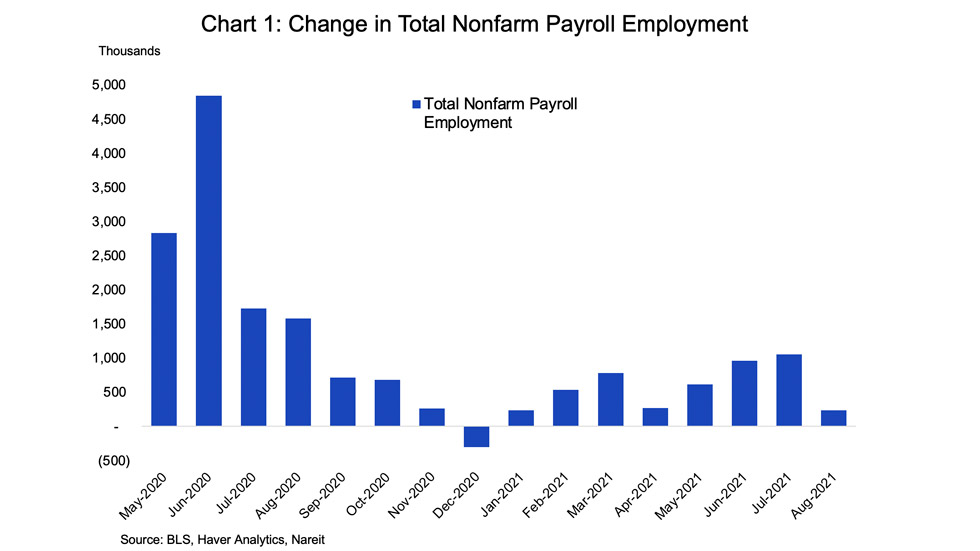

The jobs recovery slowed suddenly in August 2021 as the surge of new cases of the Delta variant of COVID-19 prompted more cautious behavior. Total payroll employment rose 235,000 in August, the slowest since last January and far behind the monthly average of 636,000 between January and July.

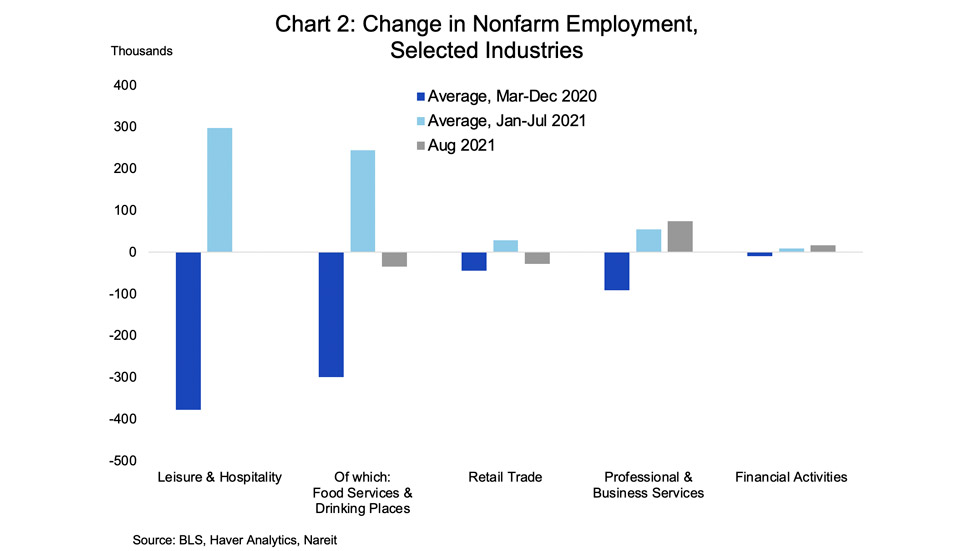

The slowdown was most pronounced in the industries that had been making outsized contributions to job growth. The change in employment in leisure & hospitality was exactly zero in August, and was negative in retail trade; these two industries had combined to provide over half the total employment growth in the first seven months of this year. Within the leisure & hospitality segment, food services & drinking places—the government’s official name for restaurants and bars—entirely accounted for the decline, while accommodations (hotels) and the arts had slight increases in employment.

Some other sectors did see sustained job growth, however, indicating that areas of the economy that do not require face-to-face interactions continue to recover. Employment in professional and business services and in financial activities rose 74,000 and 16,000, respectively, each of which is slightly above the year-to-date average through July. These sectors constitute a large share of total office-based employment.

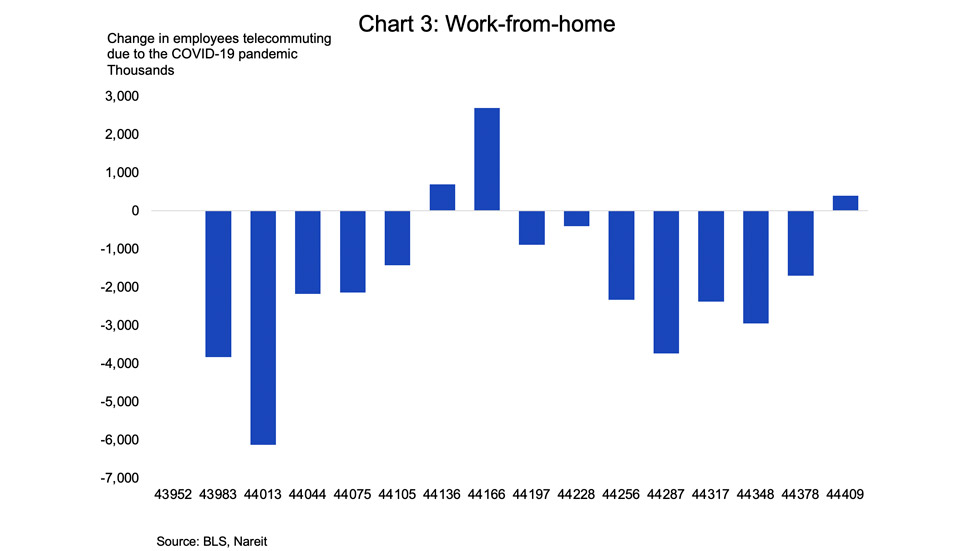

The return to the office stalled last month, however, as the number of employees who were telecommuting due to the COVID-19 pandemic rose 400,000. This is the first increase in work-from-home (WFH) since November and December 2020, when the surge in COVID-19 infections had a similar effect in slowing the return to office. Even with the recent rise, the 19.7 million employees currently working from home are down 57.3% from the peak WFH in May 2020. Moreover, the August 2021 increase in WFH was small compared to the wintertime rise, and the subsequent declines in WFH as vaccinations increased and infection rates slowed suggest that the return to office may resume as public health conditions improve.

The slowdown in job growth and the slight reversal of return-to-office suggests a slower pace of macroeconomic recovery than we had been anticipating just a few weeks ago, and especially the recovery of the office sector.