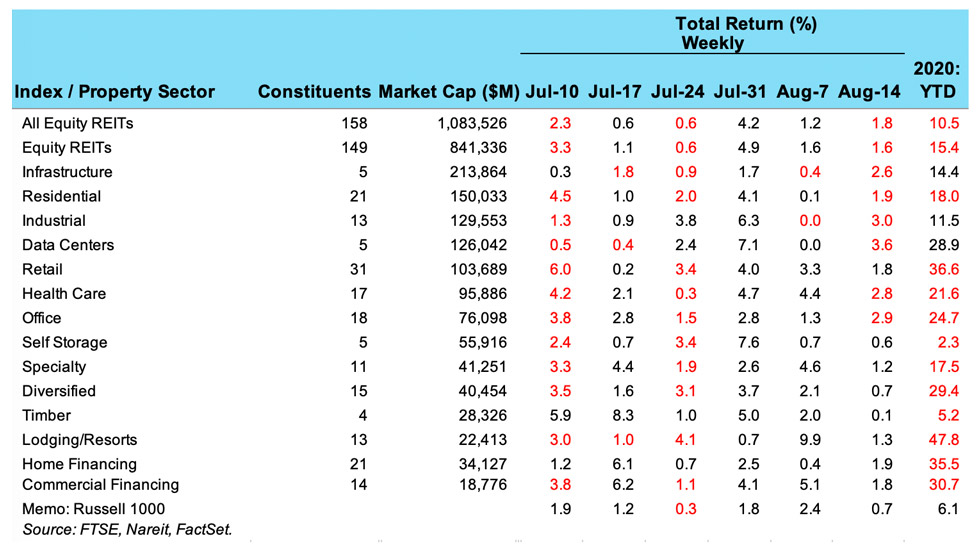

REIT stock market performance was mixed last week. The overall FTSE Nareit All Equity REITs index was down 1.8% in terms of total return. There were not any areas with large declines, but several sectors were down 2% to 3%, including office, industrial, residential, health care, infrastructure and data centers.

Other property sectors rose last week, however, including retail, lodging, self storage and diversified REITs. Both home financing and commercial financing mREITs also rose last week.