The U.S. economy and commercial real estate markets are entering a period of more robust recovery from the shutdowns during the pandemic. The path ahead, however, will be uneven across sectors and subject to various lags. Despite the bumps in the road ahead, the issue of a strong recovery is no longer “if” but “when”.

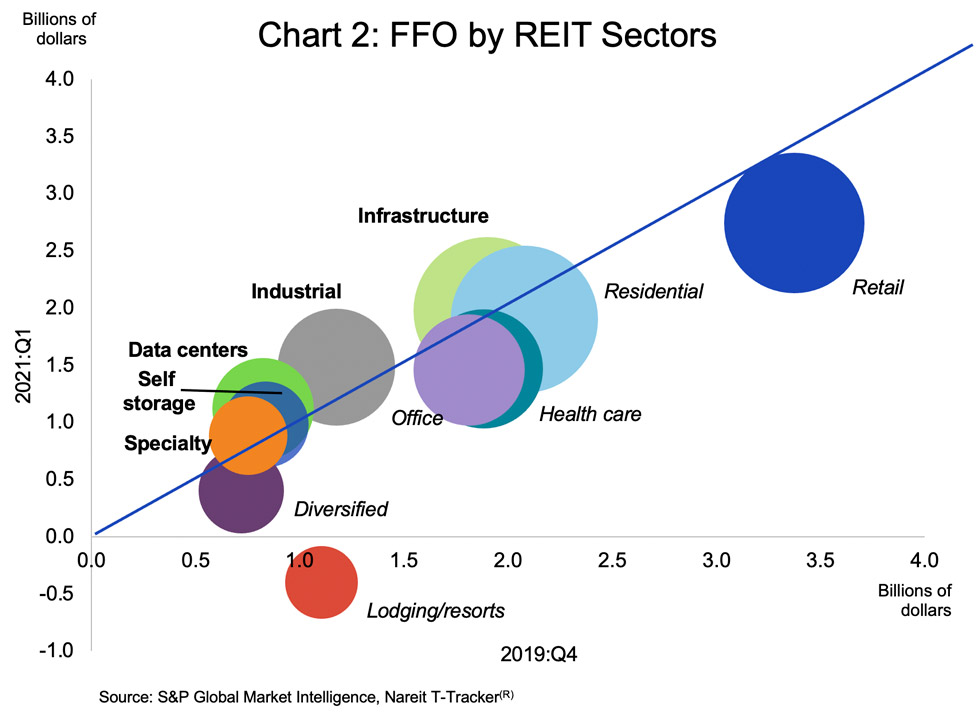

My essay in the recently-released Nareit Mid-year Economic Outlook focuses on how economic fundamentals are supportive of commercial real estate, and how the economic environment will affect REIT performance in the recovery ahead. REIT earnings and REIT stock prices will continue to depend on how social distancing during the pandemic and the reopening affect different sectors within real estate.

My colleague Nicole Funari contributes an essay on how REITs provide protection against higher inflation. While our outlook does not expect a return to high inflation, both rents and real estate values tend to rise with general prices, and REITs have generally outperformed broader markets during periods of higher inflation.

John Barwick has penned a note in this edition of the Outlook that describes how the REIT indexes have evolved to reflect the changing real estate landscape, in particular, the rise of tech-related real estate sectors that support the digital economy. Nareit, along with its index partners FTSE Russell and EPRA, have updated and expanded the FTSE-Nareit and FTSE-EPRA-Nareit indexes to better reflect the evolving real estate landscape.