The multifamily housing market had a stellar performance in 2014, leaving everyone to wonder what comes next. Would the market take a breather, perhaps, as home sales start to pick up? And how much of a threat does the swelling construction pipeline pose to rents?

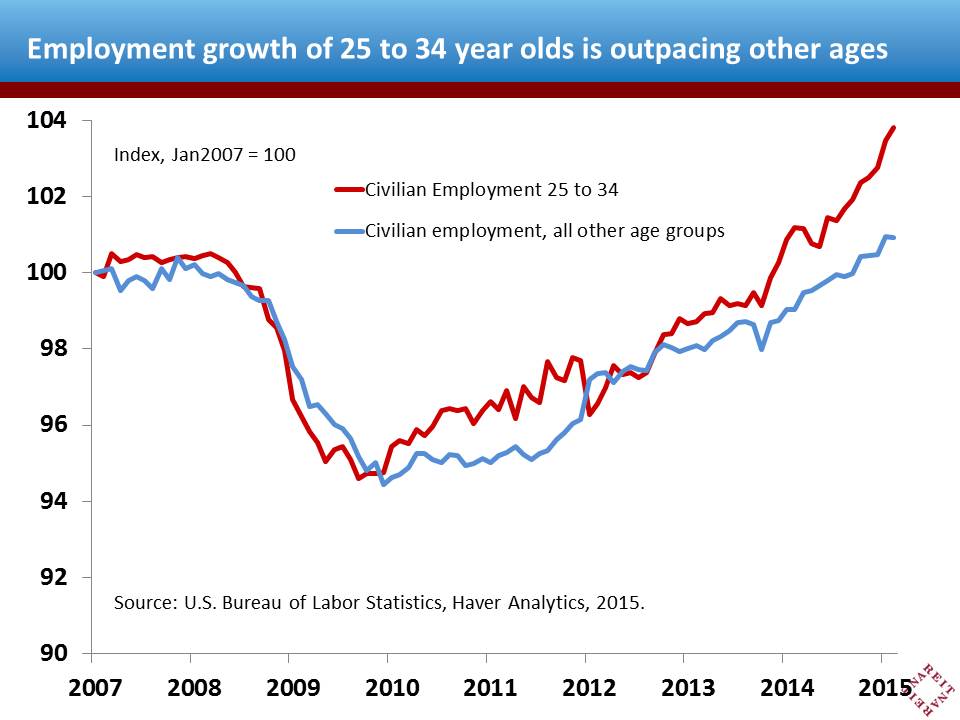

Recent news from the job market suggests that rental demand has the wind at its back. In particular, employment growth of those aged 25 to 34—the prime years for signing a new lease on an apartment—has pulled ahead of all other age groups. With rapid job growth in this age group in 2014 carrying over into early 2015, the gap in hiring patterns has continued to widen.

Stronger job prospects for this age group will help free up the “pent up demand” for apartment rentals, as those who are currently living with family or roommates will become more likely to move out on their own. With 3 million or more currently “doubled up”, rental demand seems likely to keep pace with supply in the months ahead.