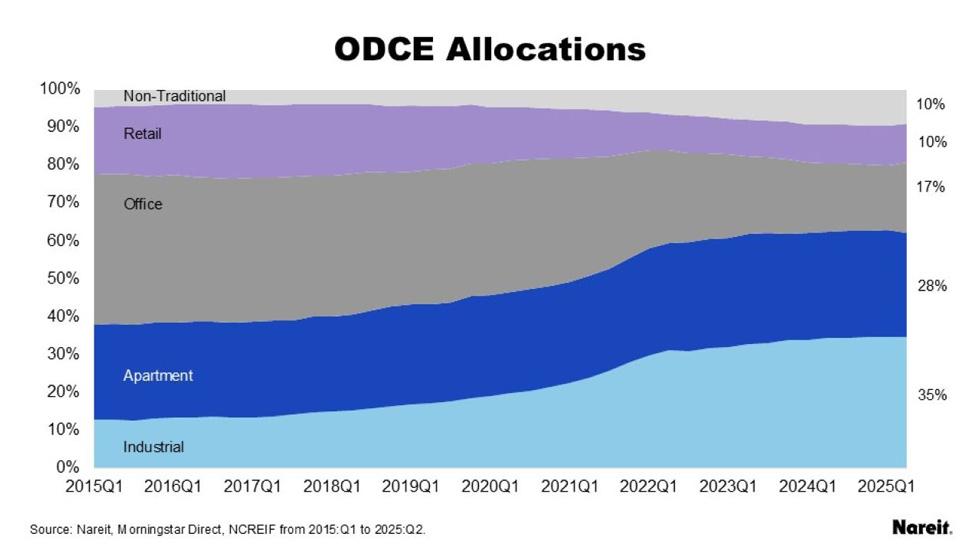

The investment allocations over time for NCREIF’s Open End Diversified Core Equity fund (ODCE funds) are significantly different from listed real estate, even accounting for the large allocation by private to the four traditional sectors of apartment, office, retail, and industrial.

Nareit’s active manager tracker publishes quarterly updates on investment holdings for the largest actively managed real estate investment funds. While the quarterly updates feature comparisons to the FTSE Nareit All Equity REITs Index, this analysis shows investment changes over time compared to ODCE funds. Thus, changes in value in the public real estate market (as proxied by FTSE Nareit) are compared to changes by REIT active managers and changes in the private market (as proxied by ODCE).

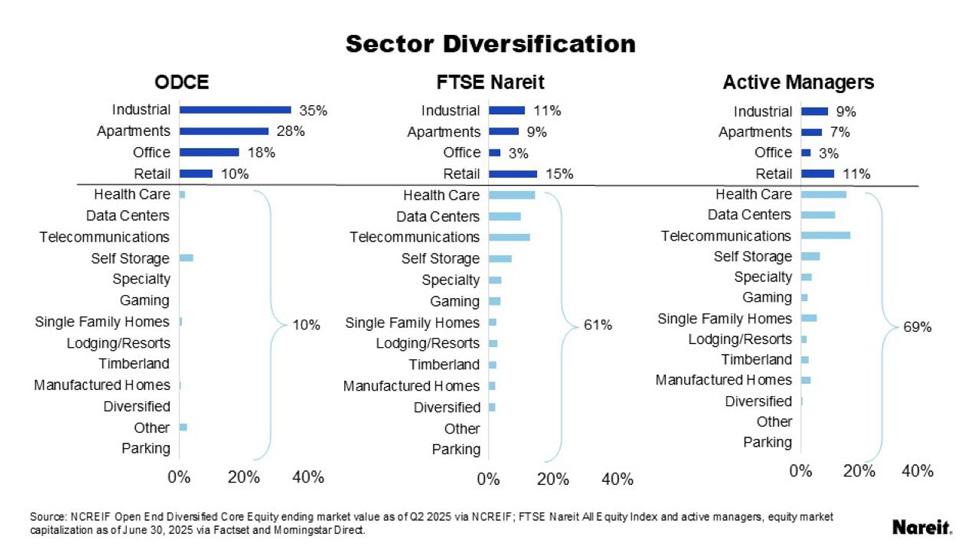

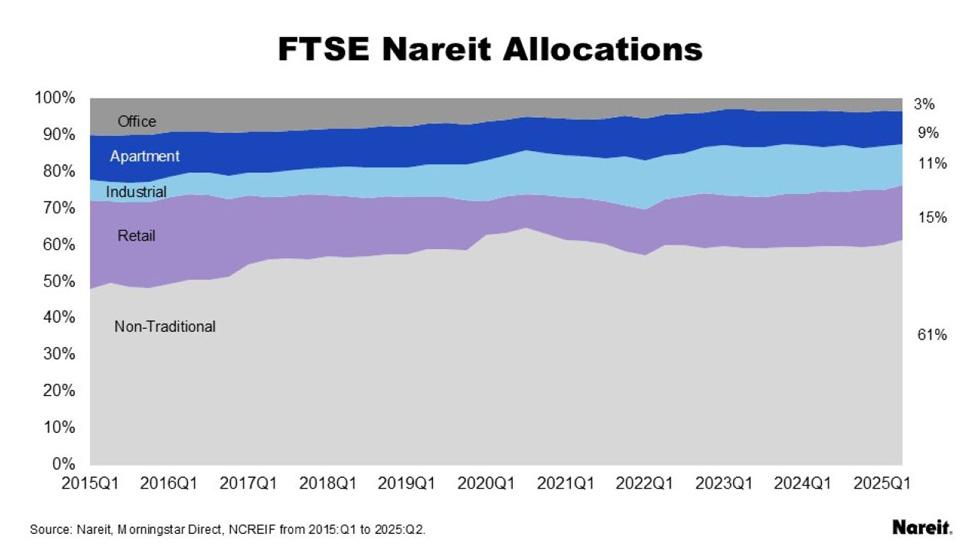

The most significant difference between the private real estate market and the listed real estate series is the focus on the traditional sectors of apartments office, retail, and industrial. Although the share of these sectors has shrunk over time for all three series, the private benchmark’s share in traditional sectors was 90% of its allocation in the second quarter of 2025 while FTSE Nareit had a 39% share, and active managers had only a 31% share.

Private real estate has continued to keep allocations to office relatively high while decreasing allocations to retail, in sharp contrast to listed real estate which has seen large decreases in office and varied allocations to retail with the market. Even accounting for liquidity differences, private real estate appears to be following a different investment strategy from listed real estate active managers.

The chart above shows the allocations among the four traditional property sectors and the remaining sectors as defined by ODCE or FTSE Nareit. The shares of the index and active managers are similar for each property sector, but ODCE’s allocations are substantially different. While ODCE’s largest allocation is industrial at a 35% share, the index’s largest allocation is retail at 15% and for active managers it is telecommunications at 17%.

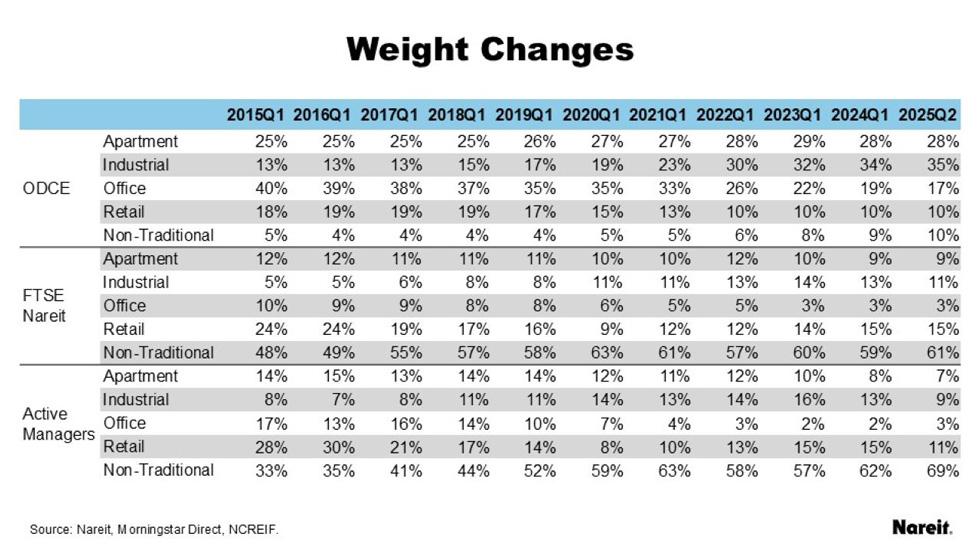

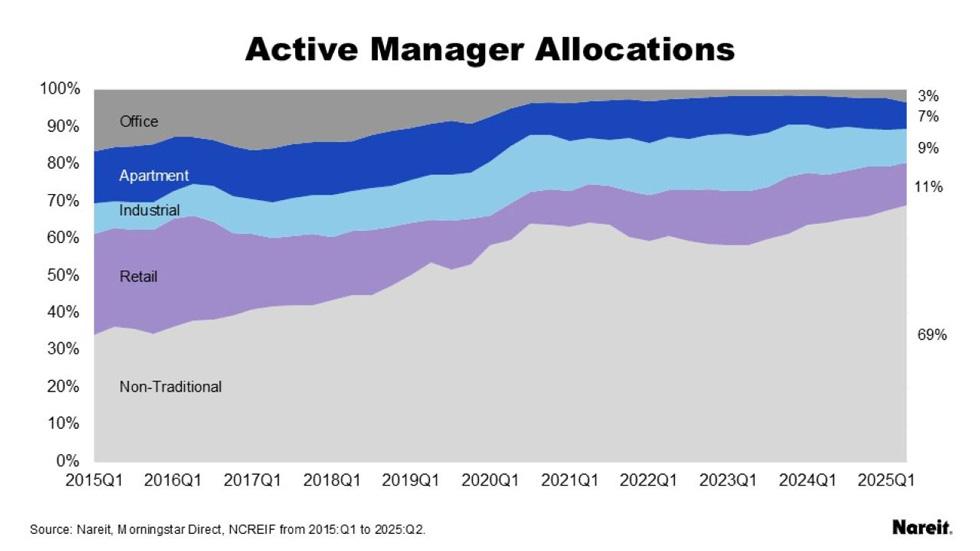

The three charts above track allocations by property sector for the three series over time: from the beginning of 2015 to the second quarter of 2025. In each of the three series, the share of non-traditional sectors has grown. However, for ODCE, allocations to non-traditional sectors started at 5% in 2015 and only grew to 10% in the second quarter of 2025. In contrast, active managers’ share in non-traditional sectors grew from 33% in 2015 to 69% in 2025 and the index share in non-traditional sectors grew from 48% to 61% during that same period.

The table above shows the weights of the property sectors on an annual basis. The REIT index and active managers have significantly lower allocations to the traditional property sectors than the ODCE funds, and they have also shown more flexibility in adjusting allocations among the four traditional sectors than ODCE funds.

Office has declined in all three series

- ODCE had the largest weight in office in 2015 at 40%, active managers were overweight at 17%, compared to 10% for FTSE Nareit.

- ODCE funds reduced their exposure by more than 50%, from 40% in 2015 to 17% in 2025.

- The REIT index and active managers reduced their exposure even more dramatically; the index allocation fell by 70% and active managers’ allocation declined by more than 80%.

Apartment allocations trended differently among the series

- ODCE has seen a small steady rise from 25% in 2015 to 28% in 2025.

- Active managers were overweight the sector compared to the index until 2020, but began to pull back post-pandemic by dropping its allocations from 14% in 2015 to 7% in 2025. This was underweight the index by two percentage points.

- The index share of apartment held steady until 2024, until dropping to 9% in 2025.

- All three series have dropped allocations in the past year, but for ODCE, apartment’s mid-2025 share is still higher than 2015. For the active managers, the latest share is about half that of 2015’s share.

Industrial saw steady growth through the pandemic for all three series

- ODCE’s exposure to industrial nearly tripled, from 13% to 35% over the period.

- Allocations for active managers doubled between 2015 and 2023, before declining to 9%.

- Allocations for active managers and ODCE were overweight compared to FTSE Nareit, but active managers’ allocation dropped in 2025 while ODCE’s allocation continued to increase.

Retail allocations were quite different for private versus listed benchmarks

- Retail has the smallest share of the four traditional sectors for ODCE; it has the largest for FTSE Nareit and active managers.

- ODCE’s starting 2015 share was only 18% and has fallen to 10% in 2025.

- Active managers had a 28% share in 2015, reached a low of 8% in the first quarter of 2021, and rebounded back to 11% in 2025 following a similar trend in FTSE Nareit.

Active managers in the REIT space differ significantly from those in private real estate principally in their investment in non-traditional property sectors. However, beyond that fundamental difference, relative allocations within the traditional sectors differ sharply over the last ten years with private real estate tending to favor office while active managers favored retail.