WASHINGTON, D.C. (Dec. 7, 2022) – REITs outperform private real estate by more than 2% in defined benefit (DB) plans, according to a new study by CEM Benchmarking, Inc. The study, which is commissioned by Nareit on an annual basis, spans more than two decades and this is the first year that the report includes data from 2020 at the height of COVID-19.

The report—Asset Allocation and Fund Performance of Defined Benefit Pension Funds in the United States, 1998-2020—provides a comprehensive look at realized investment performance of REITS and 11 other asset classes over a 23-year period.

“REITs can play a powerful role in DB plans,” said Nareit Executive Vice President of Research and Investor Outreach John Worth. “The CEM study shows that across a period that included numerous periods of economic volatility, including the first year of the pandemic, REITs consistently delivered, on average, high annual net returns and low correlations with other asset classes in DB plans. These findings—along with REITs’ outperformance of private real estate—affirm the value institutional investors unlock by using REITs as a key component of their real estate strategy.”

CEM’s Key Findings Underscore REITs’ Benefits and How They Can Strengthen DB Plans

The study is anchored in a unique data set that shows the actual performance of pension assets in 200 public and private sector DB pensions, which account for nearly $3.9 trillion in combined assets under management. The report finds that:

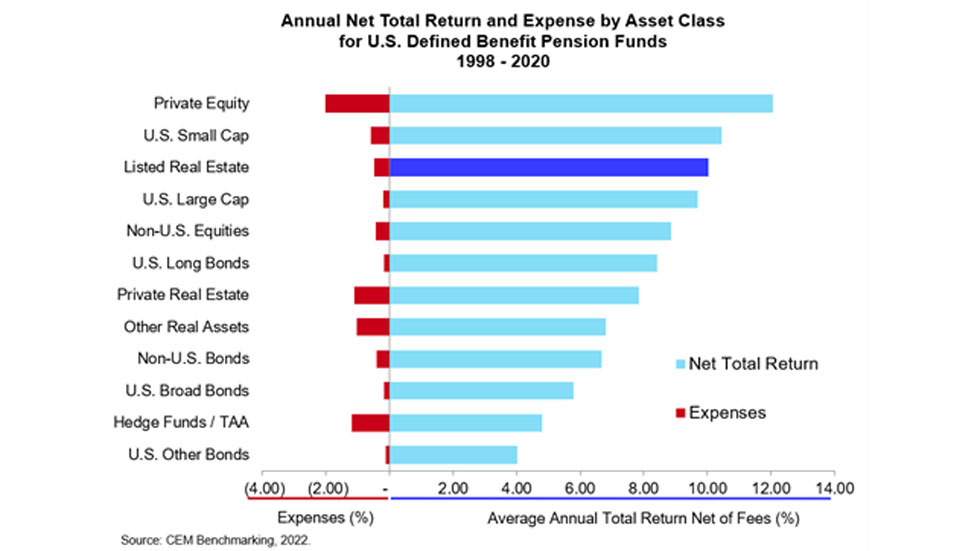

- REITs produced a 10% average annual return, the third highest of 12 asset classes analyzed in the report. Private equity, U.S. small cap, and REITs top the list of asset classes while hedge funds/tactical asset allocation strategies and U.S. other fixed income rank eleventh and twelfth, respectively. The following chart illustrates this finding.

- REITs had the second highest non-fixed income risk adjusted return. Outside of fixed income, REITs had the second highest Sharpe (.45), reflecting their high returns and above average volatility. Private equity was the most volatile asset class, after adjusting for valuation lags.

- REITs had a low correlation with equities. REITs and unlisted real estate returns were highly correlated (.91), but both had relatively low correlations with bonds and listed equity returns.

Taken together, these findings imply that REITs have good diversification benefits and strong risk-adjusted returns, even amidst volatility—critical attributes for a DB plan asset.

“Our analysis finds that, historically, REITs outperformed all styles of unlisted real estate,” said Alex Beath, Senior Research Analyst at CEM Benchmarking. “While leverage, cost, and geographic differences are important, at the end of the day, our study shows pretty clearly that U.S. defined benefit pension funds, public and corporate, would have achieved better net returns if they had more REITs and less unlisted real estate. This fact holds true whatever the style, all with similar amounts of risk and much more liquidity.”