|

December 16, 2013

Message from the President

NAREIT had an active 2013 as we worked to take the REIT story to all of our industry’s audiences. As the year comes to a close, it’s useful to re-cap some of what we accomplished on the REIT industry’s behalf. NAREIT had an active 2013 as we worked to take the REIT story to all of our industry’s audiences. As the year comes to a close, it’s useful to re-cap some of what we accomplished on the REIT industry’s behalf.

In the Policy and Politics area, we conducted an ongoing program to provide legislators and decision-makers of key government agencies with a better understanding of the REIT investment proposition, its history, and the important functions that REITs play in investment portfolios, in channeling capital to the real estate industry, and in creating jobs and economic growth.

We provided constructive input to the ongoing discussion of tax reform, including input to the House Ways and Means Committee and Senate Finance Committee. Importantly, we continued to advocate for reform of the Foreign Investment in Real Property Tax Act (FIRPTA) to encourage more overseas equity investment in U.S. real estate.

NAREIT and our partners in the Coalition to Insure Against Terrorism also have worked towards the extension of the Terrorism Risk Insurance Act (TRIA), which has made possible a functioning marketplace for terrorism risk insurance since the 9/11 terror attacks. We will continue seeking this critical law’s extension in the year ahead.

Our Investor Outreach group produced research and educational materials to help tell the REIT story to both policymakers and the investment community. NAREIT's activities ranged from providing insight into the role of REITs in pension plans and target date funds, to highlighting the role of mortgage REITs in the context of GSE reform and a changing mortgage finance market. We also took our industry’s story directly to investment decision makers in nearly 400 meetings with retirement plans, investment managers and consultants in the United States and around the world.

Additionally, we maintained a full schedule of investor and professional conferences in 2013 and a comprehensive communications program to support our policy and investor outreach objectives.

We will work in 2014 to build on the momentum behind these and other initiatives important to our industry. We are appreciative of the support of our members for our work in 2013, and we look forward to continuing to serve as our industry’s advocate in the year ahead.

Steven A. Wechsler

President and CEO

Educating DC Plans About Real Estate Investment

NAREIT attended the fourth quarterly meeting of the Defined Contribution Real Estate Council (DCREC), a newly formed organization, in New York on Dec. 10. In its founding documents, DCREC is described as being formed "… to promote the inclusion of investments in direct commercial real estate and real estate securities within defined contribution plans by furthering education about, advocacy for and best practices of such investments." NAREIT attended the fourth quarterly meeting of the Defined Contribution Real Estate Council (DCREC), a newly formed organization, in New York on Dec. 10. In its founding documents, DCREC is described as being formed "… to promote the inclusion of investments in direct commercial real estate and real estate securities within defined contribution plans by furthering education about, advocacy for and best practices of such investments."

Given the shared interests, members of NAREIT’s Research, Investment Affairs and Investor Education team continue to play an active role in the operations of the council. During November, Kurt Walten, NAREIT’s senior vice president of investment affairs and investor education, was elected as an officer of DCREC for 2014. He will join Ben Adams of investment manager Ten Capital as a co-treasurer of the council. Also elected were co-presidents Dave Skinner of Prudential Real Estate Investors and Laurie Tillinghast of UBS. In addition, Walten was re-elected to co-chair the Marketing & Public Relations Committee along with Jennifer Perkins of Principal. NAREIT will also participate in 2014 as a member on DCREC’s Research and Content, Finance, and Membership Committees.

Since its founding last year, DCREC’s membership has grown dramatically. Founding members were Clarion Partners, Goldman Sachs, Principal Global Investors, Prudential Real Estate Investors, RREEF, State Street Global Advisors, Ten Capital, TIAA-CREF and UBS. The number of full members doubled this year as the following organizations joined: ASB Real Estate Investments, Benefit Trust Company, Bentall Kennedy, BlackRock, Cornerstone Real Estate Investors, Invesco, LaSalle Investment Management, MetLife Real Estate Investors and USAA. Other members of the investment management community are expected to participate.

Activities of DCREC of particular importance to NAREIT include:

-

Supporting and encouraging dialogue and cooperation among the leaders of the defined contribution plan community and others committed to the best interests of American employees who are passionate about improving defined contribution plan investment structures and design though real estate investment allocations;

-

Encouraging and sponsoring research, publishing analysis and insights, and hosting events that support the advancement of improved defined contribution plan designs that include real estate and real estate allocations;

-

Identifying issues and removing barriers for plan sponsors so they may pursue improved real estate allocations within defined contribution institutional investment structures;

-

Educating policymakers and regulators about the importance of including real estate investment opportunities in institutional defined contribution plan designs as a way to improve retirement security.

(Contact: Kurt Walten at kwalten@nareit.com)

Don’t Miss 2014 Leader in the Light Working Forum

NAREIT Corporate Members should register now for NAREIT's 2014 Leader in the Light Working Forum, the continuation of a highly successful annual series of focused exchanges on energy efficiency and sustainability. The 2014 Working Forum is being facilitated by consulting firm Real Foundations, a NAREIT Board Associate member, and hosted by NAREIT corporate member Prologis (NYSE: PLD) at their Pier 1, San Francisco, office on Jan. 8 and Jan. 9.

The 2014 Leader in the Light Working Forum has moved to an earlier date in the calendar year to take place well in advance of the April 1 – June 30 submission period for the 2014 GRESB Survey/Leader in the Light Award submissions.

Attendees of the 2014 Leader in the Light Working Forum will be presented the opportunity to understand the investor community's perspective on the growing importance of sustainability in determining capital allocations. Additionally, the Working Forum will serve as a venue for corporate members to expand their understanding of the components of the Global Real Estate Sustainability Benchmark (GRESB) Survey, including an informative discussion on GRESB's scoring methodology, and an update from PricewaterhouseCoopers on external assurance/data verification. Attendees will also receive an update on the status of ongoing discussions between NAREIT and the U.S. Green Building Council; together with an update from the Institute for Market Transformation on changes in the regulatory and compliance landscape.

(Contact: Sheldon Groner at sgroner@nareit.com)

NAREIT Comments to PCAOB on Auditing Standards

On Dec. 11, NAREIT submitted comments to the Public Company Accounting Oversight Board (PCAOB) regarding proposed auditing standards. On Dec. 11, NAREIT submitted comments to the Public Company Accounting Oversight Board (PCAOB) regarding proposed auditing standards.

The submission was in response to the PCAOB’s Proposed Auditing Standards – The Auditor’s Report on an Audit of Financial Statements When the Auditor Expresses an Unqualified Opinion, and The Auditor’s Responsibilities Regarding Other Information in Certain Documents Containing Audited Financial Statements (PCAOB Rulemaking Docket Matter No. 034).

Among its comments, NAREIT said it supports the PCAOB’s decisions to retain the current pass/fail model of auditor reporting and to reject the requirement for an auditor’s discussion and analysis. NAREIT said it doesn’t support a requirement for an auditor to report on “critical audit matters.” According to NAREIT, the measure would add costs without improving the quality of the audit and would likely confuse and even mislead users of financial statements in some cases.

(Contact: Chris Drula at cdrula@nareit.com)

REIT.com Videos: CEO Spotlights

A host of REIT CEOs sat down for video interviews with REIT.com at REITWorld 2013: NAREIT's Annual Convention for All Things REIT in San Francisco. Below is a sample of recent interviews posted online.

Spencer Kirk, CEO of Extra Space Storage (NYSE: EXR), described the outlook for acquisitions in the self-storage space. Spencer Kirk, CEO of Extra Space Storage (NYSE: EXR), described the outlook for acquisitions in the self-storage space.

“There’s a lot of competition for these assets. People like self-storage,” he said. “With the top 10 operators owning, controlling or operating less than 10 percent of the market, we’ve got a very fragmented environment, and I think that although there’s some pricing competition that’s a little stiffer than we would like, the landscape for a number of transactions for financial consolidation appears to be wide open. I actually think we’ll see an acceleration in the acquisitions market.”

Michael Barnello, president and CEO of LaSalle Hotel Properties (NYSE: LHO), was asked if he expects the current strength of the lodging sector to hold up in 2014. Michael Barnello, president and CEO of LaSalle Hotel Properties (NYSE: LHO), was asked if he expects the current strength of the lodging sector to hold up in 2014.

“We think so,” he said. “The supply-and-demand dynamics set up very favorably for owners and operators. We’re in an environment right now where supply is lower than the historical averages, and demand has been higher than historical averages. Things are setting up to continue on that track for 2014, so we feel like we’re in a sturdy part of the cycle.”

Craig Macnab, chairman and CEO of National Retail Properties (NYSE: NNN), discussed his company’s recent portfolio repositioning, Macnab stressed that “at the end of the day, we are constantly trying to improve our portfolio.” In the third quarter, Macnab said, the company sold properties that it thought would fit better in other hands. Craig Macnab, chairman and CEO of National Retail Properties (NYSE: NNN), discussed his company’s recent portfolio repositioning, Macnab stressed that “at the end of the day, we are constantly trying to improve our portfolio.” In the third quarter, Macnab said, the company sold properties that it thought would fit better in other hands.

“We’re doing this constantly at the margin, just working a little bit on some of the weaker properties while trying to acquire stronger properties that will provide us with a nice return over a long period of time,” Macnab noted.

Denny Oklak, chairman and CEO of Duke Realty Corp. (NYSE: DCT), gave an update on his company’s repositioning efforts. Denny Oklak, chairman and CEO of Duke Realty Corp. (NYSE: DCT), gave an update on his company’s repositioning efforts.

“We’re basically there,” he said. “In our targets from about four years ago, when we started this repositioning, we’d be 60 percent industrial, 25 percent suburban office and 15 percent medical office, which was sort of a flip flop from where we were four years ago. So we’re virtually complete, and I think it’s really worked very well for us for a couple of reasons. One is the suburban office business. While it’s certainly getting better, it’s still a fairly difficult area to be in today when you look at the employment situation in the country and just overall job growth. But the good news is as we’ve repositioned into industrial and medical office, both those businesses are doing very well.”

Roger Waesche Jr., president and CEO of Corporate Offices Properties Trust (NYSE: OFC), discussed the impact uncertainty in Washington had on his company’s operations and how cyber security tenants have shielded the company from feeling the full brunt of government dysfunction. Waesche pointed out that of the 70 percent of its portfolio comprised of government tenants, occupancy levels in that niche stand at 94 percent. Roger Waesche Jr., president and CEO of Corporate Offices Properties Trust (NYSE: OFC), discussed the impact uncertainty in Washington had on his company’s operations and how cyber security tenants have shielded the company from feeling the full brunt of government dysfunction. Waesche pointed out that of the 70 percent of its portfolio comprised of government tenants, occupancy levels in that niche stand at 94 percent.

“We continue to see some challenges, but we think we’ll be able to work through this over the next year or two,” he said.

(Contact: Matt Bechard at mbechard@nareit.com)

NAREIT Comments on Built In Loss Regulations

NAREIT wrote to the Treasury Department and IRS last week to offer comments on proposed regulations that are related to nonrecognition transfers of property with a built in loss to corporations that are subject to federal income tax. NAREIT wrote to the Treasury Department and IRS last week to offer comments on proposed regulations that are related to nonrecognition transfers of property with a built in loss to corporations that are subject to federal income tax.

If the regulations were to apply, the transferee of the property would have to mark down its basis in the property to the property's value (“mark to market”) and would not be able to use the built in loss to offset future capital gains. Among other things, NAREIT agreed with Treasury’s recognition that REITs are, in fact, subject to income tax and that applying a “look through” to a REIT’s shareholders would be burdensome. NAREIT also asked the Treasury to interpret an anti-abuse provision in the proposed regulations narrowly.

(Contact: Dara Bernstein at dbernstein@nareit.com)

Meeting the Middle Men (and Women)

An important component of NAREIT’s outreach to the financial intermediary audience is our participation in financial intermediary and retail investor-focused conferences throughout the year. Financial intermediaries advise and manage approximately one-third of the $16 trillion of retirement savings in the U.S., including individual retirement accounts and 401(k) rollover accounts. An important component of NAREIT’s outreach to the financial intermediary audience is our participation in financial intermediary and retail investor-focused conferences throughout the year. Financial intermediaries advise and manage approximately one-third of the $16 trillion of retirement savings in the U.S., including individual retirement accounts and 401(k) rollover accounts.

Last week, Abby McCarthy, vice president, investment affairs and investor education, participated in the Investment Management Consultants Association’s (IMCA) Winter Institute on Global Alternative Investment Strategies in Phoenix. IMCA currently has more than 9,000 members who collectively manage more than $1.9 trillion in assets. IMCA members provide investment consulting and wealth-management services to high-net worth retail and institutional clients.

The IMCA event attracted 390 financial advisors, registered investment advisors (RIAs) and investment management firms. The event provided NAREIT an opportunity to inform and educate the financial advisor and RIA attendees with respect to the benefits of REIT based real estate investment while also providing opportunities to develop stronger relationships with many of the investment firms with which NAREIT maintains a regular dialogue, including CBRE Clarion Securities.

(Contact: Abby McCarthy at amccarthy@nareit.com)

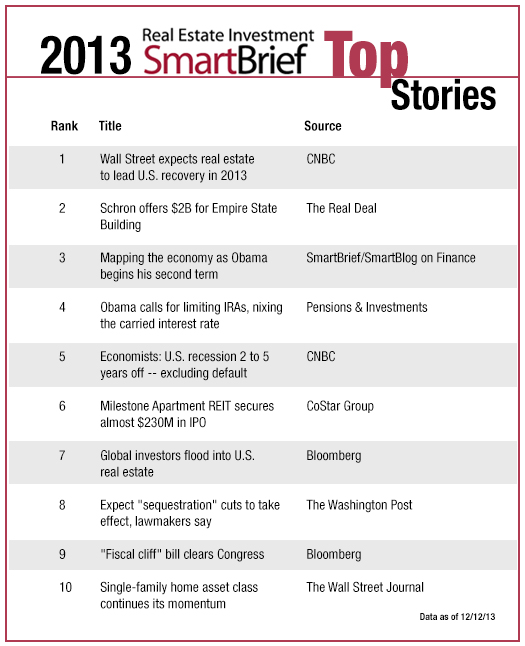

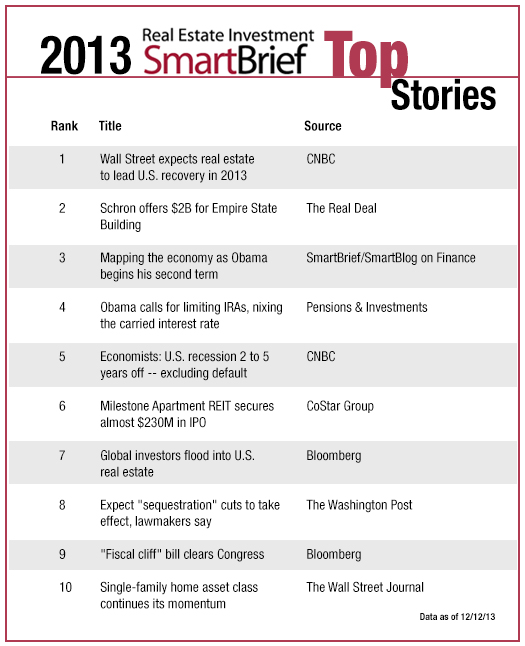

10 Most Popular Real Estate Stories in 2013

Not surprisingly, stories tied to economic and political uncertainty ranked very high among the most popular stories published in Real Estate Investment SmartBrief in 2013. Real Estate Investment SmartBrief, published by NAREIT and SmartBrief, provides a free, daily executive news summary of the most-important stories of the day and is sent to nearly 26,000 readers each day.

A story about Wall Street’s expectations for the housing recovery was the most clicked on story among SmartBrief readers in 2013. The second-most popular story was tied to one of the most publicized deals of the year, Empire State Realty Trust’s (NYSE: ESRT) initial public offering.

SmartBrief is the leading online publisher of targeted business news and information by industry. By combining technology and editorial expertise, SmartBrief filters thousands of sources daily to deliver the most relevant industry news in partnership with more than 180 trade associations, professional societies, nonprofits and corporate entities.

(Contact: Matt Bechard at mbechard@nareit.com)

REIT.com Videos: REITWorld 2013 Insights

Dozens of REIT analysts and investors sat down for video interviews with REIT.com at REITWorld 2013: NAREIT's Annual Convention for All Things REIT in San Francisco. Below is a sample of recent interviews posted online.

Michael Brooks, who’s returning to the position of CEO with the Real Property Association of Canada (REALpac) at the start of 2014, said a shortage of supply remains one of the biggest challenges for real estate companies looking to add assets in Canada. Michael Brooks, who’s returning to the position of CEO with the Real Property Association of Canada (REALpac) at the start of 2014, said a shortage of supply remains one of the biggest challenges for real estate companies looking to add assets in Canada.

“There’s still a lot of money chasing most product types in most metropolitan areas, so people who want to grow their portfolios will have a difficult time winning all of the bids that they may be involved in,” he said.

Jeff Horowitz, global head of real estate, gaming and lodging with Bank of America Merrill Lynch, discussed the outlook for more IPO activity in the REIT space coming off a very busy 2013. Jeff Horowitz, global head of real estate, gaming and lodging with Bank of America Merrill Lynch, discussed the outlook for more IPO activity in the REIT space coming off a very busy 2013.

“I’ve been saying for a number of years that we’re basically in a bit of a mature sector,” he said. “Every year, we’ll see a handful of IPOs, we’ll see some M&A and those sorts of things with certain aberrations. This year, the pipeline is much smaller. On the flip side, if we see some things, there’s a market that is wide open for it. Companies just have to be able to hit certain criteria.”

Jay Leupp, managing director with Lazard Asset Management, discussed potential surprises he was keeping an eye on for 2014. Jay Leupp, managing director with Lazard Asset Management, discussed potential surprises he was keeping an eye on for 2014.

“I’m going to step out on a little bit of a value limb here and say suburban office,” he said. “Some suburban areas that we like right now are the western part of Los Angeles along the coast, parts of the suburban Bay Area. I think that there are similar markets that look interesting in suburban Boston, suburban New York and suburban Washington, D.C.”

Steven Marks, managing director with Fitch Ratings, discussed REITs and their efforts to reduce risk. Steven Marks, managing director with Fitch Ratings, discussed REITs and their efforts to reduce risk.

“We think the companies have done a good job of de-risking,” he said. “The credit probably was not at the top of mind of a lot of REIT management teams during the most recent commercial real estate cycle. Companies weren’t as focused on leverage. They were mitigating leverage. There was a lot of growth, and there and there was a lot of development exposure. Companies now think about credit a lot differently than they did a while ago.”

Glenn Mueller, professor with the University of Denver, said the rise of leveraged ETFs has impacted REIT share prices significantly. Glenn Mueller, professor with the University of Denver, said the rise of leveraged ETFs has impacted REIT share prices significantly.

“We found that as these things grew, and especially as the market got more volatile back in 2007 and 2008, if the market had moved during the day - let’s say 2 percent - by the end of the day, it would be up 4 (percent),” he said. “Each of these ETFs is trying to keep the same portfolio mix as an index, and if a couple of stocks move and others don’t, they have to rebalance every day at the end of the day. Their demand for either selling or buying stocks created a double volatility that shouldn’t have been there. They’re a derivative product, they’re unregulated and they’ve caused havoc in smaller areas of the stock market where the market capitalization isn’t as huge.”

(Contact: Matt Bechard at mbechard@nareit.com)

Stay Connected Via Twitter

More than 10,700 people keep up-to-date on the latest news that matters to the real estate investment community via NAREIT’s Twitter feed (@REITs_NAREIT). If you have a Twitter account, be sure to follow us. A number of NAREIT Corporate Members are also active on Twitter, and we encourage you to join in the online conversation and follow them as well. More than 10,700 people keep up-to-date on the latest news that matters to the real estate investment community via NAREIT’s Twitter feed (@REITs_NAREIT). If you have a Twitter account, be sure to follow us. A number of NAREIT Corporate Members are also active on Twitter, and we encourage you to join in the online conversation and follow them as well.

(Contact: Matt Bechard at mbechard@nareit.com)

REIT.com Video: Fundamentally Speaking

In the latest edition of “Fundamentally Speaking,” Calvin Schnure, NAREIT’s vice president of research and industry information, reviewed a recent flurry of positive economic data and looked ahead to 2014. In the latest edition of “Fundamentally Speaking,” Calvin Schnure, NAREIT’s vice president of research and industry information, reviewed a recent flurry of positive economic data and looked ahead to 2014.

Schnure observed that one of the most important economic reports released lately has shown that job growth has firmed, with payroll employment rising by 203,000 in November.

The economy overall grew much faster in the third quarter than observers had expected, according to Schnure, with GDP growth of 3.6 percent. Part of that boost came from inventories, Schnure said, which has raised some concerns that a similar inventory contribution will not be seen in the fourth quarter.

However, Schnure noted that even excluding inventories, private sales were up almost 2 percent in the third quarter. “This is good, solid baseline growth,” he said.

Looking ahead to 2014, Schnure noted that economic fundamentals appear to be strengthening. “It looks to me like 2014 could be the first year that feels like a real recovery,” Schnure said.

In particular, the housing market could have a fairly solid year in 2014, Schnure noted. The median time that homes spend on the market has dropped to around two-and-a-half months from five to six months, Schnure said.

“Builders are selling homes almost as fast as they can put them up. That says that there’s strong demand from potential homeowners and we’re going to see more construction, and that’s going to have a lot of feeder effects into appliances, durable goods, et cetera,” Schnure said.

A stronger economy will help all real estate sectors, Schnure predicted. The office market will see recovery spreading from central business districts out to suburban and tertiary markets, he said. Also, the retail sector will benefit from stronger consumers, according to Schnure, while strengthened demand in the multifamily sector will help absorb new supply coming online.

“Overall, it looks to be a fairly good year for commercial real estate,” Schnure concluded.

(Contact: Matt Bechard at mbechard@nareit.com)

NewsBrief Will Not Publish Next Two Weeks

NewsBrief will not publish the next two weeks due to the holidays. NewsBrief will return Monday, Jan. 6. We wish everyone a happy and safe holiday season.

(Contact: Matt Bechard at mbechard@nareit.com)

|

NAREIT had an active 2013 as we worked to take the REIT story to all of our industry’s audiences. As the year comes to a close, it’s useful to re-cap some of what we accomplished on the REIT industry’s behalf.

NAREIT had an active 2013 as we worked to take the REIT story to all of our industry’s audiences. As the year comes to a close, it’s useful to re-cap some of what we accomplished on the REIT industry’s behalf.

NAREIT attended the fourth quarterly meeting of the Defined Contribution Real Estate Council (DCREC), a newly formed organization, in New York on Dec. 10. In its founding documents, DCREC is described as being formed "… to promote the inclusion of investments in direct commercial real estate and real estate securities within defined contribution plans by furthering education about, advocacy for and best practices of such investments."

NAREIT attended the fourth quarterly meeting of the Defined Contribution Real Estate Council (DCREC), a newly formed organization, in New York on Dec. 10. In its founding documents, DCREC is described as being formed "… to promote the inclusion of investments in direct commercial real estate and real estate securities within defined contribution plans by furthering education about, advocacy for and best practices of such investments."

On Dec. 11, NAREIT

On Dec. 11, NAREIT

NAREIT

NAREIT  An important component of NAREIT’s outreach to the financial intermediary audience is our participation in financial intermediary and retail investor-focused conferences throughout the year. Financial intermediaries advise and manage approximately one-third of the $16 trillion of retirement savings in the U.S., including individual retirement accounts and 401(k) rollover accounts.

An important component of NAREIT’s outreach to the financial intermediary audience is our participation in financial intermediary and retail investor-focused conferences throughout the year. Financial intermediaries advise and manage approximately one-third of the $16 trillion of retirement savings in the U.S., including individual retirement accounts and 401(k) rollover accounts.

More than 10,700 people keep up-to-date on the latest news that matters to the real estate investment community via NAREIT’s Twitter feed (

More than 10,700 people keep up-to-date on the latest news that matters to the real estate investment community via NAREIT’s Twitter feed (