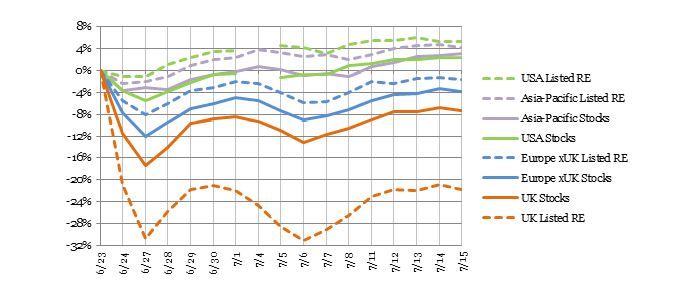

The continued fallout from the UK’s vote to exit the European Union has punished investors with exposure not only in that country but in the rest of Europe too. No assets have been hit harder than British real estate, but investors in the British stock market, European stocks, and European real estate have suffered as well. The chart below compares returns for listed stocks and listed real estate (including exchange-traded equity REITs) in the U.S., the U.K., Europe other than the UK, and the Asia-Pacific region over the days since the Brexit vote.

Listed real estate in the UK was the hardest hit, with total returns plummeting a stunning -31% in the first two trading days following the vote. (In fact, US investors in the UK real estate market would have been hit even harder given that the chart shows losses in local currency while the British pound declined sharply against the U.S. dollar.) Even with a partial recovery, as of July 15th investments in UK listed real estate were still at -22%. Of course, investors in listed UK real estate fared much better than those in funds owning illiquid British property, seven of which refused when investors sought to redeem what were supposed to be liquid shares at the inflated values that managers continued to report.

The broad UK stock market also suffered severely, losing -17% in total returns over the first two trading days; after a partial recovery, UK stock investors have lost “only” -8% of their wealth compared to where they stood just 22 days earlier.

In the rest of Europe, stock investors lost more than real estate investors as the Brexit vote engendered well-founded concerns about the continent’s macroeconomic prospects. Europe ex-UK stocks lost -12% in total returns over the initial two trading days, and as of July 15th were still down -3.8%. Europe ex-UK investors in listed real estate did slightly better, losing “only” 8.1% over the first two trading days, and remained poorer by “just” -1.6% twenty-two days after the vote.

Outside of Europe the situation was not nearly so dire, especially for investors in listed real estate. Investors in Asia/Pacific stock markets saw their total returns decline by -3.7% in the first day after the Brexit vote but by July 12th had fully recovered and are now wealthier by +3.0% compared to June 23rd. Listed property companies in the Asia/Pacific region did even better, losing just -2.3% on June 24th and recovering to a gain of +4.2% as of July 15th.

U.S. stock investors, too, have fully recovered after an initial loss of -5.6% in the first two trading days after Brexit (and a huge spike in market volatility, which more than doubled as I noted in another market commentary). As of July 15th, total returns for the broad U.S. stock market were up +2.4% relative to voting day.

The big winners have been investors in exchange-traded Equity REITs in the U.S. The immediate post-Brexit response was less pronounced than in any of the other seven markets mentioned, with a decline of -1.2% over the first two trading days; since then, however, U.S. equity REITs have gained +6.8%. As a result, investors in listed U.S. real estate now have +5.5% more wealth than they did when the Brexit vote happened just 22 days ago—and 27% more than their counterparts in the UK.

The over-riding reason to be invested in the U.S. real estate market through exchange-traded U.S. equity REITs is not to protect against anything as specific as Brexit. Rather, the reason to have a meaningfully diversified investment portfolio with significant exposure to U.S. listed real estate alongside U.S. and non-U.S. stocks, bonds, and cash (for immediate liquidity), is because unexpected events happen all the time, but asset classes—real estate, stocks, bonds, and cash—respond differently to them. In this case, geographic diversification helped mitigate the effects of exposure to the UK while asset-class diversification helped further insulate investors from the fallout of developments in an overseas market. Becoming +5.2% richer over three weeks was simply a bonus.

Technical details: total returns were measured using the FTSE NAREIT All Equity REITs Index (US listed real estate), FTSE Russell 3000 Index (US stocks), FTSE EPRA/NAREIT UK Index (UK listed real estate), FTSE All-Share Index (UK stocks), FTSE EPRA/NAREIT Developed Europe ex-UK Index (Europe xUK listed real estate), FTSE World Europe ex-UK Index (Europe xUK stocks), FTSE EPRA/NAREIT Developed Asia Index (Asia listed real estate), and FTSE All-World Asia Pacific Index (Asia-Pacific stocks).