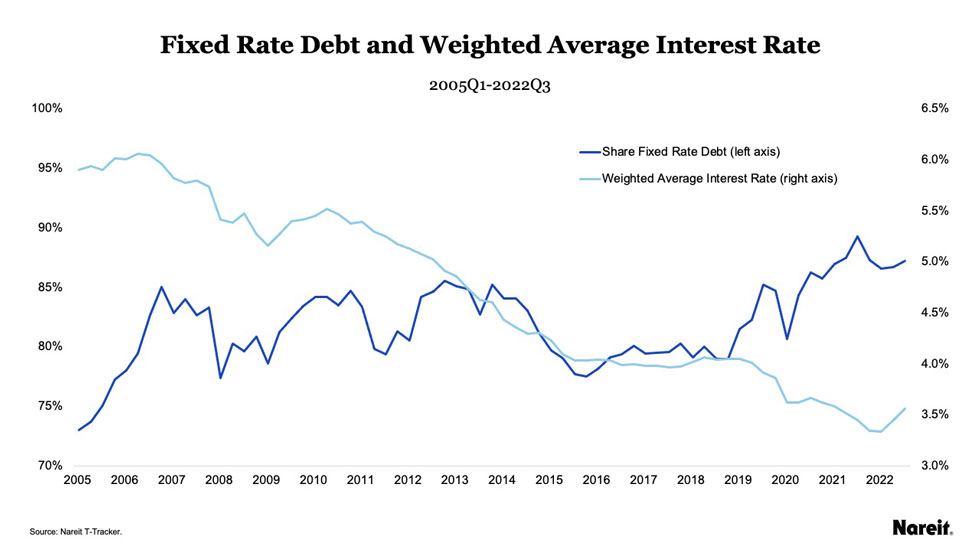

REITs have low exposure to floating rate debt, with over 87% of the debt held by the industry at fixed rates. In contrast, as cited in the Wall Street Journal, the Mortgage Bankers Association reports that almost half of all commercial property debt is floating rate debt. This leaves many private commercial property owners financially stressed as rates adjust upwards.

Typically, lenders require mortgage holders to hedge against floating rate risk with a derivative contract capping interest rates. With rates on the rise, the cost of these hedging contracts has also escalated, leaving many mortgage holders either unable pay for new contracts or for the cost of the hedge to exceed the planned rental revenue for a year.

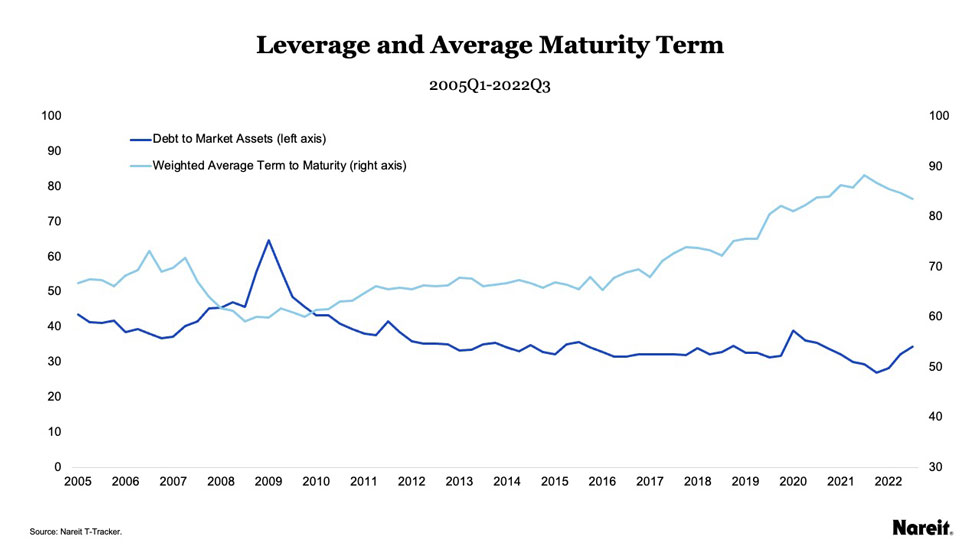

REITs have a long runway to manage leverage in the higher interest rate environment. As of the third quarter of 2022, leverage, measured as debt to market assets, is at 34.5% and the weighted average term to maturity is 83.5 months. The chart above tracks these two measures since 2005. Leverage was increasing through the run up to the GFC and briefly spiked in 2009 at 64.7% when market values fell. Since 2011, leverage has stayed below 40% and has stabilized in the low to mid 30% since 2016. During this same period, as leverage stabilized at low levels, the weighted average term to maturity increased significantly. The term of debt was just over 59 months (almost five years) in 2005 and rose to its peak in 2021 of 89 months (seven years and 5 months), falling back slightly to 83.5 months (just under 7 years) in the third quarter of 2022.

Along with lower leverage and longer maturities, REITs have moved to fixed rate financing leading to lower weighted average interest rates. The chart above shows the fixed rate debt share of total debt since 2005 and the weighted average interest rate on the total debt outstanding. The share of fixed rate debt has increased from 73% in 2005 to over 87% in 2022. At the same time that REITs moved to fixed rate debt, the average interest rate on their debt has fallen. REITs have been able to decrease their weighted average interest rates from 5.9% in 2005 down to 3.6% in the third quarter of 2022. With a low amount of variable rate debt on the books, REITs do not have to purchase as many costly hedging contracts as other commercial property owners. And with locked-in lower rates with long maturities, REITs have room to buy properties where others are forced to sell.

For more information on REITs’ leverage and exposure to higher interest rates, see Nareit’s 2023 REIT Outlook: REITs, Recessions, and Economic Uncertainty.