The following is excerpted from a Forbes.com column published June 16, 2021

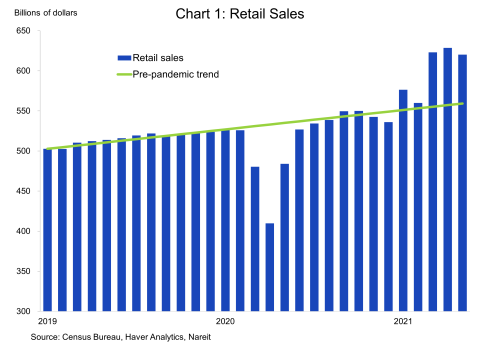

Retail sales fell 1.3% in May. Should we worry that consumers are running out of steam as the boost from stimulus checks received earlier this spring fades? An unexpected slowing of consumer spending could have negative implications for the economic recovery, as well as for the embattled retail commercial property sector and retail REITs.

A brief look at recent history dispels these fears. Retail sales in May were still elevated ; in fact, even after the decline in last month, spending was 10.9% above the pre-pandemic trend, not far from the 12.8% by which retail sales exceeded trend in April.

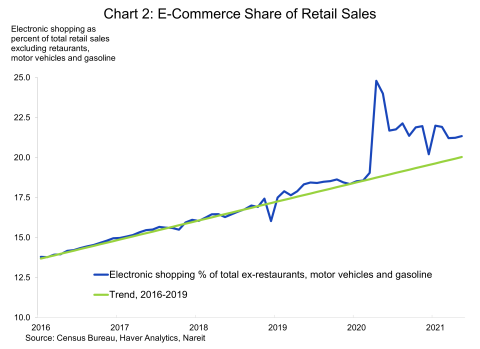

How are brick & mortar sales holding up in recent months, following the surge in e-commerce sales during the pandemic? In-store sales had been facing stiff competition from the growing online channel for several years prior to the COVID-19 pandemic, weakening conditions in the retail property markets and impacting retail REITs (note: I am senior economist at Nareit, the worldwide voice for REITs and listed investments in real estate).

The e-commerce share of retail sales (excluding food service, motor vehicles, and gasoline) jumped in April 2020 to 24.8%, from 18.3% just prior to the pandemic. Since then, however, the e-commerce share has drifted lower, and in May was 1.3 percentage points above its trend growth.

Visit Forbes.com for the full article examining brick-and-mortar retail sales as the economy recovers from the shutdowns.