Note: This story was updated in November 2021.

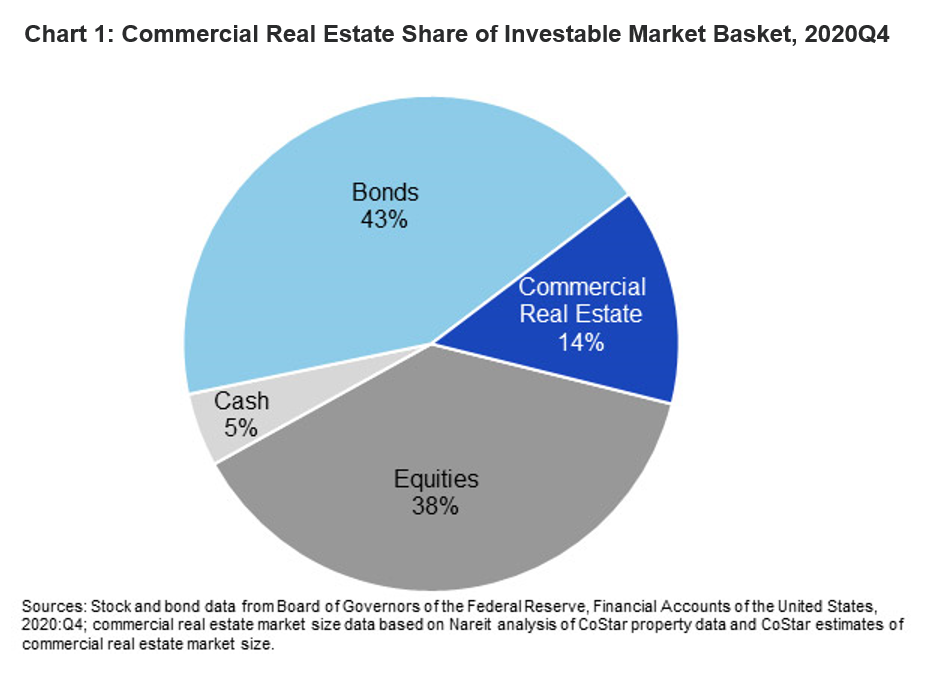

Pension, endowment, and foundation funds control over $12 trillion in total assets, with approximately $900 billion invested in real estate. Commercial real estate is a substantial component of the $123 trillion investment opportunity set in the United States. In fact, it is the third largest asset class. Real estate houses the U.S. economy and is a fundamental component of a diversified investment portfolio.

For decades, pension funds have been investing in the real estate asset class, recognizing the important role it plays within investment portfolios to help build a diversified portfolio and manage risk. As an asset class, real estate demonstrates valuable and distinct investment characteristics that have made it a staple in pension investment portfolios. Real estate has historically contributed:

- Relatively stable and consistent income (like bonds) with the opportunity to achieve capital appreciation (like stocks). That’s why sometimes real estate is called a “hybrid” investment;

- Inflation protection. Real estate tends to outperform the market during inflationary times, as property prices and rental income tend to rise as inflation increases;

- A separate and distinct from the general economic cycle;

- Diversification. Real property returns have a low correlation with the investment returns of other assets.

So How Much Real Estate Should Be in a Pension’s Portfolio?

Pension, endowment, and foundation funds control over $12 trillion in total assets, with approximately $900 billion invested in real estate.

More detailed asset allocation methods that include a broad mix of asset classes and consider returns, correlations, and volatilities consistently, demonstrate that a meaningful allocation to real estate, somewhere in the 13 to 20% range, is appropriate.

The charts below represent analyses of historical REIT performance using varying methodologies of optimization. A recently released analysis from Morningstar Associates, using the Black-Litterman methodology, found that the inclusion of REITs in a portfolio may increase the return for a given level of risk. For example, an aggressive portfolio targeting a 14% standard deviation and 5.8% return is estimated to have a 13% REIT allocation.

Even though pension fund allocations to real estate have increased over the past several years, on average, the target weight to real estate at 8 to 10% is less than market weight, and lower that of what other models would suggest as being optimal. This suggests that the majority of pension funds may not allocate enough to real estate to fully derive its portfolio benefits.

Investing in a 21st Century Real Estate Portfolio

Real estate is a fundamental asset class with investment characteristics that have delivered important portfolio benefits to institutional investors for decades. However, the economy and the real estate that houses the economy are very different today compared with when many institutions began building their real estate portfolios. These differences have important implications for how asset allocators are investing their real estate capital today.

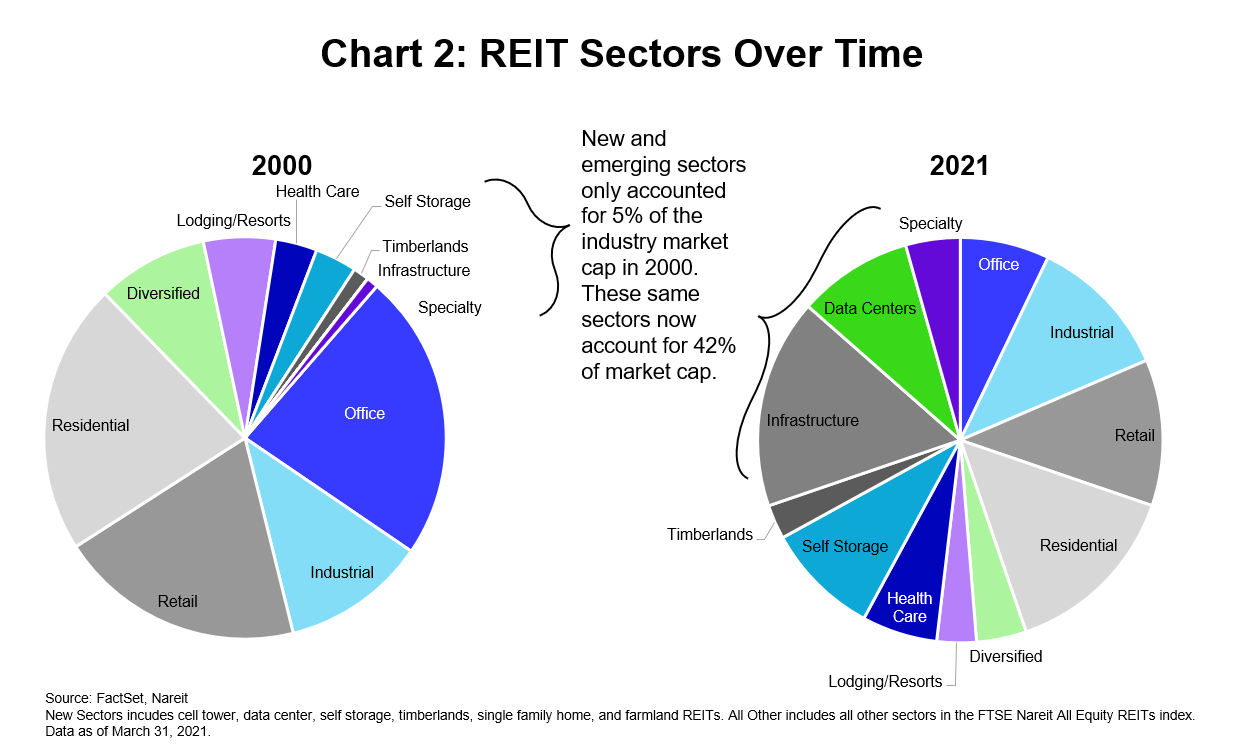

Today’s REIT industry provides access to 21st century real estate sectors, including infrastructure, cell towers, data centers, and networked logistics properties that house the growing digital economy.

Institutional investors are increasingly utilizing REITs to gain access to these new economy sectors as part of a portfolio completion strategy. A portfolio completion strategy is a tool investors have to invest in property sectors, including new economy sectors, that complement the traditional real estate property types in order to achieve more robust diversification, boost portfolio investment returns, and dampen volatility.

What are the Challenges of Managing a Real Estate Portfolio?

REITs can help address a number of the portfolio management challenges that face today’s real estate investor. A powerful strategic and tactical tool, REITs enable investors to act on their convictions—facilitating portfolio completion and rebalancing—and provide the opportunity to capitalize on market opportunities.

#1: It is difficult to fully invest in the entire real estate asset class globally.

Late last century, when pension funds began investing in real estate, portfolios were constructed principally of private market investments in office, retail, and industrial properties, which became recognized as the “core” or “traditional” property types. The economy and the real estate that houses it is dynamic and has evolved over the decades.

Today, investors have broad menu to choose from both in terms of property types and geographies. A 21st century real estate portfolio has efficient access to traditional and “non-traditional” property sectors globally. REITs enable investors to optimize property and geographic exposures within their real estate allocation, delivering access to traditional core” property sectors and beyond including hotel, self-storage, healthcare and life sciences sectors; as well as the new economy property sectors like infrastructure, data centers, and networked logistics and industrial properties that support the secular trends toward e-commerce and the digital economy.

#2: As a relatively illiquid asset, it can be challenging to control the real estate investments within a portfolio.

Commercial real estate is a physical “bricks and mortar” asset and relatively illiquid, which can make it difficult to efficiently implement strategic moves or execute tactical adjustments to the real estate allocation. Because REITs are traded on stock exchanges, they provide investors with real estate returns in a vehicle that also provides effective governance and market liquidity. Market liquidity allows investors to be nimble in controlling risks that are otherwise difficult to control when managing a portfolio of physical assets like real estate. Adding liquidity within the real estate portfolio in the form of REITs makes it easier to:

- Rebalance;

- Efficiently act on property type or geographic convictions;

- And capitalize on public market / private market valuation arbitrage opportunities in order to take advantage of pricing dislocations between the REIT and private markets that may occur during the market cycle.

#3: Investors want to maximize investment performance while managing investment costs.

As pension funds have increased allocations to diversifying asset classes, including real estate, transparency into these investments has become an area of emphasis—including transparency into their associated costs and fees.

Public market investments, which are bound to comply with regulatory disclosure requirements, can improve the overall transparency of a real estate portfolio. Because they are public market investments, REITs offer significant transparency and can help to manage overall real estate portfolio investment costs.

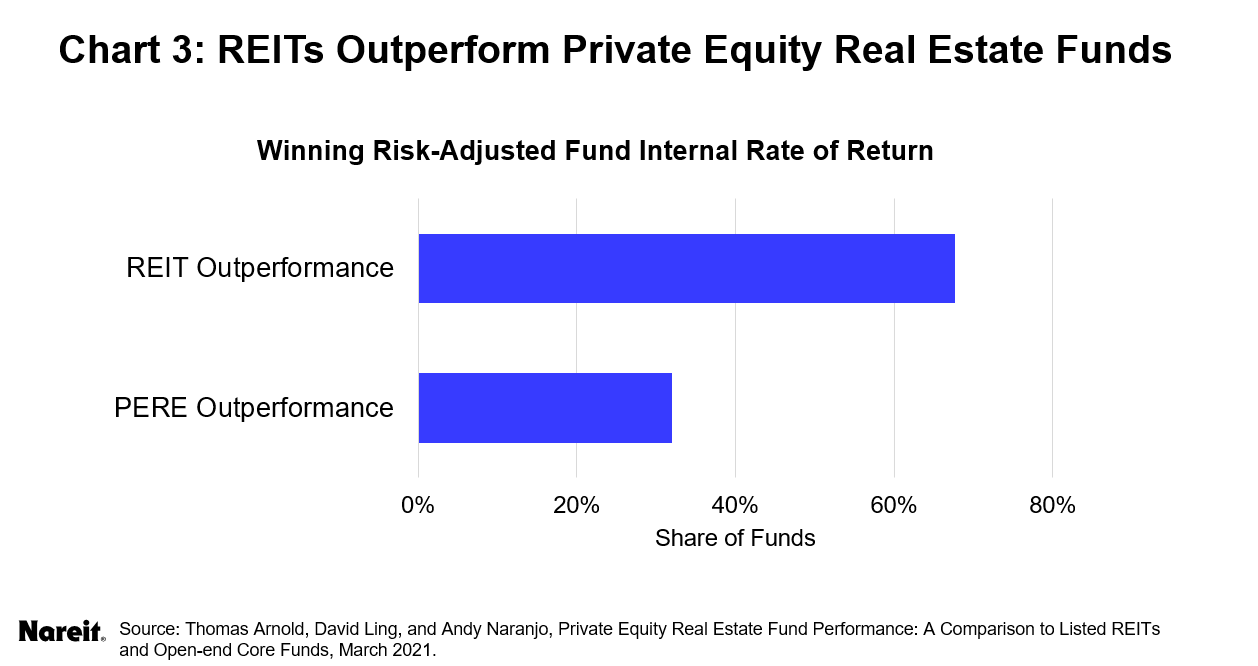

For long-term investors, research demonstrates that investing in real estate through REITs has not only delivered competitive investment performance within mixed asset investment portfolios, but also has outpaced private real estate investment returns on an absolute and risk-adjusted basis.

CEM Benchmarking looked at investment allocations and realized investment performance across aggregate asset classes using a unique dataset cover over 200 public and private sector pensions over a 22-year period. The research firm found that REITs have continued to outperform unlisted real estate investments. Over the 22-year period covered by the study, listed equity REITs had the second highest average net return of 10.7%.

A recent study by a team of academic researchers and practitioners compared private equity real estate (PERE) fund performance with REITs over matched investment horizons. On a risk adjusted basis, REITs won 68% of head-to-head matchups against both domestic and global PERE funds.

#4: Achieving diversification within the real estate allocation—as part of a risk management strategy—can be difficult.

Including real estate as an asset class is a significant step towards building a diversified pension investment portfolio, and an important arrow in the risk management quiver. Real estate is a mature asset class providing investors with an array of opportunities to gain real estate exposure and earn real estate driven investment returns. These opportunities present investors with ways to diversify within the real estate allocation, and therefore, additional tools to manage risk within the real estate portfolio.

Real estate investment can take the form of either equity or debt and can be accessed through private market structures (i.e., direct property investment or private comingled funds) and through public market investment structures (i.e. REIT securities listed on the stock exchanges or funds that invest in REIT securities).

For many investors, including smaller pension plans or those that who are just beginning to build a real estate investment program, REITs are often the most efficient and cost-effective way to access the asset class. For experienced investors with adequate resources, taking advantage of all that the asset class offers through both the public and private markets may be prudent; and for investors that have only private real estate investments in their portfolio, there are specific benefits of adding a meaningful allocation to REITs.

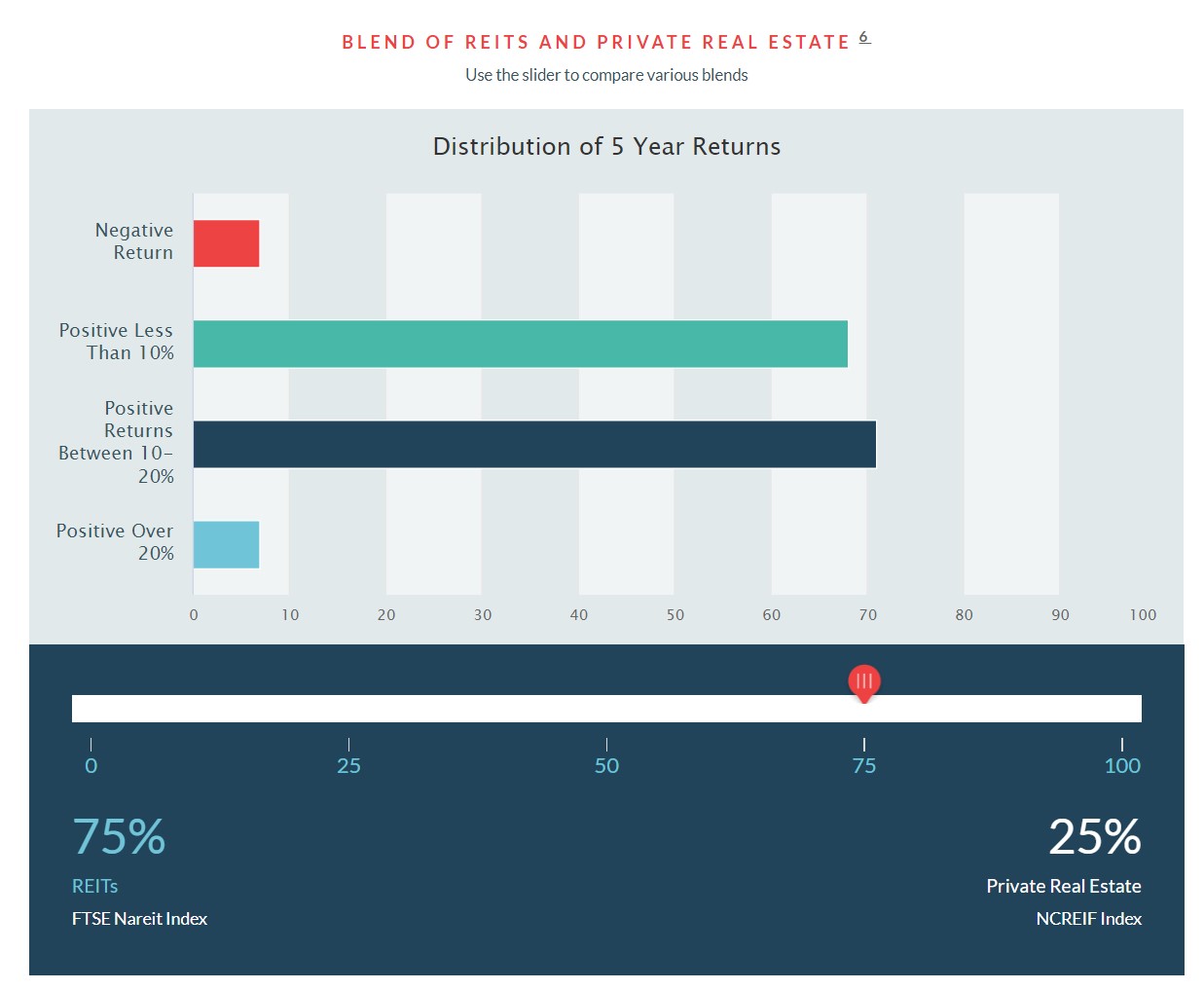

Today, most pension funds that invest in real estate, on an asset weighted basis, invest in the asset class using a blend of REITs and private real estate investment.

As the graph below shows, downside or drawdown risk, as measured by negative investment returns, is mitigated by combining REITs and private real estate investments. Upside opportunity, or the ability to achieve higher returns from the real estate portfolio, comes from the addition of REITs due to their comparatively stronger historical investment returns.

In conclusion:

- Real estate is a fundamental asset class;

- There are multiple ways to earn real estate investment returns and invest in the real estate economy;

- REIT investments can help investors manage real estate portfolio management challenges;

- The REIT industry has become more diversified and less cyclical;

- Providing efficient access to traditional and new economy property sectors;

- Adding REITs to a portfolio of private real estate investments can help mitigate drawdown risk & provide the opportunity to achieve higher returns.

Nareit launched pensionsandrealestate.com, designed especially with pension trustees in mind, with the goal of providing information to help trustees and pension fund investors think critically about their plan’s real estate investments.

Please reach out to Meredith Despins, Nareit’s SVP of Investment Affairs & Investor Education, with any questions.

- Sources

-

1. The Role of REITs and Listed Real Estate Equities in Target Date Fund Allocations, Wilshire Funds Management, 2019 /data-research/research/nareit-research/reits-critical-retirement-portfolios; Global Listed Real Estate Investment: Asset Allocation in a Non-Normal World, Morningstar December 2010; Commercial Real Estate Investment Through Global Public Markets, Morningstar, November 2011; The Role of REITs and Listed Real Estate Equities in Target Date Fund Asset Allocations, Wilshire Funds Management, January 2013; Real Estate Investment In Liability-Driven Portfolios, Morningstar Inc., July 2011; Real Estate Investment Through REITs, Morningstar Inc., September 2008.

2. Source: Nareit analysis of quarterly net total returns for NCREIF Fund Index – Open-End Diversified Core Equity (ODCE) and FTSE Nareit All Equity REITs Index, 1978Q1-2020Q4, after subtracting assumed fees of 12.5 bps/qtr for REITs. Performance results are provided only as a barometer or measure of past performance, and future values will fluctuate from those used in the underlying data.