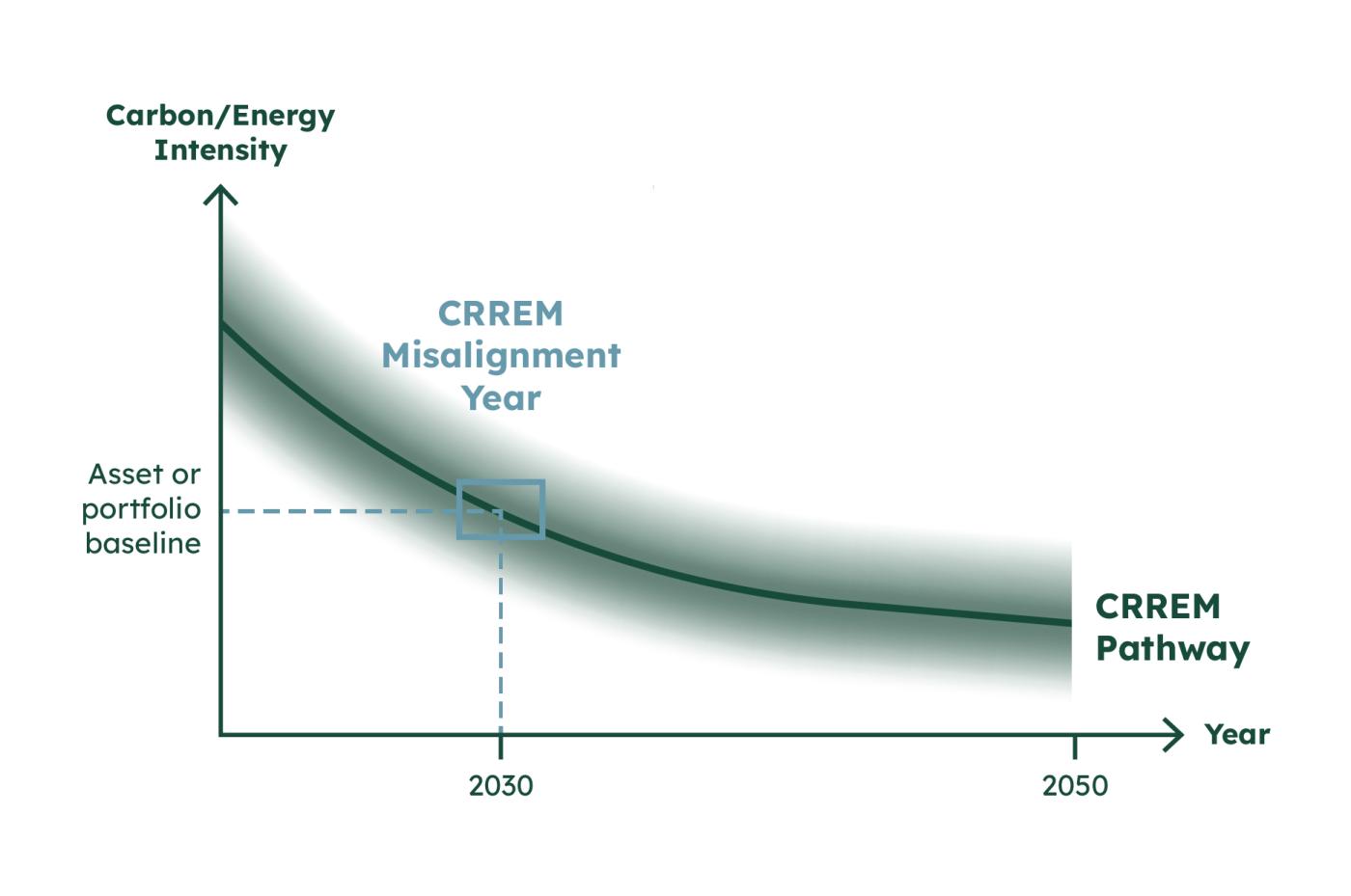

The CRREM Foundation has announced that it will no longer use the term “Stranding Year” to describe the year in which a building’s current or projected carbon or energy intensity exceeds the respective CRREM pathway threshold. In a press release, CRREM states that the term stranding " is not an entirely accurate reflection of what performance against the CRREM Pathway measures or indicates, introducing the term “CRREM Misalignment Year,” referring to the year in which a building’s carbon or energy intensity exceeds its allocated 1.5°C budget according to the CRREM Pathways.

The CRREM Foundation is a non-profit entity founded in 2024. Its mission is to increase market transparency by facilitating the global net-zero carbon standard for real estate using its signature tool, the CRREM Pathways. The change follows concerns raised by Nareit in a letter to the CRREM Global Consortium, following the CRREM North America project.

The change does not change the underlying data or methodology; however, CRREM shares how this new terminology more accurately reflects the insights a CRREM Pathway analysis is intended to be, a science-based early warning for investors and other real estate stakeholders. The change in terminology recognizes that assets are financially stranded only when markets recognize risks in and while climate transition risks may influence asset value overtime, exceeding a modeled carbon or energy intensity budget does not automatically mean the asset is or will become financially stranded as properties can often be repositioned through retrofitting, repurposing, or other value-added strategies, and not all markets are pricing in transition risks.

CRREM introduced new shading around the curve, reflecting a broader range of values and providing further clarity on the intended use and interpretation of the pathways, as a market average for a given asset type in a specific country/region, and that a building’s performance can deviate from the CRREM Pathways for a number of reasons. CRREM recommends investors aim to distinguish between design—and usage-based deviations, and performance-based deviations that may reflect an underinvestment in building efficiency.