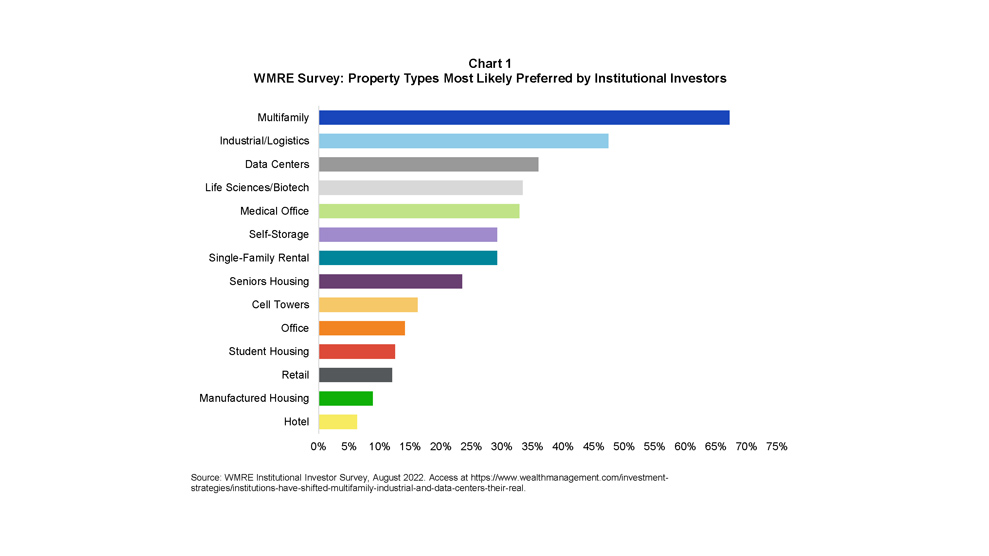

A preview of the institutional investor survey by Wealth Management’s Real Estate division (WMRE) showed institutional investors are looking to newer property types, such as data centers, life sciences, and medical offices to drive returns in their portfolios. Investors can look to REITs to offer broad diversification across property sectors and ample coverage of the property types highlighted in the survey.

WMRE’s Institutional Investor Survey, conducted in August 2022, asked a range of participants which property types they felt institutional investors currently preferred. The rankings of responses in Chart 1 show that the traditional property types of multifamily and industrial remained popular with 67% and 47% of respondents, respectively, finding them more likely to be preferred by investors. Data centers (36%), life sciences (33%), and medical office (33%) were the next highest ranked property types, showing increased interest in real estate focused on technology and health care.

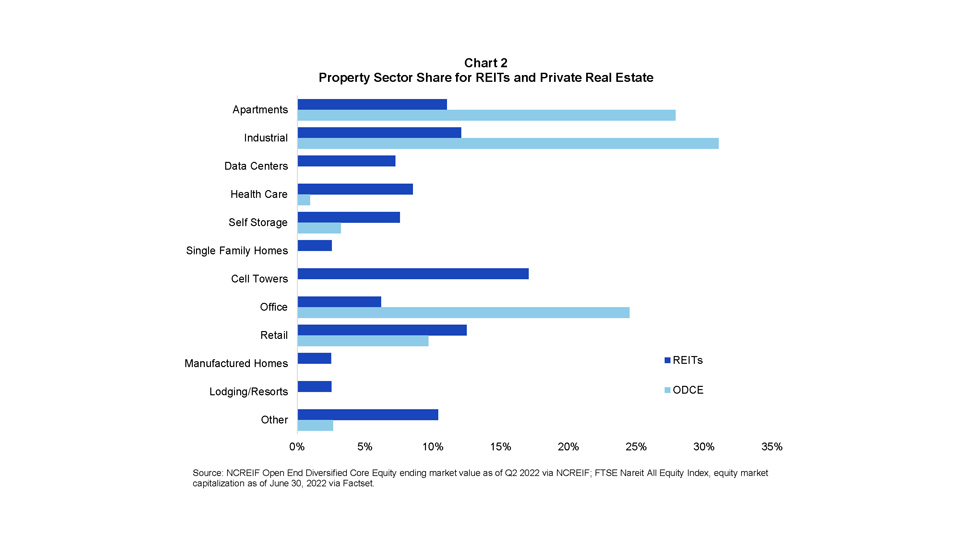

REITs provide broad access across property sectors with strong exposure to property types highlighted by the survey. Private real estate funds tend to have less exposure across property types. Chart 2 compares the breakdown by property sector of the FTSE Nareit All Equity REIT Index (REITs) and the NCREIF Fund Index - Open End Diversified Core Equity (ODCE).

Property sectors can contain multiple property types, and for comparison purposes, note that companies that own life science properties are generally in the office property sector, but there are health care sector companies with life science portfolios in both the REIT index and ODCE. In both indexes, medical offices are in health care and student housing is in apartments. Senior housing is in health care for REITs and in other for ODCE.

As shown in Chart 2, REITs offer institutional investors ample opportunity to invest in the traditional sectors of multifamily housing and industrial properties along with technology and health care sectors including data centers, life science, and medical office properties. However, the ODCE fund holdings are indicative of the difficulty accessing these newer property types through private real estate. REITs provide broad coverage across all the property types identified in the WMRE survey, while private real estate remains overweighted in the traditional sectors of retail, office, residential, and industrial.