The mortgage market is critically important for the economy and for financial markets. Funding through the mortgage market helps homeowners finance their home purchase and gives a source of funding for apartment owners who provide rental housing for millions of Americans. In addition, mortgages are an important investment market for banks, funds and mortgage REITs, as well as for individual investors. The smooth functioning of the mortgage market is essential for the stability of the financial system, as the troubles that originated in the mortgage market in 2008 made all too clear.

The economic and financial impacts of the COVID-19 crisis are affecting mortgage markets today in several ways. Many investors have sought to shed risk exposures across all asset classes. This has put pressure on prices and liquidity in markets for mortgage backed securities (MBS). In addition, the likelihood that some homeowners may delay or miss their mortgage payments has raised concerns about credit risk in mortgage investments.

Two distinct parts of the MBS market face different challenges:

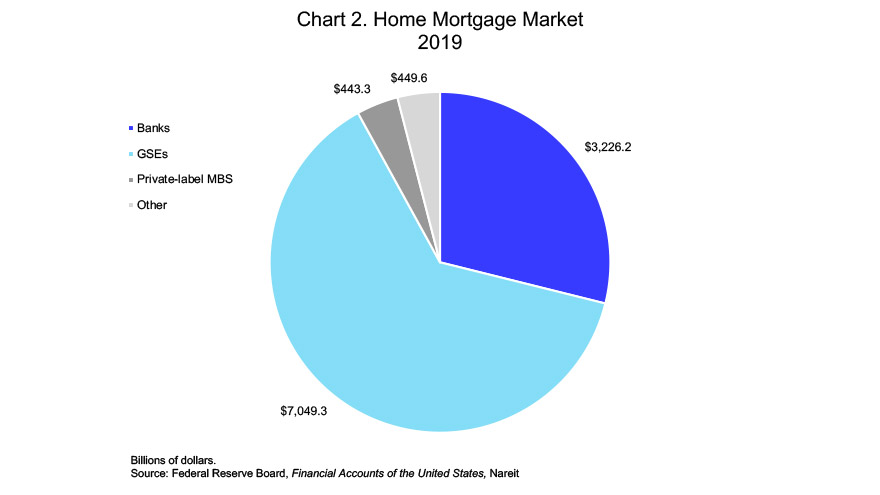

- Agency MBS. These securities are backed by mortgages on single-family homes and are guaranteed by Fannie Mae and Freddie Mac (also referred to as the Government Sponsored Agencies, or GSEs). The $7.0 trillion outstanding agency MBS constitute 63% of the $11.1 trillion mortgage market today. Agency MBS also dominate most mREITs’ portfolio holdings.

There has been selling pressure in agency MBS, as in all asset classes, including Treasury securities and equity markets as investors shed risk and seek to bolster cash positions. This has impacted pricing and volatility in the agency MBS market.

The agency MBS market, however, has the full and unlimited support of the U.S. government. Payments of principal and interest are guaranteed, and the Federal Reserve has pledged to purchase agency MBS in whatever amounts are needed to support the smooth functioning of the market.

- Non-agency MBS. Also called private-label MBS, these are issued by banks and other entities outside of Fannie Mae and Freddie Mac. These securities do not carry a government guarantee nor benefit from any liquidity support from the Federal Reserve. This has resulted in severe stress in the private MBS market and for some mREITs that have significant holdings.

Part of the concern today is undoubtedly due to the private-label MBS role in the 2008 crisis. There are few parallels, however, and in fact, significant differences in today’s environment. In 2008, the private MBS market was dominated by subprime adjustable-rate mortgages (ARMs). These mortgages had weak underwriting to low-credit quality borrowers who were often unable to make their monthly payment when interest rates reset after the second year. Today, however, most of the mortgages in non-agency MBS are those not eligible for purchase by Fannie and Freddie because they are over the size limit for conforming loans, or because they have other characteristics inconsistent with the agency MBS criteria. By and large, though, they are perceived as having relatively low default risk.

The underlying conditions of the housing market and mortgage market in 2008 were far different from today as well. There had been a speculative construction boom in 2005-2008 that resulted in millions of unsold homes sitting on the market, which sent home prices plummeting. Most homeowners holding a subprime mortgage in 2008 had little or no equity in their home after subtracting the mortgage balance from the home’s value. Today, in contrast, construction has lagged demand and inventories are lean. Prices have risen appreciably in recent years, building home equity (and reducing default risk), and the absence of excess supply may limit any price declines in the months ahead.

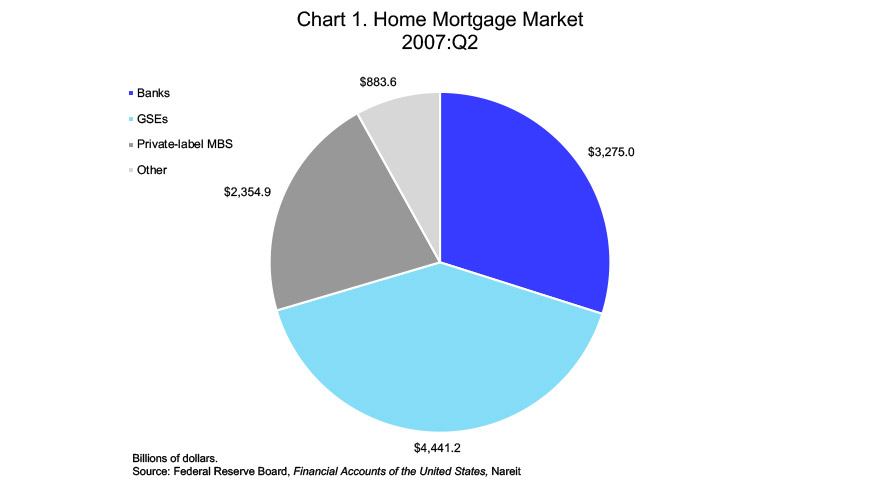

One final but important difference in the private MBS market at its peak prior to the mortgage crisis compared to today is the sheer size of the market. In 2007:Q2, there were $2.4 trillion non-agency MBS, which constituted more than 21% of the total market for single-family mortgages (chart 1, dark grey slice). This amplified the risks that subprime mortgages posed to the financial system. Today, in contrast, private MBS total $443 billion, or slightly less than 4% of total single-family mortgages (chart 2, below). The share of home mortgages guaranteed by the GSEs, in contrast, has risen from 40.5% in mid-2007 to 63.1% today.

Most mREITs own primarily the agency MBS that are guaranteed by the GSEs and are being supported by the Federal Reserve. Pricing and liquidity conditions in the agency MBS markets have improved since the Fed announced its expanded purchase program. With the Federal Reserve indicating its full commitment to ensuring the smooth functioning of the mortgage market, there is a lot more help on the way to deal with the crisis.

Note: The agency CMBS market also provides funding to the residential sector through GSE-issued and guaranteed MBS backed by multifamily mortgages. The agency CMBS market had faced severe pricing pressures, but conditions improved after the Fed announced on March 23 that these securities would be included in future Fed purchases. Please see yesterday’s post, Mortgage REITs, CMBS Markets and the Fed for further discussion.