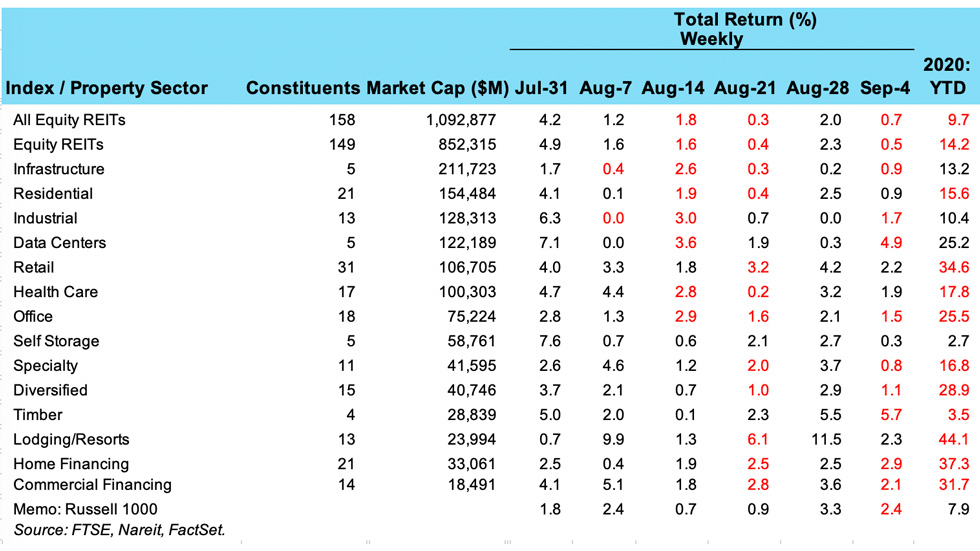

REIT stocks have provided a buffer against the broader market declines in early September. The FTSE Nareit All Equity REITs index was down 0.7% last week, while tech stocks pulled major indices much lower, with the Nasdaq down 3.3% and the S&P 500 falling 2.3%. One of the benefits of investing in REITs is that they face a different set of economic drivers and do not move lock-step with the broader market. This diversification reduces volatility and risk in the portfolio of a REIT investor.

Several REIT property sectors did decline last week. Timber REITs had a total return of -5.7%, and data centers delivered a -4.9% return. Mortgage REITs also declined last week.

Several sectors rose, however, with lodging/resorts up 2.3% and retail up 2.2%. Health care, residential, and self storage REITs also rose.