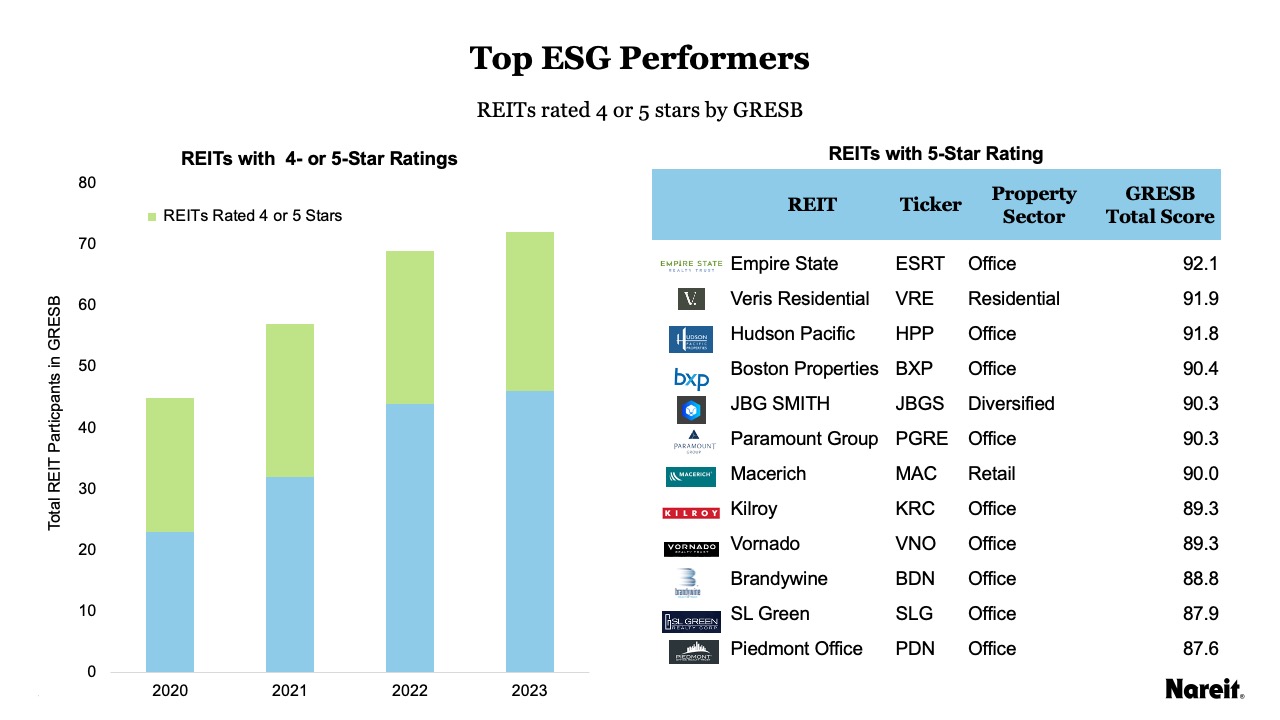

GRESB, an independent organization providing validated sustainability performance data and peer benchmarks for investors and managers, has released its 2023 Real Estate Assessment, which measures the sustainability performance of individual real estate portfolios based on self-reported data. U.S. publicly traded REITs have increased their participation in GRESB, growing from 45 REITs participating in 2020 to 72 in 2023. Participating REITs continue to see improvements in their GRESB ratings and score favorably compared to private real estate participants in GRESB.

The chart above on the left shows the increase in publicly listed REITs that participate in GRESB and the portion that have achieved at least a 4-star rating since 2020. Of the 72 REITs that participated in GRESB in 2023, 26 achieved at least a 4-star rating, up from 20 in 2020. From 2022 to 2023, 65% of REITs participating in both years improved their scores by an average of 4.8 points. Above on the right, the table lists the 12 REITs with a 5-star rating in order of their GRESB scores. New to 5 stars this year are Macerich, the only retail REIT to achieve 5 stars, and Piedmont Office Realty Trust.

In 2023, 331 private U.S. real estate funds and companies participated in GRESB. The chart above shows the 2023 value-weighted GRESB scores normalized out of 100 for publicly listed REITs and private real estate for the environment, social, and governance categories. The overall score is included in the chart above on the right. REITs and private real estate scored the same except for the governance category, where REITs outperformed by 5 points on a 100-point scale. Both REITs and private real estate funds and companies scored an average of 77 overall.

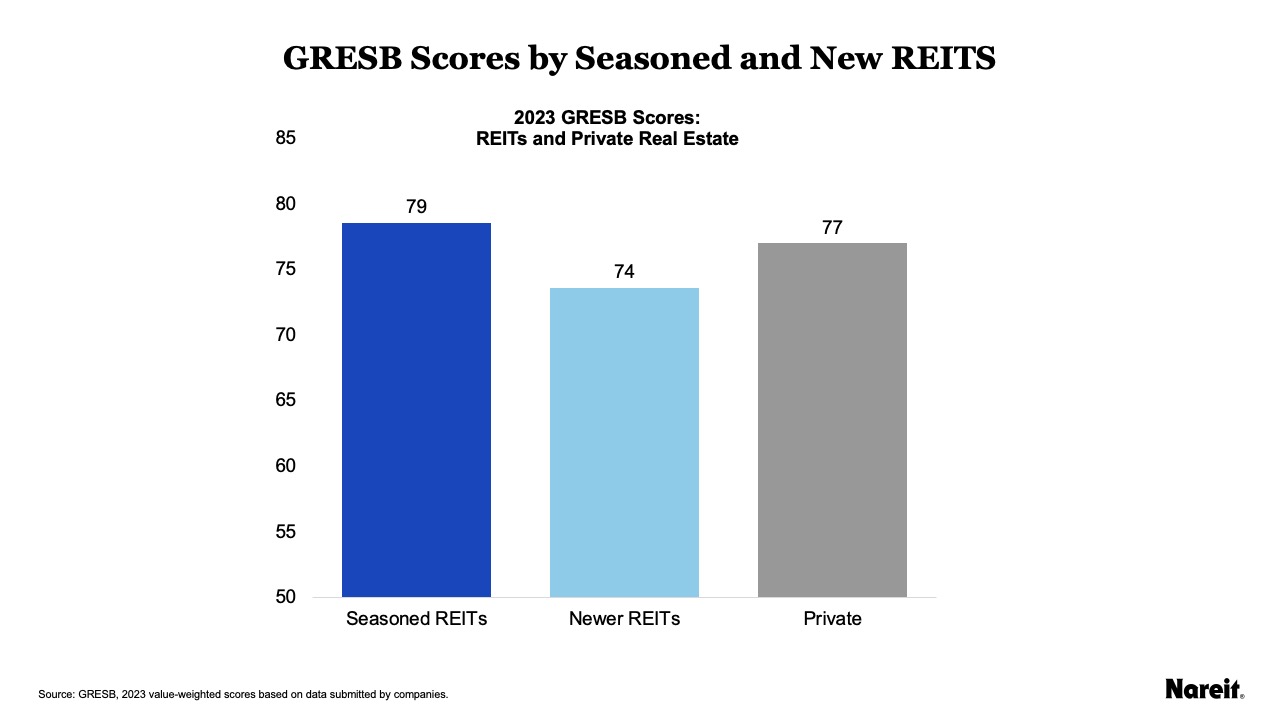

REIT GRESB scores tend to improve over multiple years of participation in the annual assessment and as sustainability programs are implemented and standard practices are formalized. In 2023, 51 REITs had participated in GRESB for three years total, and 21 REITs were newer participants. The chart above shows the value-weighted overall GRESB score for seasoned REITs compared to newer participants and the private benchmark. Seasoned REITs outperform new participants by 5 points with a score of 79, two points higher than the overall private benchmark.

Seasoned REITs compare favorably to private real estate in GRESB performance, and REITs overall slightly outperform private real estate in GRESB’s governance category.