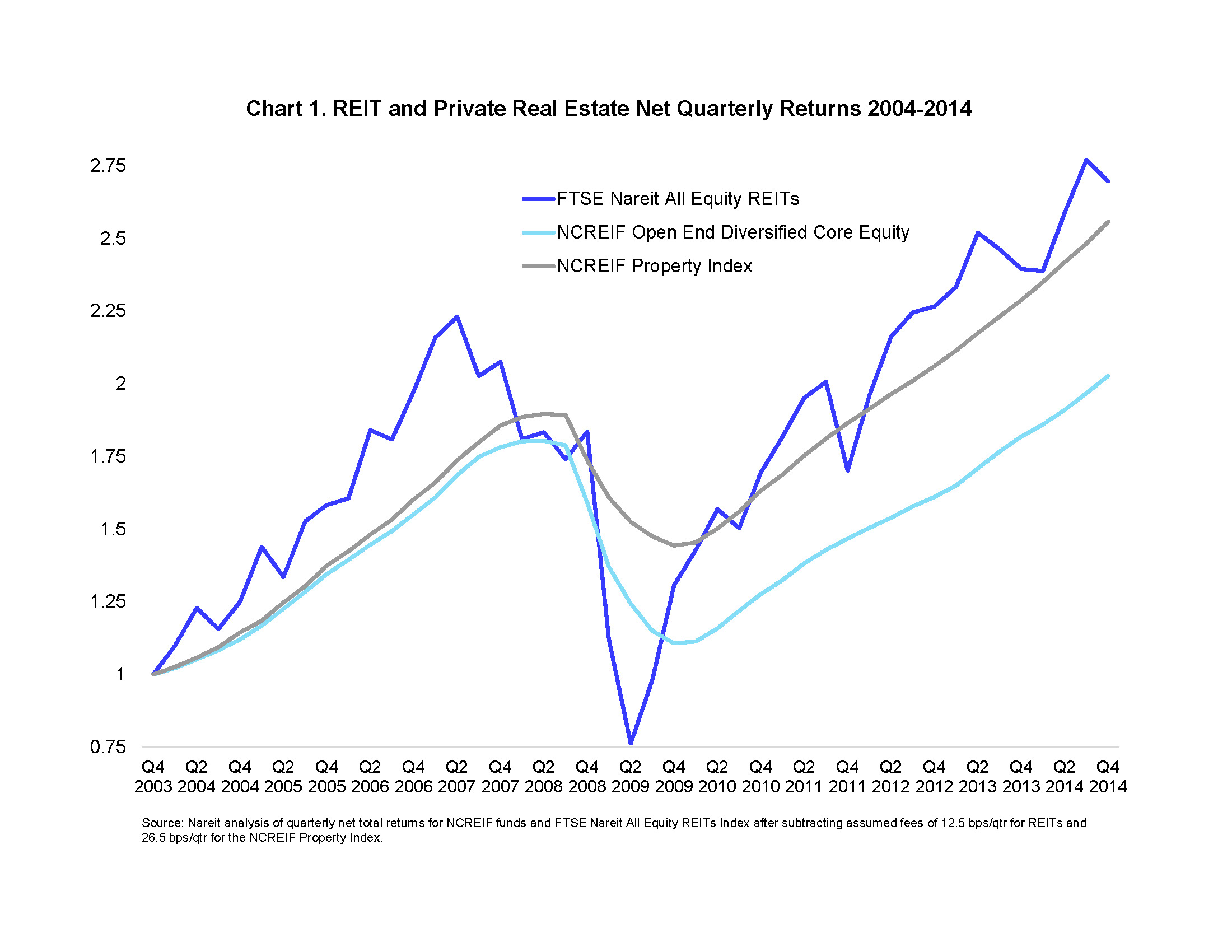

Looking back to the GFC, we can see these differences in Chart 1. Private real estate returns are smoother than REIT returns (reflecting both appraisal smoothing and monthly quarterly averaging). REIT returns peaked in the second quarter of 2007, while the NCREIF Property Index (NPI) and the Open End Diversified Core Equity (ODCE) peaked a full year later in the second quarter of 2008. Following the GFC, REIT returns bottom out in the second quarter of 2009. The ODCE fund and NPI don’t bottom out until fourth quarter 2009.

These lags disguise that ultimately, the real estate assets underlying REITs and private real estate are substantially the same. CEM Benchmarking Inc’s latest report shows how removing reporting lags from private real estate dramatically increases the correlation between REITs and private real estate.

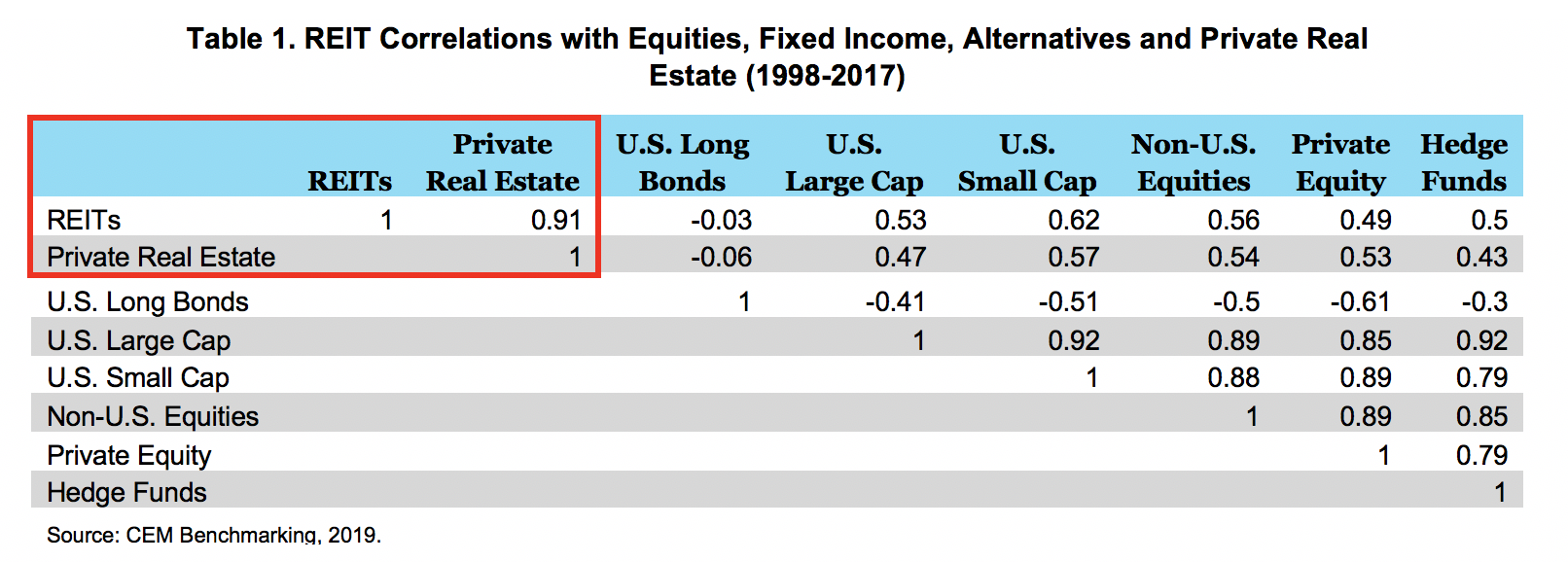

The CEM study details realized investment performance across asset classes over a 20-year period using CEM’s proprietary dataset covering more than 200 public and private sector pensions. Because of the unique nature of the dataset, CEM can adjust for reporting lags on a pension fund by pension fund basis. Table 1 shows the correlations of several asset classes including REITs and private real estate (in the red box). This de-lagging results in a significant increase in the correlation between private real estate and REITs. The correlation goes from 0.08 without adjusting lags to 0.91, nearly perfectly correlated.

All real estate property values are changing, but private real estate values will be reported with a substantial lag. Failure to account for these reporting lags can lead to false comparisons between REITs and private real estate. Understanding these lags provides opportunities for REIT investors.