This is part two of a two-part market commentary series. Please read part one here.

A recent Nareit market commentary highlighted that the “ostrich effect,” an investor behavior where risky situations are avoided by pretending that they do not exist, may aptly describe the attitudes of many private institutional real estate investment managers and appraisers when it comes to their valuation practices. It found that despite meaningful increases in REIT implied and private transaction cap rates, as well as debt rates, private appraisal cap rates have been slow to adjust to current market conditions. These actions have incurred real costs. They have impeded the market’s price discovery process, limited transaction market liquidity, and obliged investors to pay artificially high investment management fees.

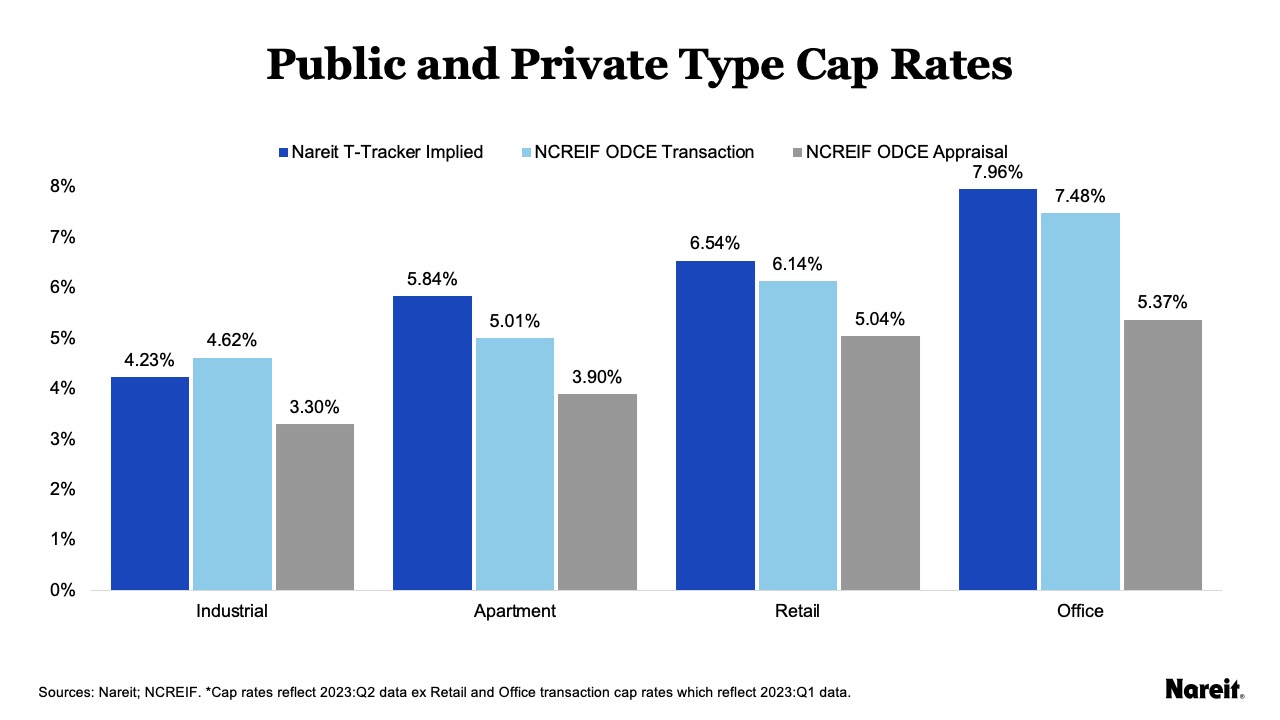

Examining sector-specific public and private cap rates highlights the differences between market and appraisal-based valuations across the four traditional property types. With many private institutional real estate investment managers and appraisers continuing to bury their heads in the sand when it comes to their valuation practices, denial is not just a river in Egypt.

The chart above displays the latest available public (REIT implied) and private (transaction and appraisal) real estate cap rates for the four traditional property types using data from the Nareit Total REIT Industry Tracker Series (T-Tracker®) and the National Council of Real Estate Investment Fiduciaries (NCREIF). The NCREIF transaction and appraisal cap rates solely focused on properties from open end diversified core equity (ODCE) funds. All cap rates reflect data from the second quarter of 2023 except for the retail and office NCREIF ODCE transaction cap rates, which are from the first quarter of 2023. Retail and office transaction cap rates were unavailable in the second quarter of 2023 due to a lack of sufficient or no transactions.

Demonstrating progress in the valuation adjustment process, the gaps between REIT implied and transaction cap rates have been attempting to close with changes in both REIT and private market valuations. In contrast, the spreads between REIT implied and appraisal cap rates have remained wide as property appraisals have been slow to adjust to current market conditions. Case in point, on a quarterly basis, the industrial appraisal cap rate has been lower than the U.S. 10-year Treasury yield since the second quarter of 2022.

Sector-specific differences between REIT implied and appraisal cap rates can capture the varying disparities found in market and appraisal-based real estate valuations. Of the four property types, office had the largest differential at 259 basis points. The differences for apartments, retail, and industrial were 194, 150, and 93 basis points, respectively. Although the spreads exhibited considerable variation, the potential valuation impacts associated with private appraisal cap rates moving to REIT implied cap rates were more similar. All else equal, closing the gaps for the industrial and retail sectors would require private value write-downs of more than 20%; the declines would need to exceed 30% for the apartment and office property types.

The great divides found in each of the property types are indicative of serious disparities between today’s market and appraisal-based real estate valuations, particularly for the office and apartment sectors. Recognizing that significant rises in appraisal cap rates are warranted, further material write-downs are likely on the horizon for the private real estate market. These potential declines diminish the attractiveness of private real estate funds by creating an impediment for new or increasing investment and providing an impetus for existing investors to exit. At the same time, they may increase the appeal of public real estate investment, as U.S. public equity REITs more accurately reflect current market valuations.