As the COVID-19 pandemic stretches on, concerns about its toll on the U.S. economy and the U.S. stock market have become heightened. With no clear ending in sight, investors are dealing with uncertainty about their long-term financial health. While it’s tempting to stay glued to the latest return information, it’s important to remember that most Americans are invested in equities for retirement, not for day trades. While REITs have underperformed the broader stock market so far in 2020, it is long-term returns that matter.

This analysis shows that REITs have been a favorable choice when looking at long-term returns. Generally, REITs outperformed the broad stock market more often than not when returns are measured in years. Importantly, the longer the time horizon, the more often REITs have outperformed stocks. While past performance is no guarantee of future returns, this is a measure long-term buy and hold investors should consider.

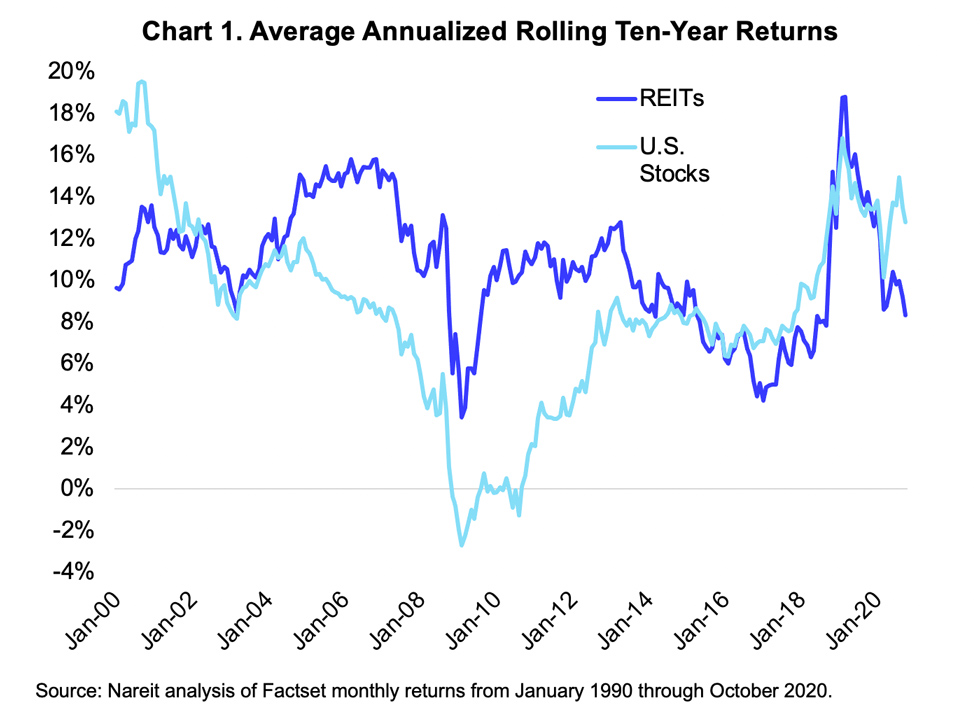

Chart 1 shows the average annualized rolling ten-year average returns for REITs and the Russell 3000 for each month starting at January 2000 and ending in October 2020. In more recent history, REITs have outperformed the broader stock market, even during the Great Financial Crisis. This is partly due to inflated non-REIT returns in the early 2000s due to the tech bubble for the Russell 3000, that gives the ten year returns a much higher starting point. Importantly, the chart shows the lower variability of REIT ten-year returns. The standard deviation for 10-year returns for the two series shown in Chart 1 is 9.0% for REITs compared to 16.0% for U.S. stocks.

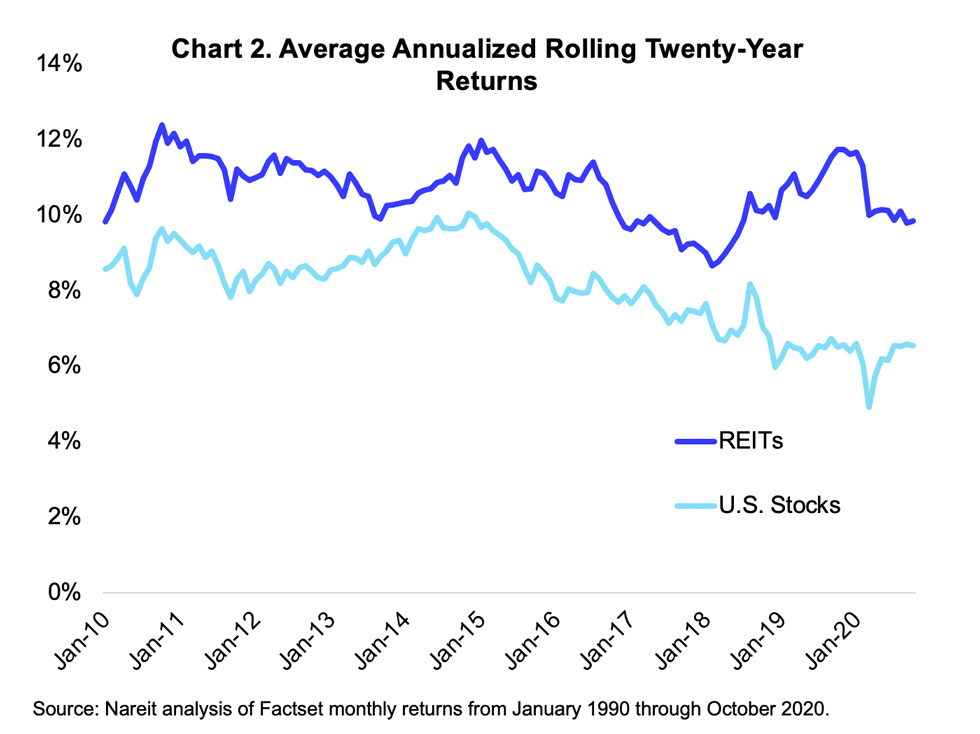

Looking at an even longer time horizon, REIT favorability becomes more pronounced. Chart 2 shows the average annualized twenty-year returns for REITs and U.S. stocks. REIT outperformance is accompanied by a lower standard deviation (adjusted for 20-year returns) of 6.0% compared to 13.8% for U.S. stocks.

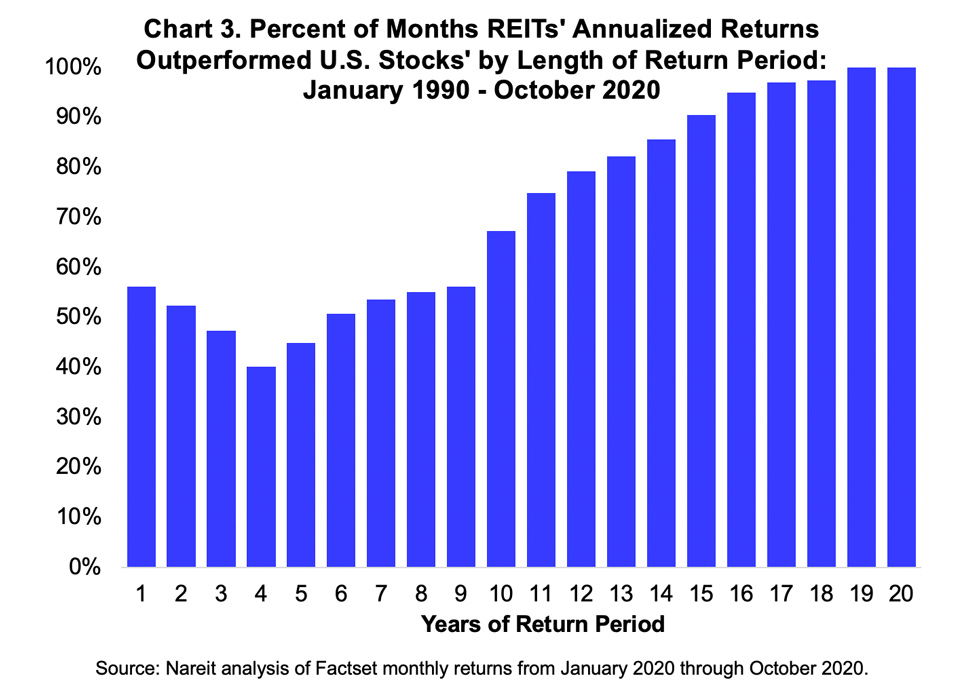

Measuring average annualized returns for the modern REIT era, starting in the early 1990s, the longer the time period the better REITs perform compared to the broader U.S. stock market. Chart 3 plots the percent of months REITs outperformed U.S. stocks at increasing years of holding length. Looking at annual returns, REITs outperformed U.S. stocks more than 56% of the time. When REIT returns are measured over 19 years or greater, REITs outperform U.S. stocks every month. In Chart 1, REITs underperformed in a ten-year period for March 2020, but outperformed in every period longer than 16 years. While past performance is of course no guarantee of future returns, REITs have a solid track record of returns for long-term investors.