Housing markets present a classic chicken-and-egg problem. Do price trends determine construction and the supply of new homes and apartments, or do the supply and demand conditions set prices? Any economist will tell you, of course, that they are determined jointly, as prices do influence supply and the supply-demand balance does affect prices. But there are times when it is clear that one of these forces is in the driver’s seat and the others follow.

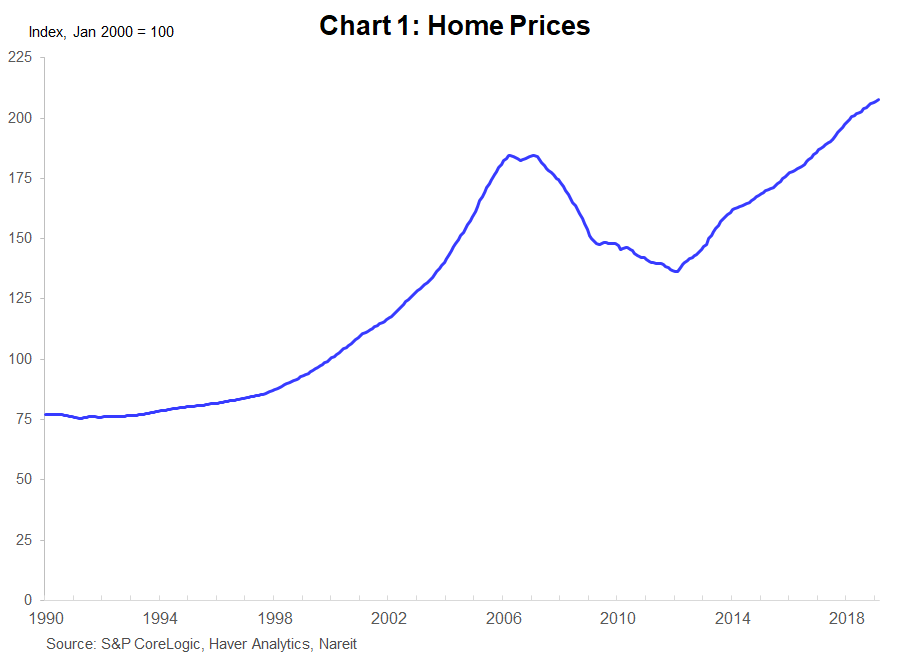

The housing boom in the mid-2000 is a clear example of prices driving the market. Rapidly rising house prices, and the expectation that prices would continue to climb, fed a speculative boom in homebuilding. Such hopes, unfortunately, were overdone, and the resulting glut of new homes led to a subsequent price collapse and the housing and mortgage crisis that followed.

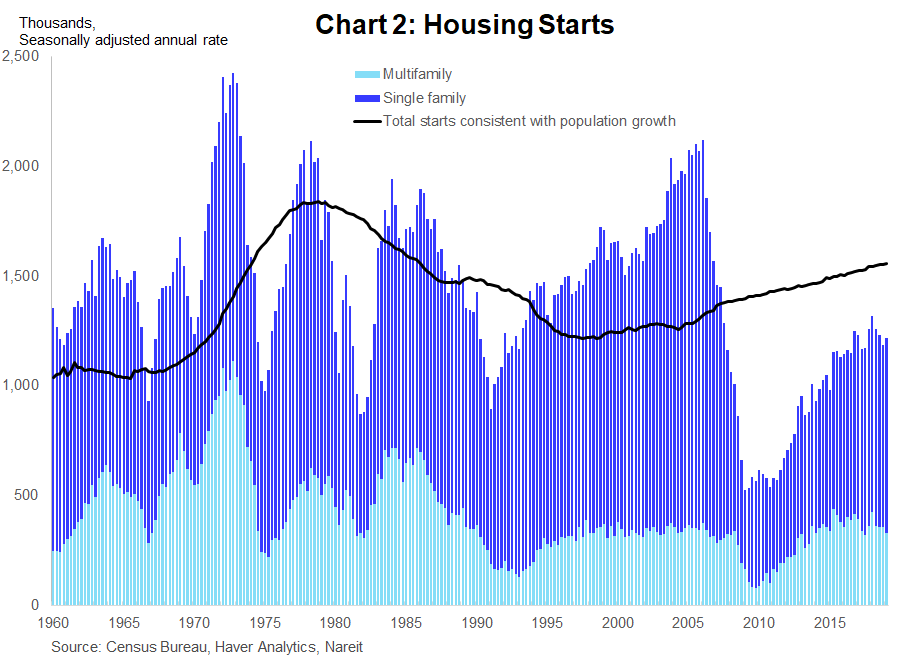

Home prices are again rising rapidly, leading many analysts to wonder whether we are in the early stages of a replay of the boom-bust cycle. Yet today, housing markets are on their heads compared to the mid-2000s. The most prominent feature of today’s housing market is a lack of supply. New construction of single-family homes and apartments fell during the crisis to a pace far slower than what is needed to keep pace with a growing population, and even in recent years homebuilding has not risen enough to make up for the past shortfall. There is little inventory of homes available for sale in markets across the country, and tight supply conditions are pushing prices higher.

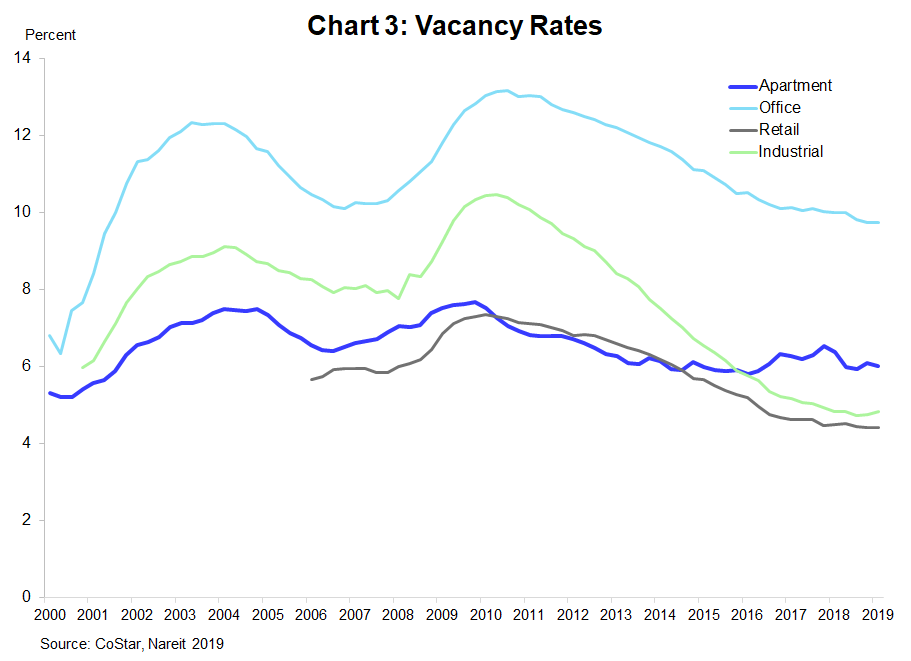

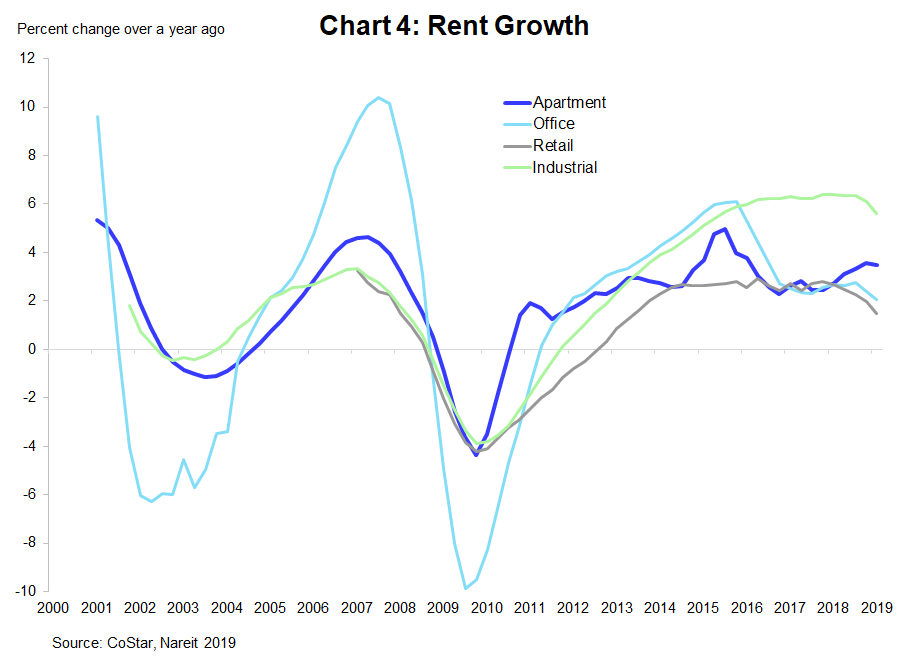

The shortage of single-family homes has spillover effects into apartment markets. There are millions of households that, under more typical housing market conditions, might have been homebuyers. Today, however, with a lack of available homes for sale—and perhaps also concerns about the financial risks of homeownership—many of these households are in rental apartments. Thus, despite a high level of multifamily (i.e. apartment) housing starts, the cascade of demand from would-be first-time homebuyers into rental markets has kept apartment vacancy rates low and rents rising (see the recent research, Apartment Markets and the Cascade of Demand with my colleague, Alexandra Thompson, for a detailed examination of the impact of diverted homeowners on apartment markets).

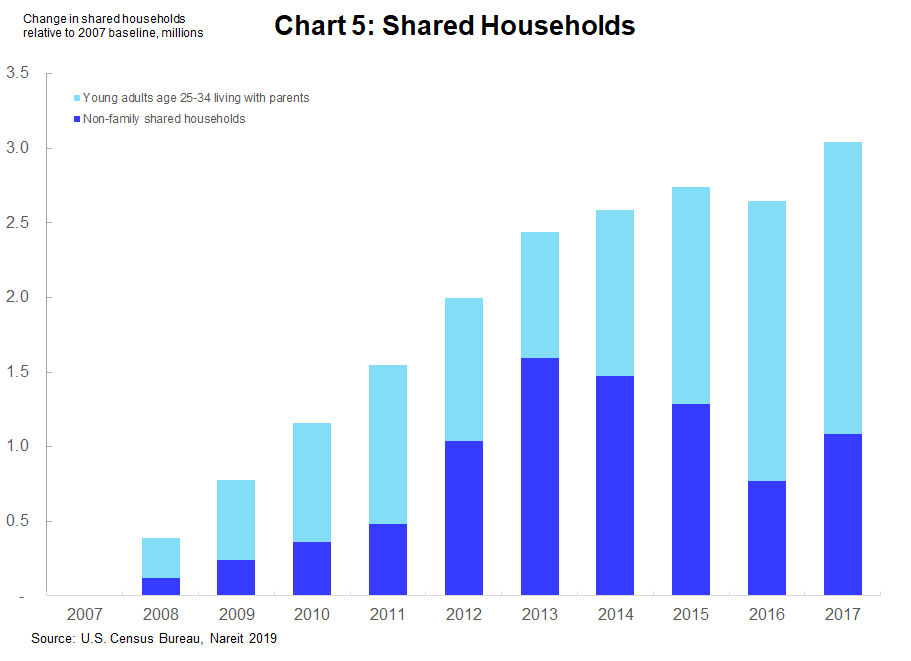

The shortfall of total housing units, both single-family homes and apartment units, is in the millions, and is equivalent to several years of new construction. This suggests that construction of homes and apartments can continue at or even above the recent pace for several years without leading to a supply glut. There is a corresponding pent-up demand for housing, represented by people sharing their homes with family or non-relative roommates. The number of shared households rose sharply following the financial crisis, and is roughly 3 million higher than a baseline of shared households at a constant percentage of total households since 2007. This shadow demand is ready to absorb the new supply. These conditions suggest that the housing market is not in danger of overbuilding, and in fact will be able to sustain current trends in construction and home price appreciation for quite some time.