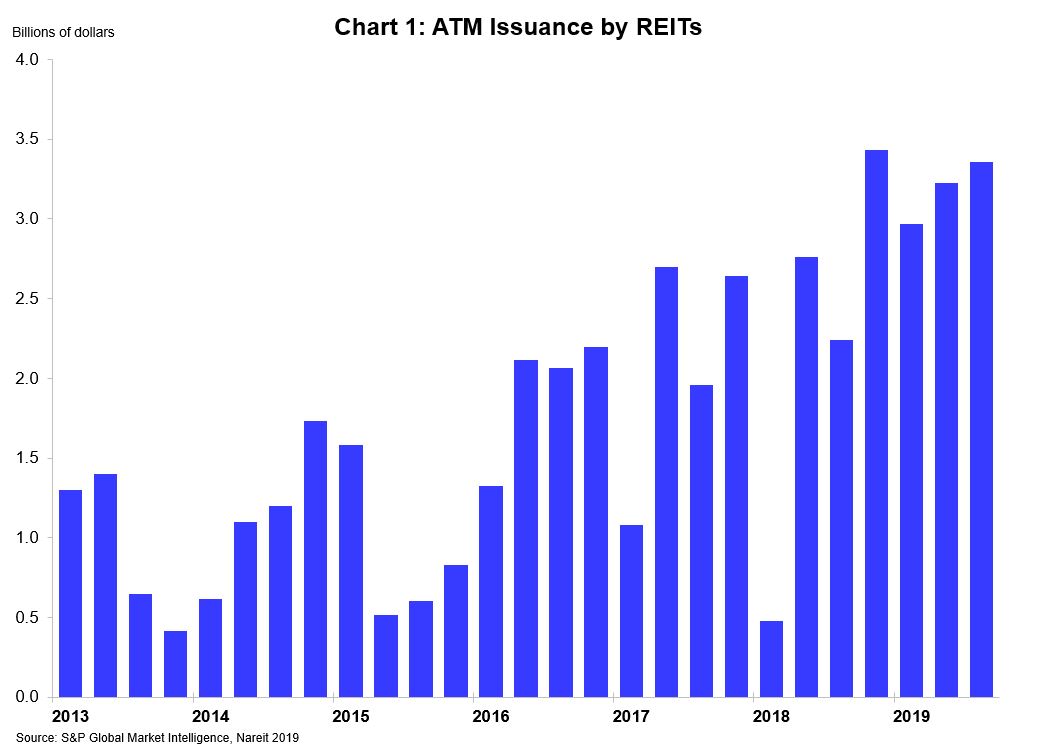

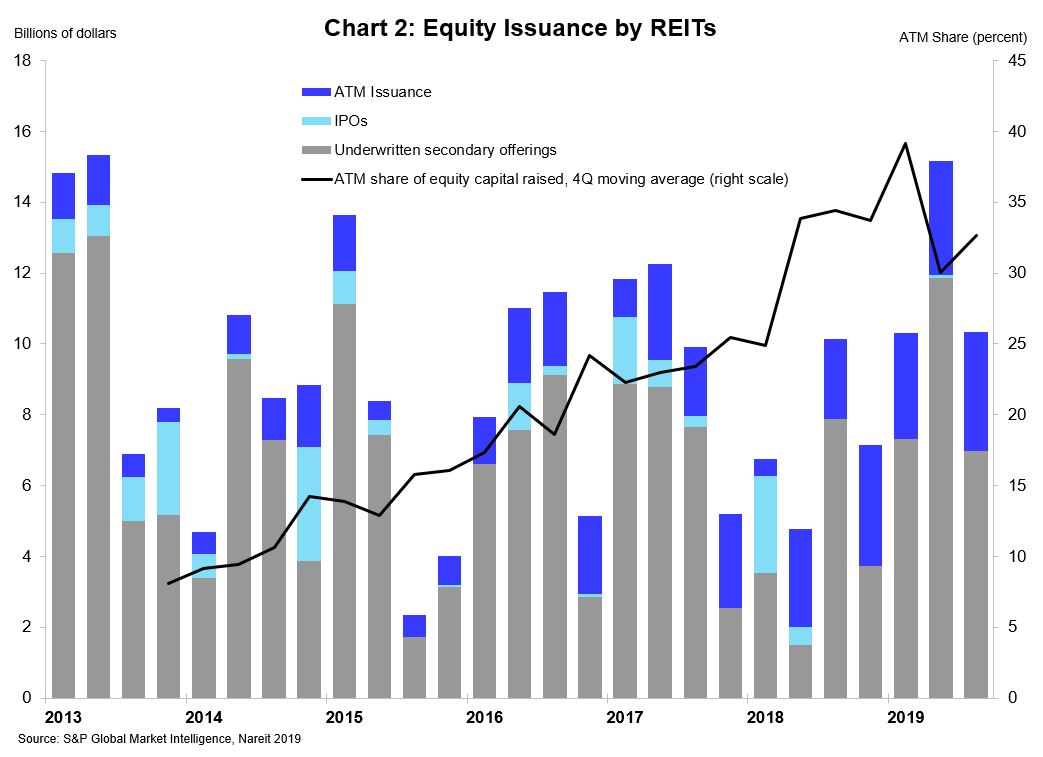

Equity REITs raised $3.4 billion in the third quarter of 2019 through at-the-market (ATM) programs, just shy of the record high in 2018Q4. Issuance through these programs is up significantly over the previous year with three of the four prior quarters passing $3 billion (and one very close to $3 billion). ATM programs offer REITs a more cost-effective method of raising equity and has become a more prominent source of equity for REITs over the previous five years. Issuance through ATM programs accounted for 32.6% of common equity raised in 2019Q3, up significantly from 8.1% in 2013Q4.

The number of REITs with active ATM programs also continues to grow. In the third quarter, 49 REITs raised capital through ATM, including REITs from most property sectors. Retail REITs tapped the greatest amount of capital from ATM programs in Q3, followed closely behind by healthcare REITs.