With the commercial real estate (CRE) market characterized by softening fundamentals, a lingering public-private real estate valuation problem, and higher interest rates, property transaction activities have remained stifled. Data from Nareit’s quarterly REIT Industry Tracker, however, show that, on average, REITs have continued to be active buyers and sellers throughout the ups and downs of real estate cycles.

As public and private real estate values become more in sync with one another and property transactions increase, REITs are expected to be ready for action, as they are better positioned than many of their CRE competitors in pursuing potential acquisitions and accretive growth opportunities.

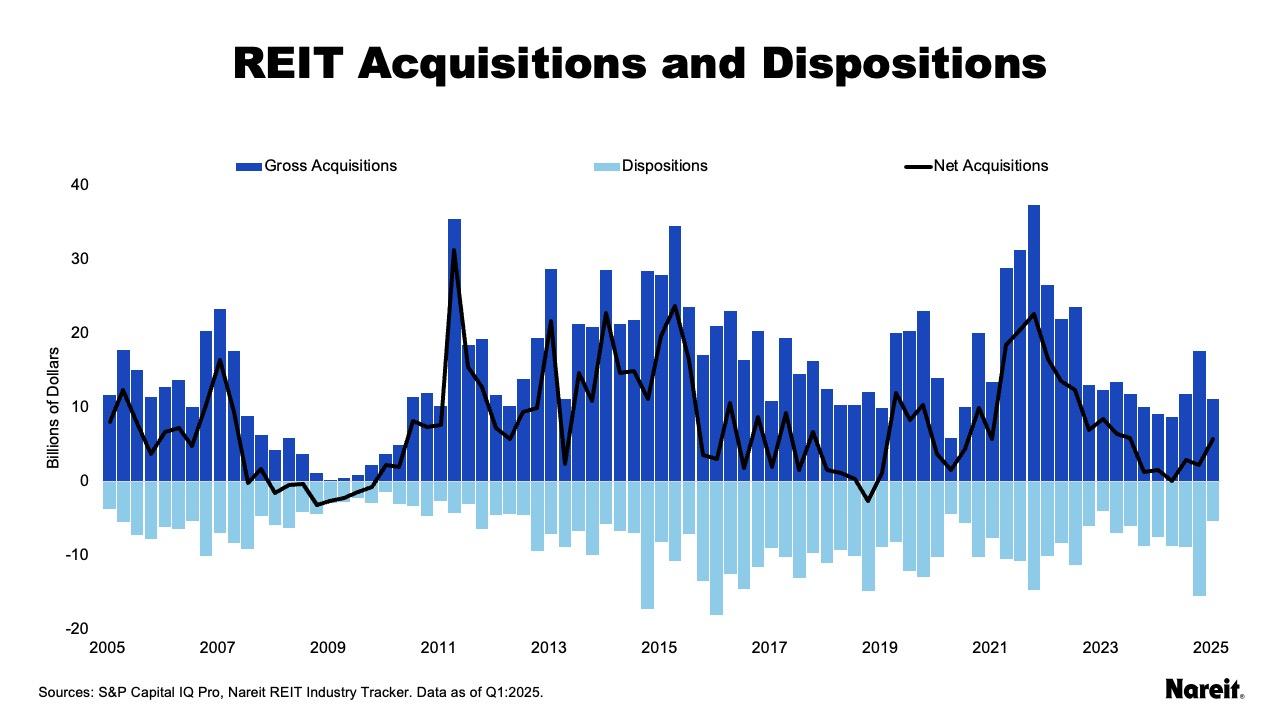

Using data from Nareit’s REIT Industry Tracker, the chart above presents quarterly REIT gross acquisitions, dispositions, and net acquisitions in billions of dollars from the first quarter of 2005 to the first quarter of 2025. These aggregate measures include property purchases and/or sales from all 13 REIT property sectors with the exception of timberland, which does not report its transaction activities. The net acquisitions metric was calculated by subtracting a quarter’s dispositions from its gross acquisitions.

History shows that REITs have been active buyers and sellers throughout real estate cycles, but have modified their appetites with changing market conditions. REIT transaction activity declined markedly across extended periods of valuation divergence and higher capital costs; it accelerated when public-private valuations were aligned and costs were lower.

Highlighting their focus on growth, REITs have generally been net buyers of real estate for the last 20 years; the global financial crisis (GFC) marked the last prolonged time period when REITs were net sellers. Underscoring their portfolio management diligence, REITs have also consistently pruned their property portfolios throughout the cycle. Recent REIT transaction activity has remained muted. In the first quarter of 2025, quarterly gross acquisitions, dispositions, and net acquisitions were materially below their respective 20-year averages.

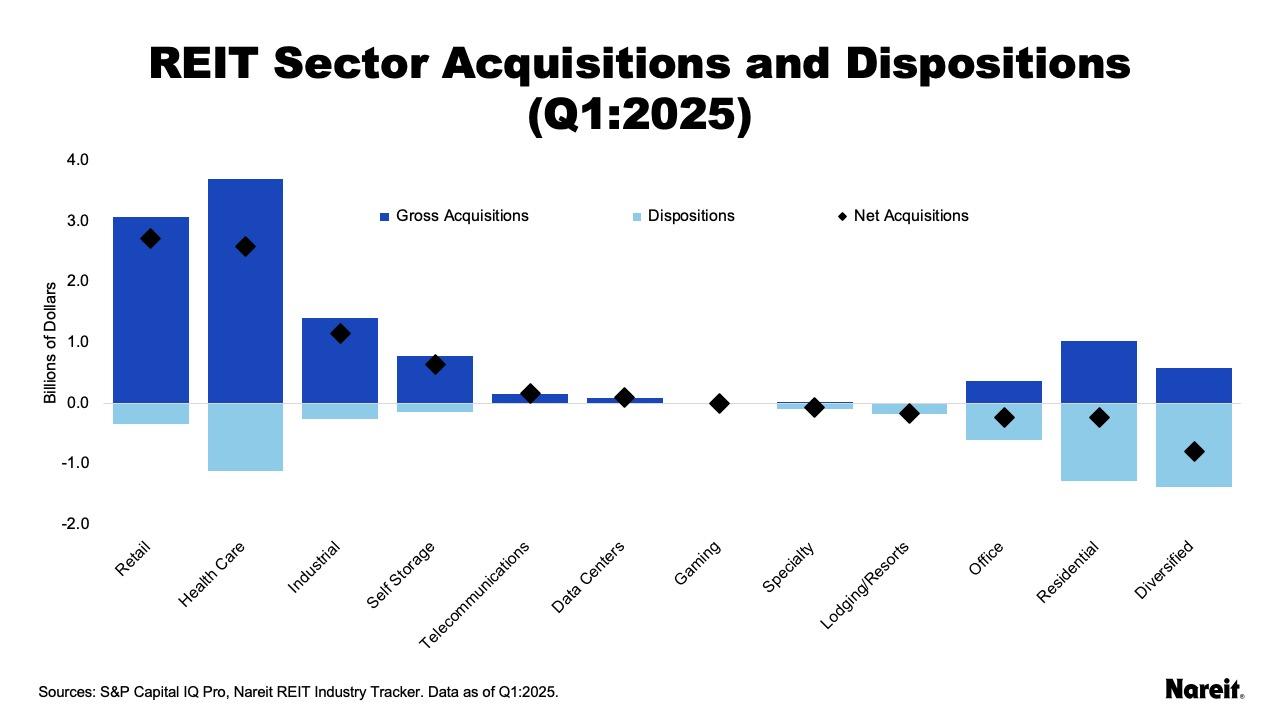

The chart above presents gross acquisitions, dispositions, and net acquisitions in billions of dollars for all 13 equity REIT sectors except for timberland in the first quarter of 2025 using Nareit’s REIT Industry Tracker data. REIT sectors had significantly different transaction experiences in the first quarter of the year. Retail, health care, industrial, and self-storage were the largest net buyers. Office, residential, and diversified were the biggest net sellers over the past year.

Although current CRE transaction activity may be muted, a revival is likely on the horizon as public and private real estate values become more aligned with one another. As the marketplace regains its footing, REITs are anticipated to maintain their competitive advantages over typical property investors. Best-in-class operator knowledge, solid operational performance, discipled balance sheets, and ready access to a variety capital sources, including equity, debt, and joint venture partnerships, are expected to give REITs an edge over their competition.