Nareit research has shown that REIT total returns have tended to bounce back and even surge after periods of significant REIT underperformance relative to private real estate. Since the divergence between public and private property total returns in the third quarter of 2022, these real estate markets have been attempting to become more in sync with one another, but progress has been slow. The process has been impeded by headwinds related to monetary policy tightening and rising interest rates. After the Federal Reserve completed its rate hikes in the third quarter of 2023, REIT total returns enjoyed a resurgence, while private real estate returns failed to gain traction. Historical experience suggests that the convergence of the wide valuation gap between public and private real estate will likely ensure continued REIT outperformance into 2024.

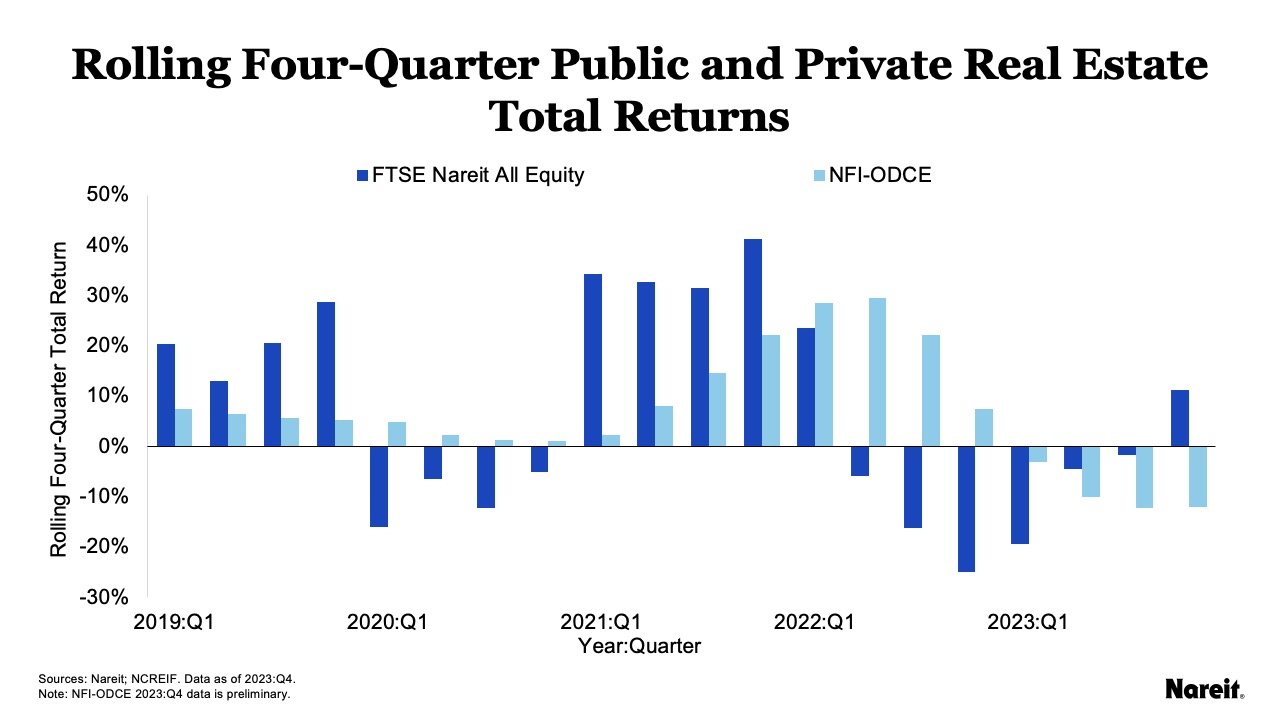

The chart above illustrates rolling four-quarter total returns for public and private real estate since the first quarter of 2000. The FTSE Nareit All Equity Index (FTSE Nareit) and NCREIF Fund Index–Open End Diversified Core Equity (NFI–ODCE) were used to measure public and private real estate performances, respectively.

The cyclicality of real estate is evident when following the total returns from both public and private property markets. A lead-lag relationship is also apparent with FTSE Nareit leading NFI–ODCE performance. At times, public and private real estate total returns have materially differed. Although REITs have faced their fair share of challenges over the last couple of years, they have outperformed private real estate by 23.3% in the four quarters through the end of 2023.

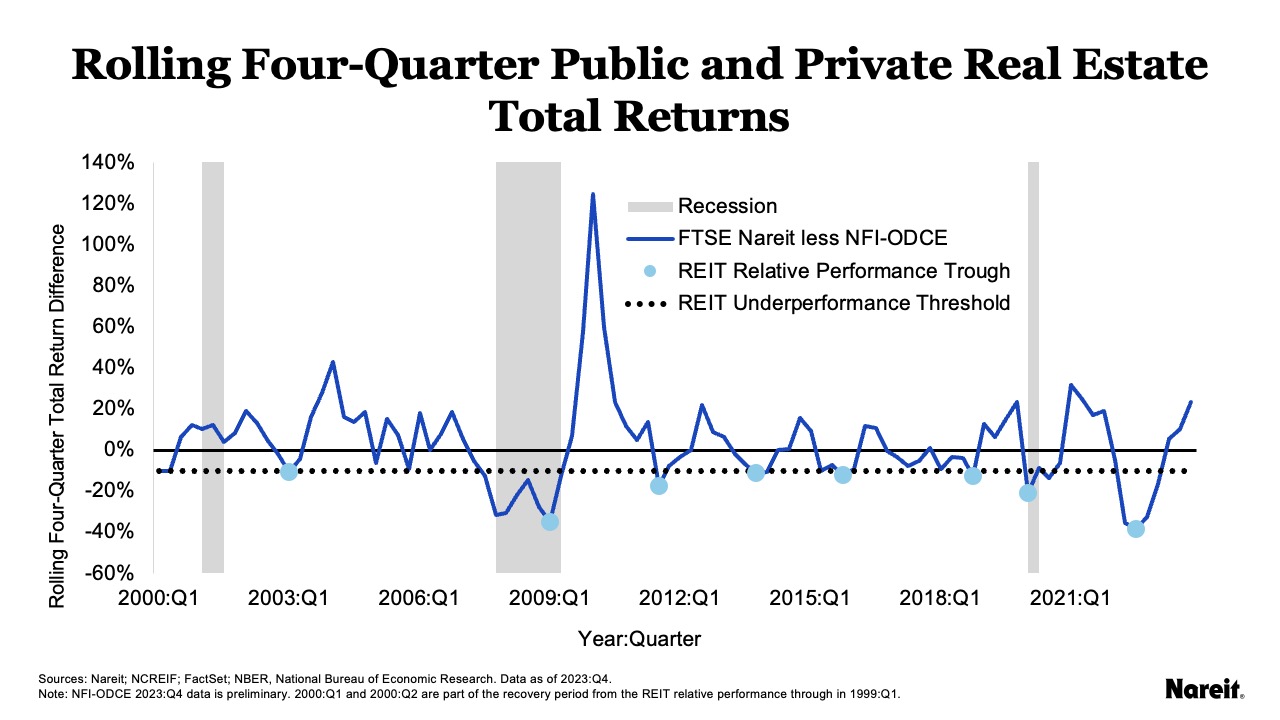

The chart above revisits the public and private property market divergences from the first quarter of 2000 to the fourth quarter of 2023. It displays rolling four-quarter total return differences between public and private real estate, REIT relative performance troughs, and U.S. recessions. Negative values highlight periods of REIT underperformance relative to private real estate; positive values indicate periods of REIT outperformance.

Since 2000, there have been eight periods of significant REIT underperformance relative to private real estate; only two coincided with U.S. recessions. Each of these REIT relative performance troughs had a nadir that was more negative than an established threshold of -10%. The most recent trough in the third quarter of 2022 had a total return difference of -38.4%. This marked the most significant degree of REIT relative underperformance in the last 45 years.

A review of the chart reveals a pattern where public-private total return differences tended to significantly rebound after troughs. In other words, REITs have been apt to materially outperform private real estate in post-trough periods. This trend appears to have continued after the most recent trough.

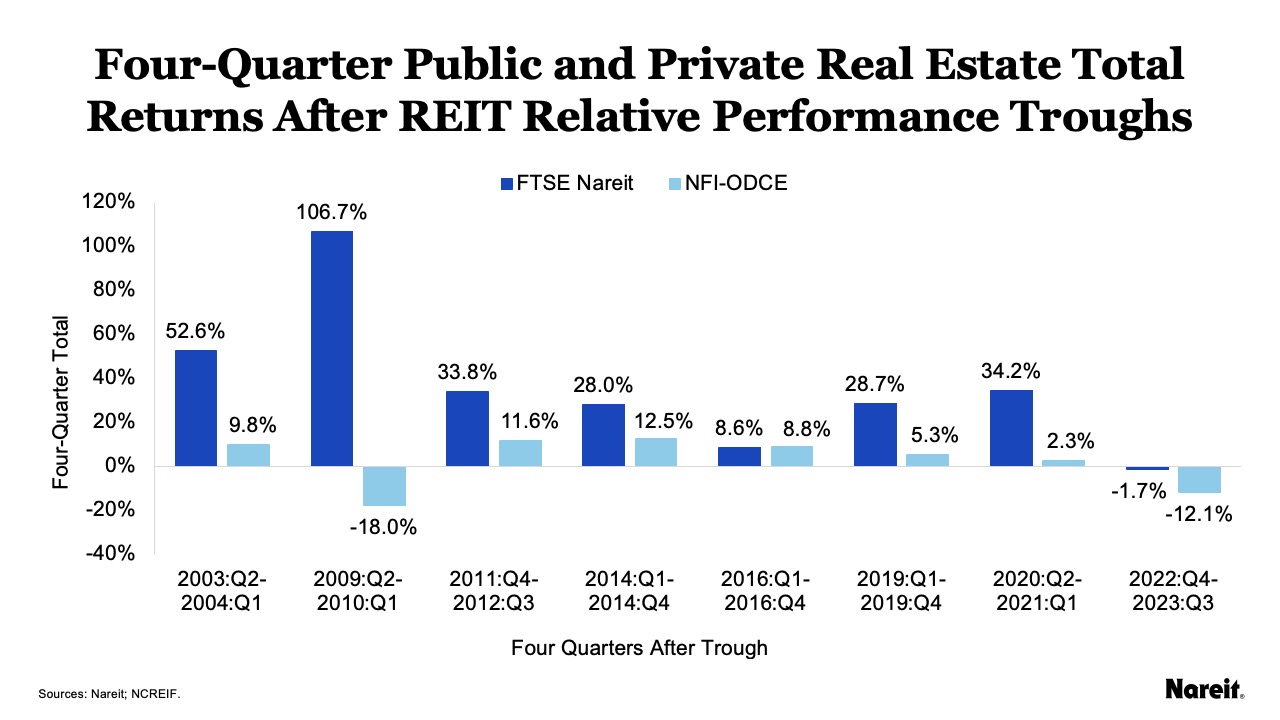

The chart above presents four-quarter total returns for public and private real estate after each of the eight REIT relative performance troughs since 2000. After the troughs, the REIT four-quarter total return averaged 36.4%; the private real estate return was 2.5%. The average REIT outperformance spread was 33.8%. REITs outperformed private real estate in seven of eight instances, or 87.5% of the time. When REITs did underperform, the public-private gap was a modest -0.1%.

After the most recent trough, REITs outperformed private real estate by 10.4%, but both public and private four-quarter total returns were negative. This is an intriguing result as REIT recoveries have tended to be stronger with more extreme divergences. The inability for property total returns to push into positive territory likely stemmed from headwinds related to rising interest rates. The four-quarter, post-trough recovery period coincided with the most recent monetary policy tightening cycle. The Federal Open Market Committee (FOMC) raised the target federal funds rate a total of 5.25% across seven quarters from the first quarter of 2022 through the third quarter of 2023.

Upon completion of the FOMC’s rate hike program in the third quarter of 2023, REIT total returns bounced back in the last quarter of the year, posting a total return of 17.9% and outperforming private real estate by 22.7%. These results were consistent with historical market dynamics where REIT total returns have tended to enjoy a resurgence after monetary policy tightening cycles end and also included material outperformance of their private market counterpart.

After impressive performance at the end of 2023, investors have become increasingly curious about the prospects for REITs in 2024. Public and private real estate valuation metrics likely hold the key to investor curiosity. At the time of the most recent REIT relative performance trough, the third quarter of 2022, the REIT implied and private real estate appraisal capitalization (cap) rate spread was 246 basis points. Reflecting the real estate market’s continued slow valuation adjustment process, it only modestly declined to 216 basis points four quarters later. Although recent FTSE Nareit and NFI–ODCE performances likely narrowed the public-private cap rate spread further, the gap is expected to remain wide. Historical experience suggests that the convergence of this outsized gap is anticipated to ensure continued REIT outperformance into 2024.