At the start of the year, economists and financial markets anticipated that the Federal Open Market Committee (FOMC) would embark on a series of target fed fund rate cuts in 2024. Recent statements by FOMC members have suggested a different path forward, where the timing of any potential interest rate drops may be delayed. Furthermore, in the March 2024 Summary of Economic Projections, some FOMC participants have expressed expectations of fewer rate cuts this year.

A lack of Fed rate cuts, however, are still not expected to pose a problem for U.S. public equity REITs. Fourth quarter 2023 data from the Nareit Total REIT Industry Tracker Series® (T-Tracker) show that, on average, REITs have maintained long-term, well-structured balance sheets with low leverage ratios, predominantly utilizing unsecured debt and fixed interest rates. With their disciplined balance sheets, REITs may not be immune from higher interest rates, but they are reasonably well-insulated from them.

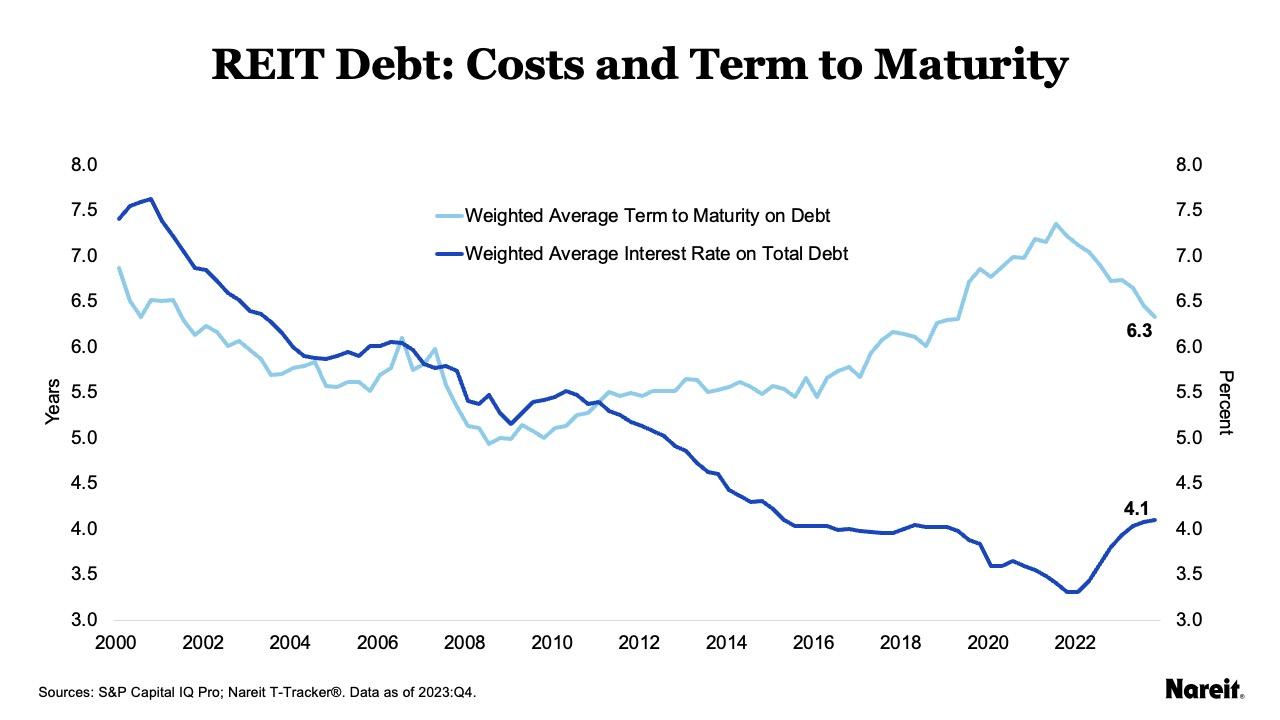

Using data from T-Tracker, the chart above displays the weighted average terms to maturity and weighted average interest rates on total debt for U.S. public equity REITs since the first quarter of 2000. REITs have made concerted efforts to lower their leverage ratios and lock in debt at low, fixed rates. As of the fourth quarter of 2023, the average REIT leverage (debt-to-market assets) ratio was 33.2%, the weighted average term to maturity was 6.3 years, and the average in-place cost of REIT debt was 4.1%.

The chart above presents quarterly unsecured and fixed rate debt as percentages of total debt for U.S. public equity REITs from the first quarter of 2000 to the fourth quarter of 2023. Highlighting REITs’ typical longer term investment focus, fixed rate debt accounted for more than 90% of total REIT debt in the last quarter of 2023. Unsecured debt comprised nearly 80% of total debt. Access to unsecured debt provides REITs with a competitive advantage over many of their private real estate market counterparts.

Balance sheet discipline has served REITs well in the current interest rate environment. While REITs are not immune from higher interest rates, they are poised to be reasonably well-insulated from them. A lack of Fed rate cuts is still not expected to pose a problem for U.S. public equity REITs.