Nareit recently released its third annual REIT Industry ESG Report, highlighting the progress REITs and the publicly traded real estate industry have made in implementing and reporting on environmental, social, and governance (ESG) initiatives.

As investors and the public are increasingly focused on corporate responsibility, REITs have continued to advance their ESG initiatives in 2020 by integrating ESG issues into corporate strategies, addressing climate change risks, prioritizing social impacts and DEI, and more.

Download the 2021 REIT Industry ESG Report, and read the top takeaways below:

1. REITs are increasingly making public commitments to ESG goals and reporting on their progress.

ESG issues are being incorporated into many REITs’ corporate strategies and long-term business planning, with 77% of respondents to the 2020 Nareit Member Survey reporting that ESG risks and opportunities—such as climate change, health and safety, or regulatory compliance—are integrated into strategic and financial planning.

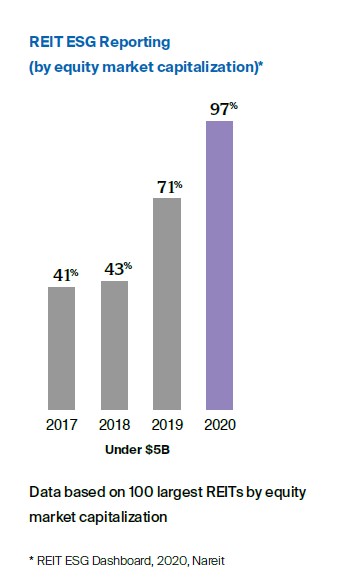

REITs are also increasingly reporting on their ESG progress, with 97% of the top 100 REITs by equity market cap reporting on ESG in 2020, up from 71% in 2019.

2. REITs are taking steps to address DEI systemically.

REITs are taking steps to address diversity, equity, and inclusion (DEI) systemically, with a focus on building a more diverse and inclusive workforce and leadership pipeline, and providing safe spaces and dedicated governance structures for employees’ voices to be heard.

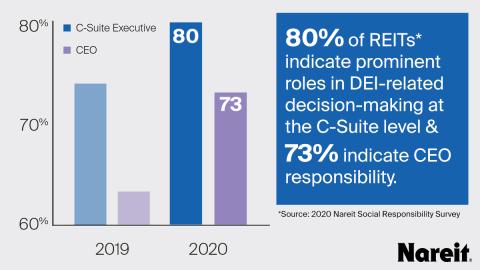

Of the Nareit members that participated in the GRESB survey, 98% indicated that they monitor inclusion and diversity metrics at the governance and workforce levels. Over the past year, REITs enhanced their management and oversight of DEI at the top, with 80% of REITs indicating prominent roles in DEI-related decision-making at the C-Suite executive level and 73% indicating CEO responsibility.

3. ESG is becoming a priority for investors—and REITs are meeting the demand

AFIRE’s 2020 International Investor survey found that two out of three real estate investors increased their risk consideration of climate change issues from 2019 to 2020, with nearly nine out of ten investors including ESG criteria for investment decisions, and 90% receiving the same or higher returns when accounting for ESG criteria.

REITs are responding to these ESG demands from investors, with the percentage of REITs publicly reporting their sustainability efforts continuing to improve year-over-year. While ESG reporting has historically been more common for larger REITs, reporting data from the past year revealed that REITs of all sizes are committing to greater ESG disclosure. REITs with an equity market cap under $5 billion that are reporting jumped from 71% in 2019 to 97% in 2020—more than doubling the 43% seen in 2018.

4. REITs are proactively managing their environmental footprint.

As an industry, U.S. listed REITs are a driving force behind the movement to make the global building portfolio healthier and greener, with over 2,100 REIT-owned buildings having a green certification—and growing.

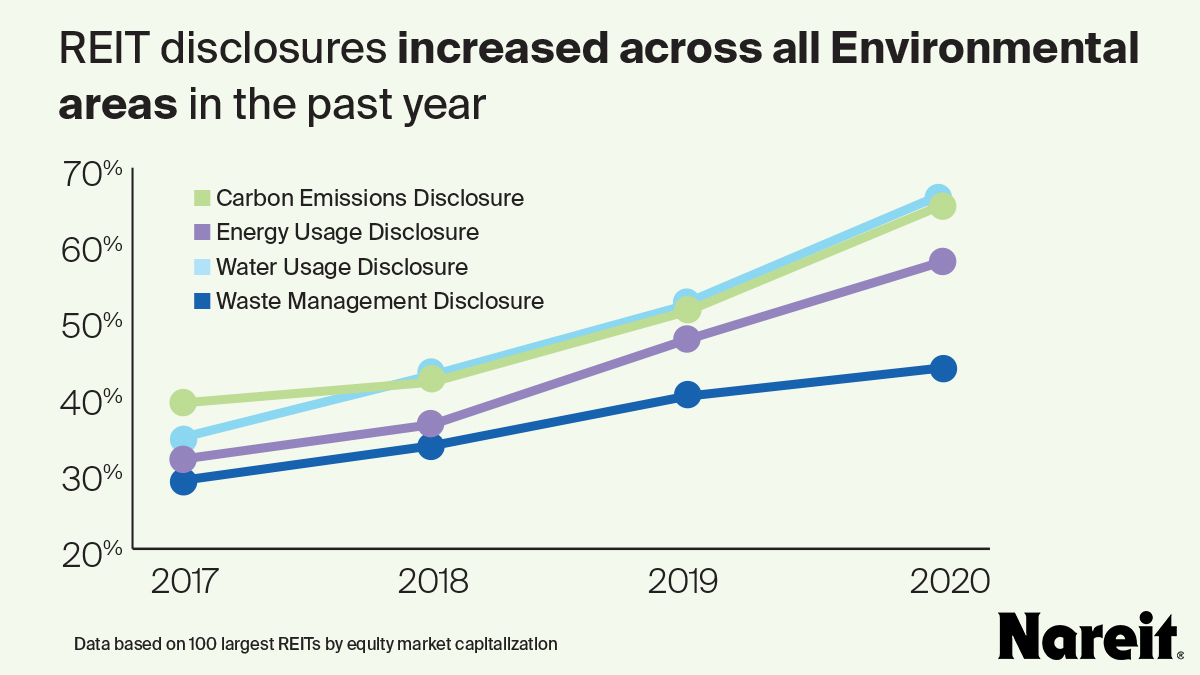

REITs are also increasingly reporting on their environmental efforts, with many REITs implementing strategies to conserve water and energy while reducing waste and carbon emissions.

5. REITs from all sectors are taking innovative approaches to environmental stewardship, social responsibility, and good governance.

The 2021 REIT Industry ESG Report highlights case studies from 24 REITs showcasing their ESG success stories and unique solutions—from supply chain optimization to innovating sustainability practices through digitization.