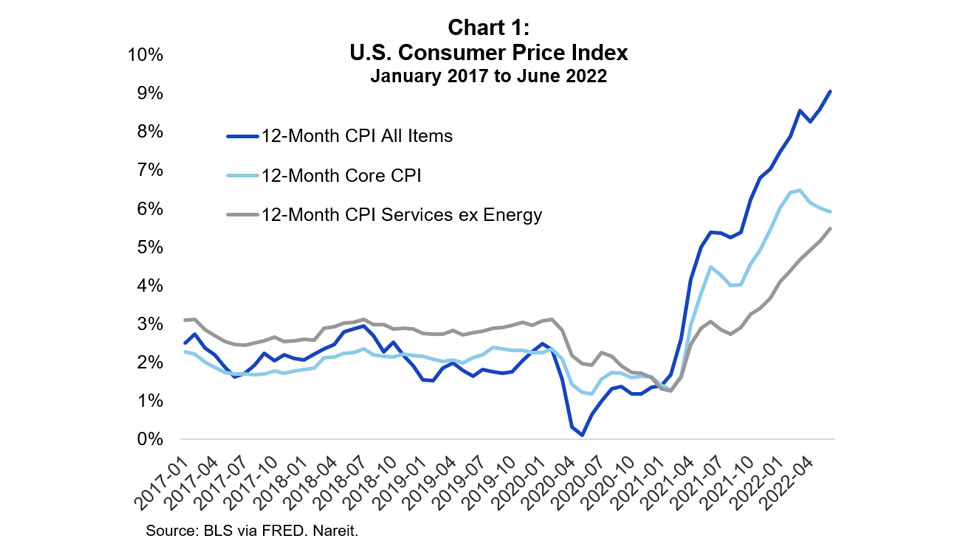

The Bureau of Labor Statistics (BLS) released the June 2022 Consumer Price Index (CPI) data showing continued high inflation at 9.1% annually. CPI increased 1.3% in June on a seasonally adjusted basis after rising 1.0% in May. Rising gas prices continue to be the dominant contributor to inflation followed by significant increases in food and shelter.

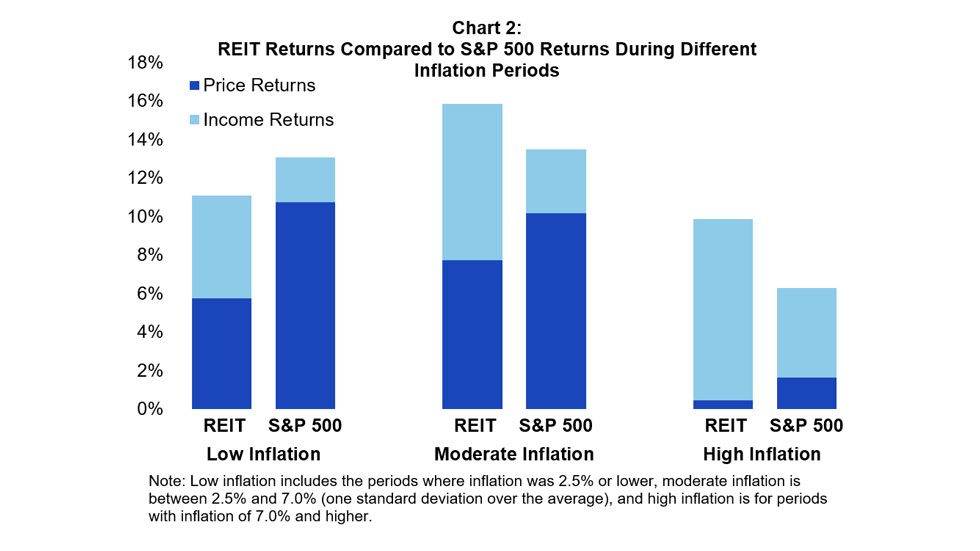

REITs have historically outperformed the broader stock market in periods of high inflation, and that remains true for the most recent quarter. REITs are down only 5.9% compared to the end of June 2021 while the S&P 500 is down 10.6%.

Chart 1 compares CPI for core, all item, and services excluding energy. Core CPI, which excludes food and energy, peaked in March at 6.5% year-over-year and is down to 5.9% for June. Concerningly, there is increasing evidence that inflationary pressures are spreading through the economy as prices for services, which are less affected by supply chain issues from the pandemic and international conflict, have continued to rise, up 5.5% for June.

Chart 2 compares 12-month returns of equity REITs and the S&P 500 measured quarterly during periods of high, moderate, and low inflation. High inflation is defined as greater than one standard deviation from the time period’s annual average of 3.9%, greater than 7.0%. Moderate inflation is between 7.0% and 2.5% (based on the Federal Reserve target), and low inflation is below 2.5%. REITs historically tend to outperform the S&P 500 in high inflation quarters, with strong income returns offsetting low REIT price returns. On average, REITs outperformed the S&P 500 by 3.6 percentage points during these periods. In periods of moderate inflation, REIT dividends more than compensated for the higher price returns on the S&P, leading total returns on REITs to exceed the S&P 500 by 2.4 percentage points. In periods of low inflation, REIT returns fall just below the S&P 500 as the income return does not fully compensate for the S&P 500’s superior price returns.