Single Family Rentals: Demographic, Structural and Financial Forces Driving the New Business Model

The Single Family Rental (SFR) housing market has grown rapidly since the start of the housing crisis. Home prices have risen sharply, however, especially in some of the markets where institutional investors including several REITs have set up SFR business. This raises questions about the prospects for the SFR sector.

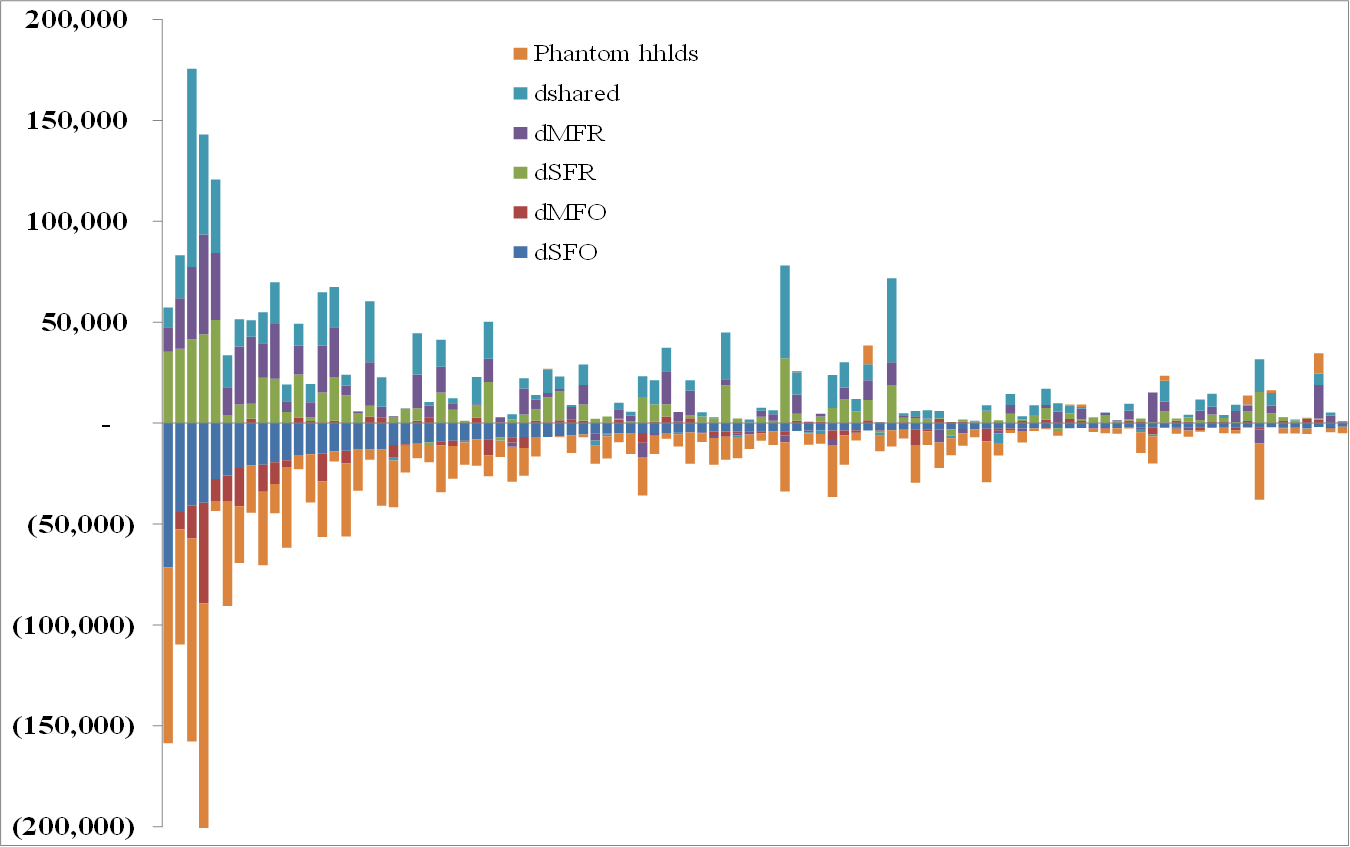

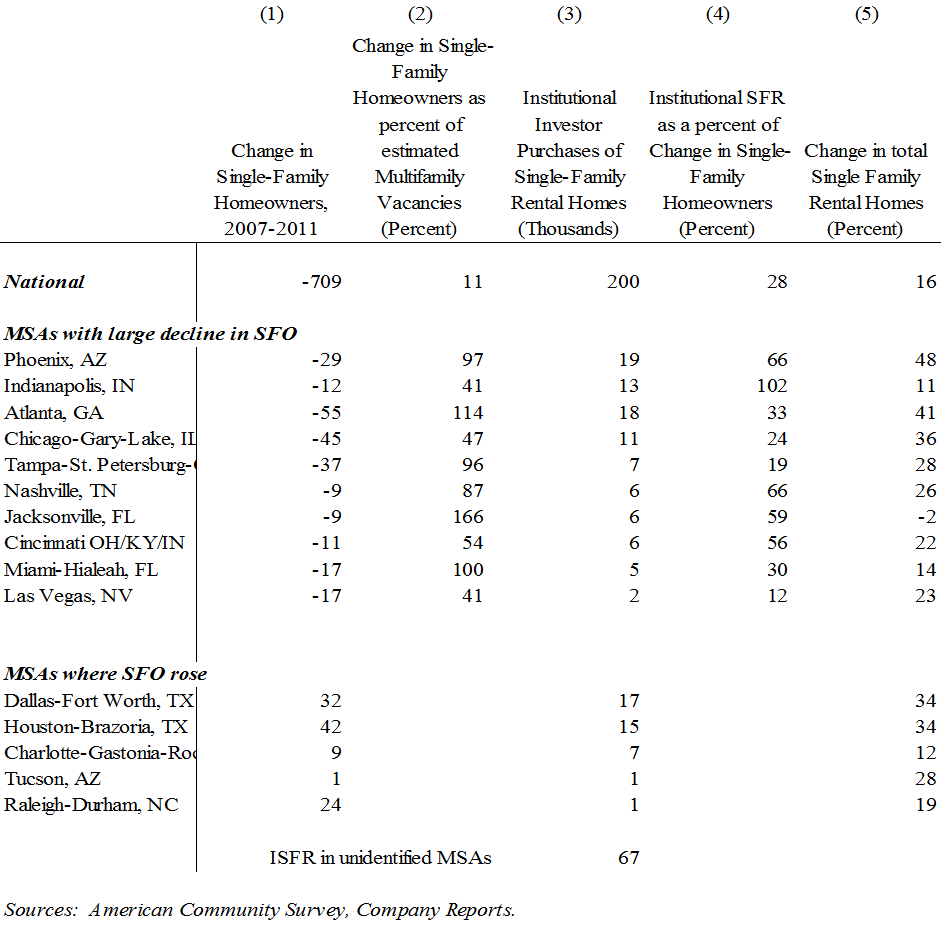

The transition to a lower rate of homeownership generated large flows of households from owner-occupied into rental properties. The transition of the housing stock from ownership to rental is not frictionless, however, and requires both capital to purchase homes for rental, and management expertise to operate the rentals. Institutional investors, including several REITs, bought homes for rental in many metro areas (MSAs) where the flows were large relative to the pool of potential local investors.

Housing stress rose during the crisis, especially in the MSAs with large housing tenure transitions. Institutional investors made significant investments in these MSAs, which increased the availability of suitable rental properties. REITs have demonstrated their ability to raise capital in public markets to finance real estate, and achieve scale economies by operating large portfolios of properties. Had REITs and other institutional investors not provided capital and management teams, housing stress may have been even worse in these markets.

See here for recent NAREIT research on the demographic, structural and financial forces driving the business model.

For a more in-depth look at the analysis of the SFR model, access the academic research paper posted in March 2014: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2418684

Growth in Single Family Rentals is concentrated in a few metro areas--as is the change in ownership, shared and “phantom” households