Since 2010, the apartment sector has been on a roll, in terms of occupancy gains and rents, which has driven returns through the roof. Combined with sale prices often in excess of replacement costs, these favorable economics have forced Adam Smith’s invisible hand into building apartments. Apartment construction is no longer a nascent trend, as supply additions will be back up to relatively normal levels in 2013, and make no bones about it – there are many markets with excessive new construction today, and many more coming.

Since 2010, the apartment sector has been on a roll, in terms of occupancy gains and rents, which has driven returns through the roof. Combined with sale prices often in excess of replacement costs, these favorable economics have forced Adam Smith’s invisible hand into building apartments. Apartment construction is no longer a nascent trend, as supply additions will be back up to relatively normal levels in 2013, and make no bones about it – there are many markets with excessive new construction today, and many more coming.

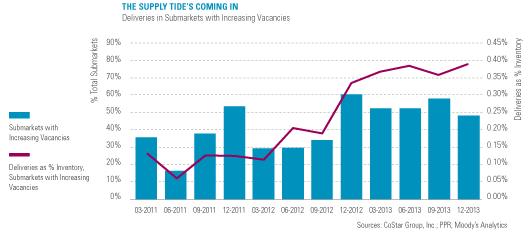

New construction will begin to push up apartment vacancy rates in some submarkets in 2013, a trend growing even more pronounced in 2014. Indeed, as the chart below shows, about 20 percent of submarkets tracked by PPR had rising vacancy rates in the second quarter of 2011, climbing to 30 percent in the third quarter of 2012. In these submarkets, quarterly deliveries as a percentage of inventory increased from 0.1 percent to 0.25 percent (0.4 percent to 1 percent of inventory on an annualized basis).

"New construction will begin to push up apartment vacancy rates in some submarkets in 2013."

Poster children for especially high levels of supply include the central and CBD submarkets in Austin, where more than 2,000 units are underway, and the far west side of San Antonio, which boasts Texas-size inventory additions of more than 1,700 apartments in the Westover Hills and Briggs Ranch neighborhoods. In North San Jose’s Oak Creek micromarket, almost 3,000 apartments are underway. In each of these cases, vacancies are expected to rise with the projects, until supply slows in 2014 and beyond and the markets tend toward equilibrium vacancy rates.

Does that mean that apartments are a bad investment? Not at all. Over half of the submarket clusters PPR tracks nationwide have less than 1.0 percent of the inventory underway, so few oxen are being gored here. However, it does mean that market, submarket, and street-corner selection are far more important than they were in 2010, when the only rising tides to be seen were jobs and renters.