In a recently published research note, Nareit estimates 86.6 American adults, or 44% of American households, own REIT stocks directly or indirectly through mutual funds, ETFs or target date funds (TDF). This represents an 8% increase in the previous year’s estimate of 80.2 Americans.

The key sources of data for this analysis are the 2016 Federal Reserve Board Survey of Consumer Finances (SCF), the Employment Benefit Research Institute data on 401(k) equity allocations (EBRI), Census population and household counts, Census household income statistics and Nareit analysis of Morningstar Direct data on asset weighted REIT exposures by investment product type. The main cause of the difference between the estimated REIT ownership for 2017 and 2018 is the increased share of REIT ownership by the underlying funds.

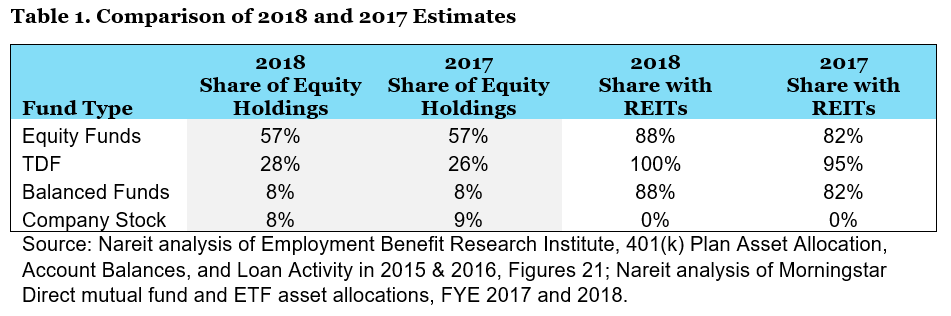

Table 1 shows the estimates used from EBRI and Morningstar Direct for the respective year’s analysis. In the first two columns, EBRI’s estimates of equity ownership show a small increase for target date funds from 26% to 28%. In the Nareit analysis of Morningstar Direct data, REIT ownership showed across the board increases in ETFs, mutual funds, and TDFs. The share of ETF and mutual funds increased from an average of 82% holding REITs to 88%, while all the TDF funds included had some amount of REIT exposure. Taken together, this leads to an estimated increase of 6.3 billion American adults now directly or indirectly invested in REITs.