As interest in sustainable investing has grown, the amount of sustainable funds available to U.S. investors has also risen. The Morningstar Sustainable Funds Landscape Report shows that the number of sustainable open-end and exchange-traded funds available to U.S. investors rose to nearly 600 in 2022, up 12% from 2021. These are funds that are marketed as sustainable offerings and incorporate ESG criteria in their portfolio construction. These funds are associated with lower levels of ESG risk; nearly 70% of these funds received the highest Morningstar Sustainability Ratings in 2022, compared with just 27% of funds overall.

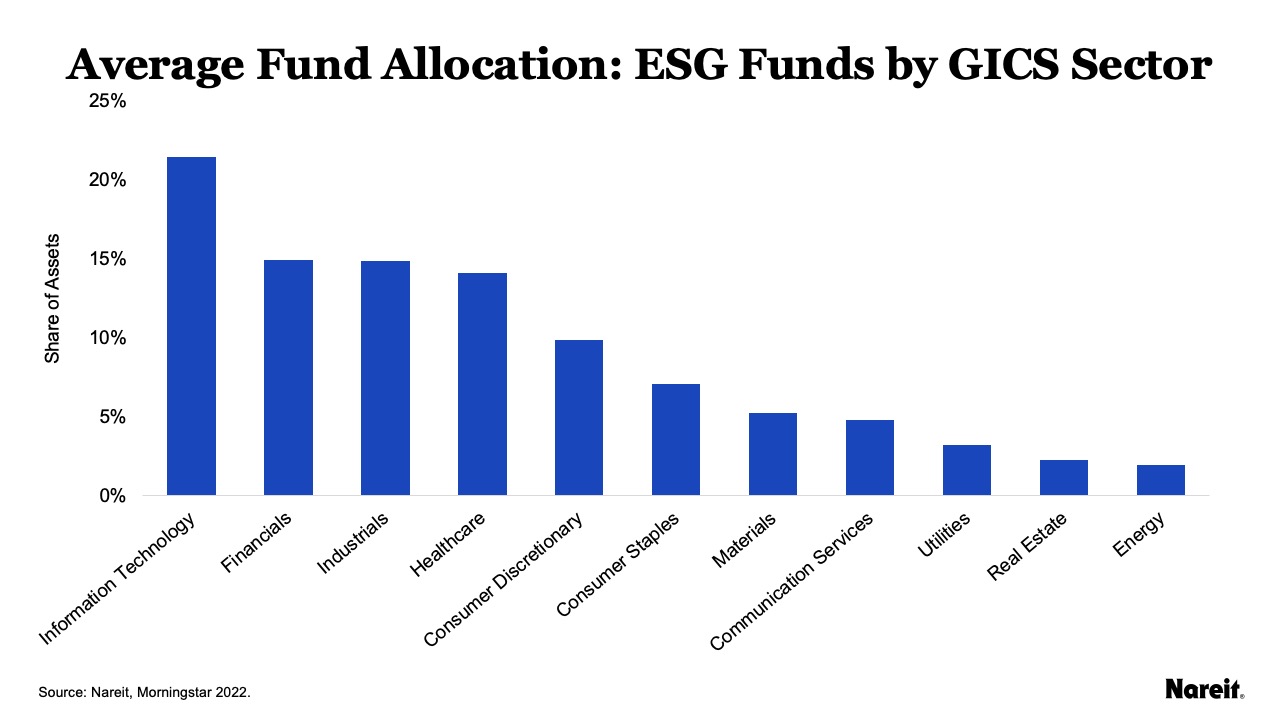

On average, the sectors that make up the highest share of assets in ESG funds are information technology and financials, while energy and real estate make up the lowest share.

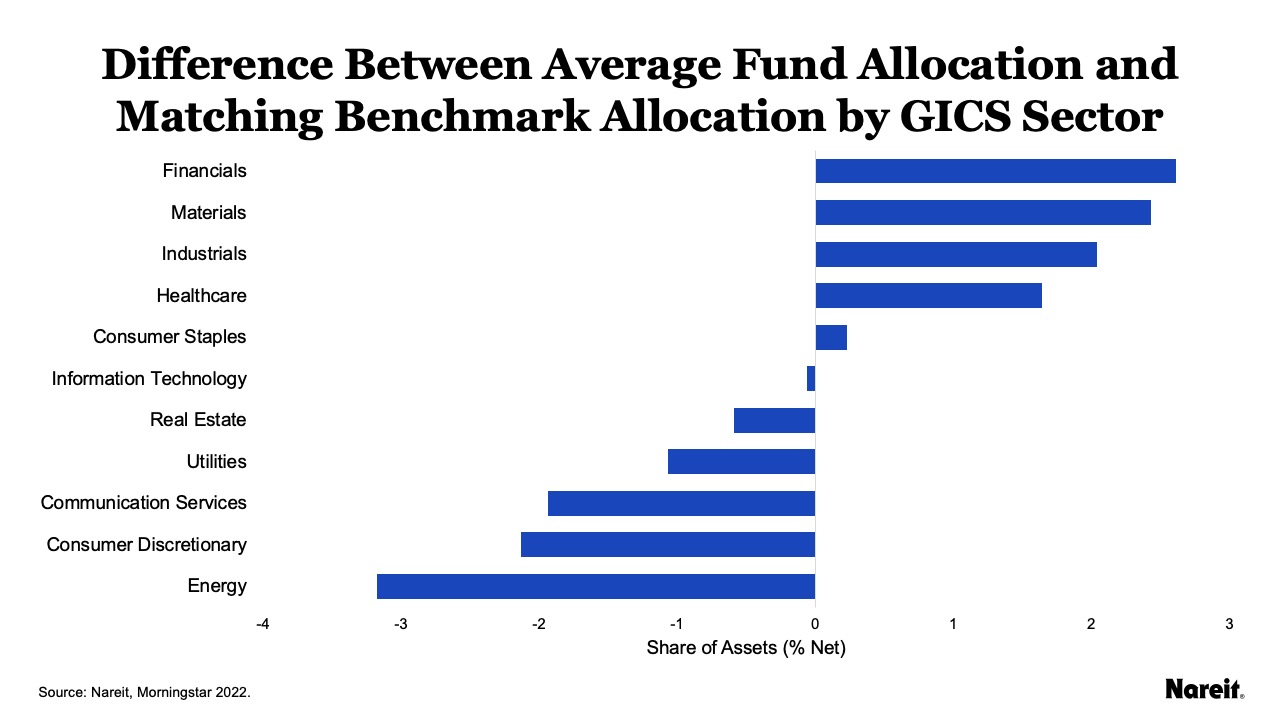

Comparing the composition of these sustainable funds to their equity benchmark (such as the S&P 500) shows which sectors are over- and under-weighted in these funds compared to the benchmarks.

A comparison of the fund weighted average allocation and matching benchmark allocation shows that the financials sector is most over-weighted in ESG funds compared to their matching benchmarks (+2.6%). The energy sector is the most under-weighted sector (-3.2%). This suggests that ESG fund managers view companies in the financials sector as the most sustainable.

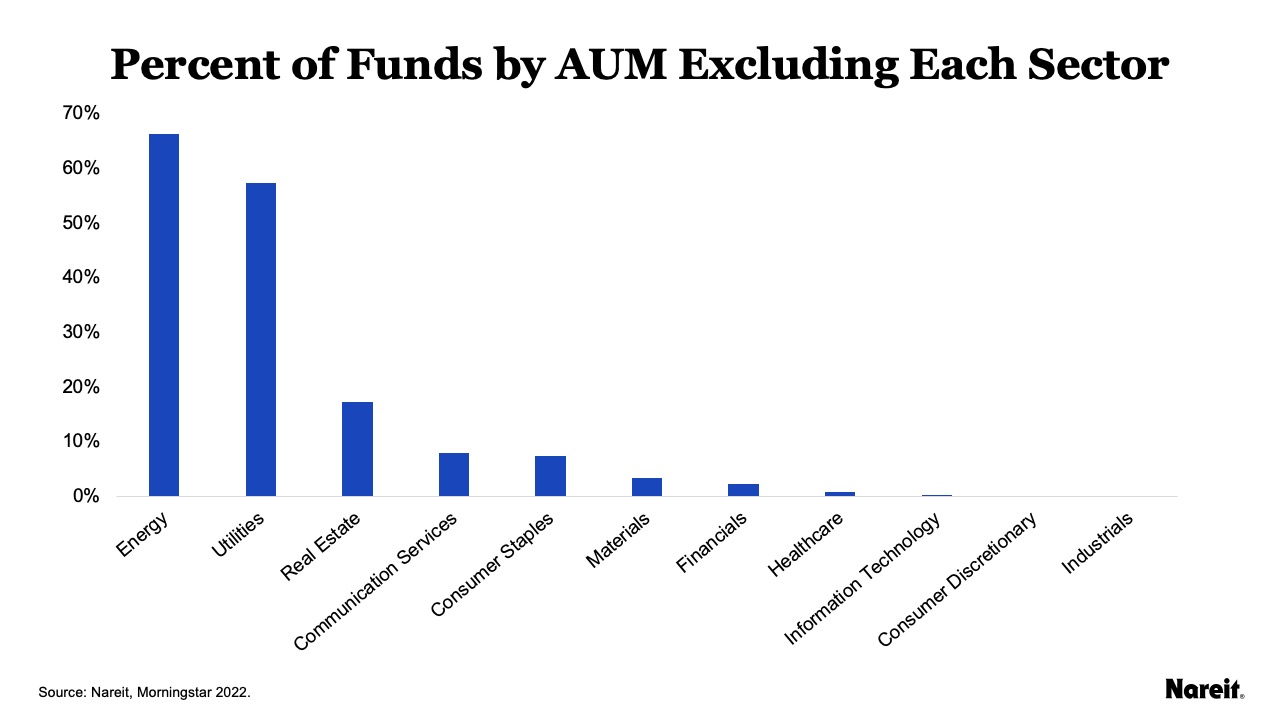

Real estate is underweighted in ESG funds when compared to their matching benchmarks (-0.6%). Many funds (17.2% by AUM) have a zero weight for real estate, suggesting that they may exclude the sector. While real estate is the fifth most underweighted sector, it has the third largest percent of funds by AUM that have completely excluded the sector. When removing the funds that exclude real estate, the sector is underweighted by -0.2%.

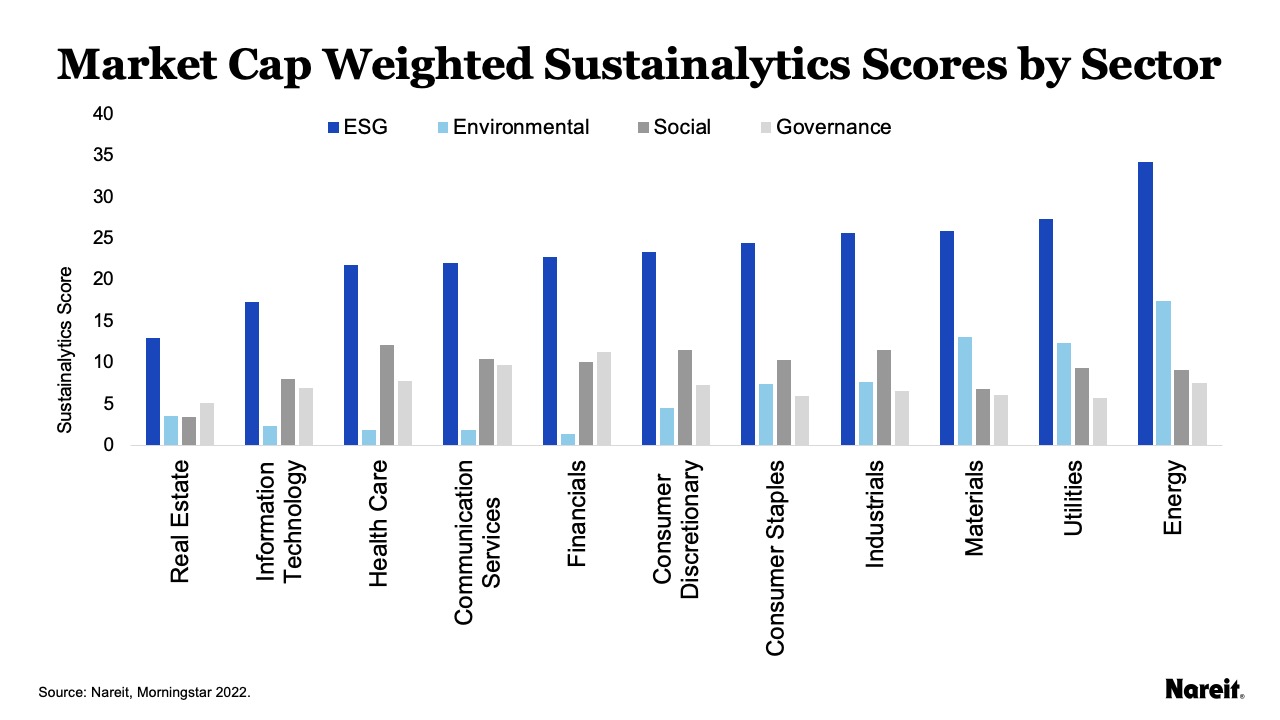

These results are surprising when compared to popular ESG rating systems such as Sustainalytics. As these sustainable funds are created with the goal of reducing ESG risk, it would be expected that the most over-weighted sectors to be those with the highest scores. While real estate is under-weighted by these funds, it is the sector with the best Sustainalytics rating (lower risk scores represent better ratings).

The energy and utilities sectors are most often excluded from ESG funds, with 66% of funds by AUM having a zero weight for energy and 57% of funds for utilities. It would make sense for these sectors to be excluded, as they are the lowest rated by Sustainalytics.