The Nareit universe of REIT indexes is growing and evolving to match an expanding industry and increased demand for data.

Fifty years after the first REIT index launched in 1972, the Nareit universe of REIT indexes continues to expand and evolve along with the real estate industry and a growing appetite from investors and analysts for more benchmarking data.

Globally, there are now dozens of Nareit indexes published in conjunction with its partners, FTSE Russell and European Public Real Estate Association (EPRA), that track industry performance across a multitude of categories. The rise in both active and passive institutional investment in REITs is further fueling the demand for benchmarks that accurately reflect specific investment objectives. In fact, there are now an estimated $321 billion in total assets that are tracking various FTSE EPRA Nareit and FTSE Nareit index products.

The FTSE Nareit indexes play a key role in the market, providing highly regarded independent third-party data to different stakeholders including investors, asset managers, and analysts, notes David Zonavetch, managing director, co-head & portfolio manager, real estate securities – Americas at DWS. “As investors/analysts we use the data to run back tests at an index level and sub-index level, in addition to measuring performance versus a benchmark for our clients,” he says.

“These indexes have essentially become the industry standard for benchmark purposes,” adds Iman Brivanlou, managing director of High Income Equities at TCW and the TCW Global Real Estate Fund. “Whenever we have discussions with a prospect or show the performance of our funds, it’s almost table stakes to reference the FTSE Nareit Index and show our performance relative to that index,” he says.

Brivanlou also utilizes individual indexes for a specific property type or region as a “yardstick” when discussing investment mandates with a prospect or client. “To the extent that I want to differentiate my strategy, I can point to these indexes and say, look at my footprint as we may have more in this property type or this geography,” he says. In addition, the indexes contain a lot of useful information in terms of market weights for use in structuring funds, notes Brivanlou.

Leveraging Strengths of Key Partners

One of the key factors that differentiates the Nareit indexes from other REIT indexes is the partnership with FTSE Russell, a subsidiary of the London Stock Exchange Group that produces, maintains, licenses, and markets stock market indices.

“FTSE knows how to make the best indexes in the world and keep them updated every second of every day, while Nareit complements that with its perspective and understanding of commercial real estate,” says John Worth, executive vice president, research and investor outreach at Nareit. “We bring those two together, so you get world-class index construction married with an understanding of what’s going on in the commercial real estate space and what are the emerging trends,” he says.

The first Nareit REIT Index (now the FTSE Nareit U.S. Real Estate Index Series) was a broad market index that included equity, mortgage, and hybrid REITs. It was a research product that published monthly performance data. The index followed that general formation until the late 1990s when there was growing demand in the financial information space for more real-time performance benchmark information. “Portfolio managers and analysts needed and wanted index-level information on a real-time basis,” says Abigail McCarthy, senior vice president, investment affairs at Nareit.

As the index space became increasingly competitive in the early 2000s, it became obvious to Nareit that it needed to partner with a group that had all the tools and information systems in place to be able to effectively produce a real-time information product for the marketplace, notes McCarthy. The Global Real Estate Index began in October 2001 through a joint venture between Nareit, its sister organization in Europe, EPRA, and Euronext. In February 2005, FTSE Group assumed responsibility for calculating and distributing the renamed FTSE EPRA Nareit Global Real Estate Index Series.

“This partnership for the real estate index is unique in the sense that Nareit brings a lot of industry expertise,” says Catherine Yoshimoto, director, product management at the London Stock Exchange Group.

The FTSE, EPRA, and Nareit partnership has produced over 100 different individual indexes globally that package data in different peer sets, such as by country and property type. The real estate indexes allow users to benchmark performance relative to other industries and sectors, and also provide a basis for comparing how individual REITs compare to the overall industry.

“When you get the FTSE indexes, it’s not just a black box set of rules,” Worth says. Users get the resources of FTSE, and the research teams at Nareit and EPRA. And if users have a question or concern, there is actually someone to call and someone behind a decision that understands the REIT and real estate space, he adds. Some REITs have been dropped out of other real estate indexes because the index provider misunderstood the REIT business model and financial statements. “Our role in the index is to make sure things like that don’t happen, and that we’re evolving the indexes at pace with the way the industry is evolving,” he adds.

Indexes Continue to Evolve

Fifty years later, the FTSE Nareit U.S. All Equity REIT Index remains the default REIT benchmark for many analysts, investment managers, and investors. It also serves as the basis for many market-weighted REIT funds. “The index performance of that benchmark drives a lot of the narrative about REITs and the fund flows,” says Alex Pettee, president and director of research & ETFs at Hoya Capital Real Estate.

At the same time, the FTSE Nareit indexes have continued to evolve with new informational products that reflect the changing industry. “More so than any other equity sector, I think the importance of the indexes is more paramount in the REIT sector,” Pettee says. REITs are the most passively owned asset class, meaning the most index-driven asset class. “I think that’s largely because the index model has been so successful in REITs,” he says.

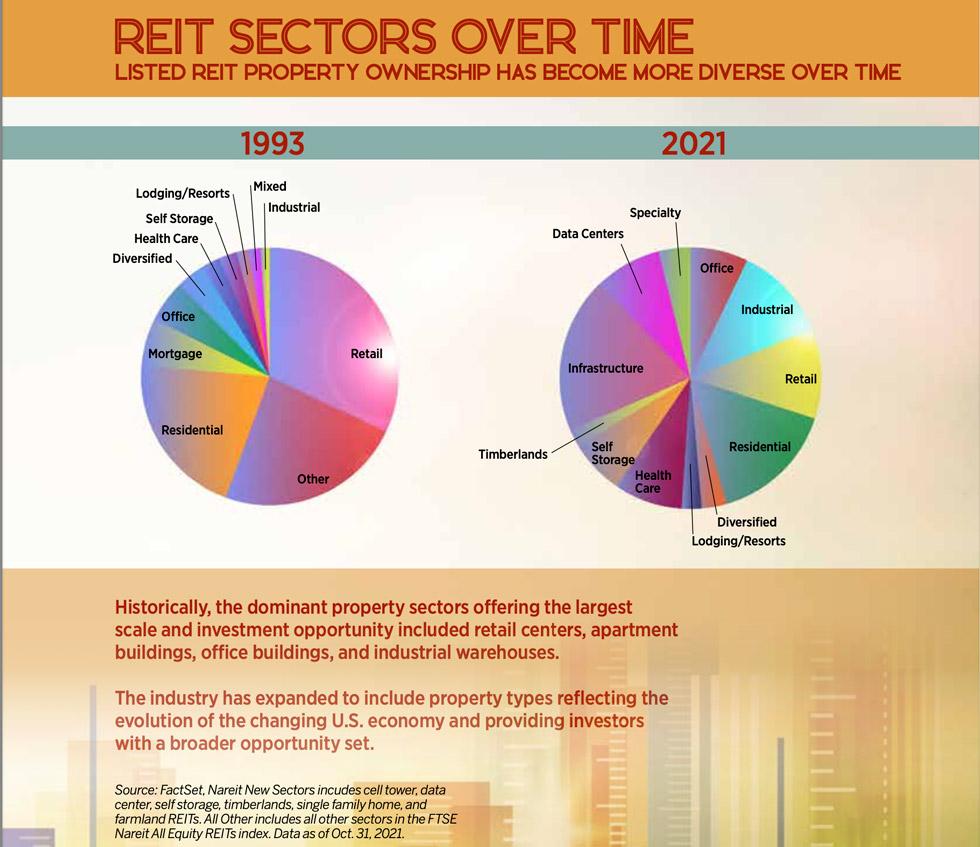

The pre-modern REIT model featured a larger number of diversified REITs. Indexes that showed REITs through a narrower lens of a property sector (a concept initiated by Nareit in 1993) have helped to shape how the sector grew in the modern REIT era. “If it hadn’t been for these indexes and the different ways to slice and dice the real estate sector, I don’t know if it would have evolved in the same way,” Pettee says. The property sector classification is what drives the REIT research at Hoya Capital. From the REIT perspective, it also makes sense to be included in one of these property sectors, because they tend to get more analyst coverage than those that don’t fit neatly into one sector, he adds.

Industry expansion beyond the core property types is reflected in growth of the indexes, and the FTSE Nareit U.S. series has traditionally been a little faster to adopt new property sectors, such as health care, self-storage, timberland, data centers, and infrastructure (including cell towers).

For example, data centers and cell towers have become critically important among REITs, now representing more than 20% of the FTSE Nareit All Equity REITs Index. FTSE, Nareit, and EPRA added data centers as a property sector to the global index series in 2019, and in 2021, FTSE Russell launched the FTSE EPRA Nareit Global Extended Index Series, which extended coverage of the standard benchmark by adding cell tower companies.

“It is this idea that as we are increasingly moving to a more digital economy, real estate is tracking that and making sure that the indexes stay up to date with the underlying real estate that houses the economy,”Worth says.

Another new addition in 2021 was the launch of the FTSE EPRA Nareit IdealRatings Islamic Index Series. In its Islamic Series, FTSE works with IdealRatings, which screens members of the FTSE EPRA Nareit Global Extended Index for Shariah principles. Initial demand for the global Islamic real estate indexes was driven by a U.S.-based asset manager seeking that type of investment mandate for international clients. Since then, there has been interest in the Islamic Index Series from other clients both in the U.S. and internationally, Yoshimoto notes.

“Client preferences are trending towards more coverage and more choice in terms of the ability to choose different exposures,” Yoshimoto says. “Once we have that initial index, then clients tend to look at what other screens they can apply, and we continue to discuss with clients what additional indexes we can provide for them.”

FTSE and Nareit also are working to develop products to satisfy the growing global demand for investment information that tracks performance of sustainable strategies. According to a research report published by the Global Sustainable Investing Alliance, global sustainable investment had reached $35.3 trillion at the start of 2020. In recognition of the demand for more benchmarking products, FTSE, EPRA, and Nareit introduced its Green Index series in 2018 that allows investors to identify real estate companies with strong sustainability performance.

For example, the FTSE EPRA Nareit Developed Green Focus Index as of November 2021 contains 292 constituents from 21 different countries. Constituent weights are adjusted (tilted) based on two sustainable investment considerations—green building certification and energy usage. “As we go forward, one of the expectations is that we will be generating more ESG-oriented products, both for the U.S. and globally,” Worth says.

Following Key Trends

The REIT indexes also continue to expand beyond property sector and geographic region with new products being developed around key themes such as e-commerce.

The FTSE Nareit New Economy Index, which launched in December 2020, offers a digital economy investment play within real estate. The 16 constituents are listed REITs from the infrastructure (which includes cell towers) and data center sectors, as well as industrial/logistics REITs that are involved in supporting the e-commerce economy such as communications, data centers, and logistics real estate.

The FTSE Nareit New Economy Index represents a formidable category with a market cap of roughly $495 billion—about one-third the size of the $1.47 trillion market cap of the FTSE Nareit All Equity REITs Index as of November 30, 2021. “Again, it is this idea that as we are increasingly moving to a more digital economy, real estate is tracking that and making sure that the indexes stay up to date with the underlying real estate that houses the economy,” Worth says.

Indexes also warrant credit in helping to attract some of the capital flowing to tech investments. For example, the Pacer Benchmark Data & Infrastructure Real Estate Sector Index (SRVR) was one of the first ETFs that targeted data centers and other tech REITs. Now with a market cap of about $1.6 billion, that fund has done extremely well in attracting a large base of investors, Pettee notes. There are now more vehicles that invest in these niche sectors, such as tech REIT funds or net lease funds or residential. “That is the innovation that we’re seeing most prominently. You’re seeing these property sectors put into investable products,” he says.

More Innovation Ahead

DWS is among those users that are continuing to push for more granularity and innovative data sets. In the future, there will likely be more demand to develop indexes that measure performance based on certain REIT factor exposures, Zonavetch notes. For example, DWS has increasingly drilled down in certain sectors, such as health care, where it can further segment by geography, lease structure, and government reimbursement to allow for better portfolio construction in different economic regimes, he says.

The evolution of the indexes also shows how FTSE and Nareit are creating products to meet investor needs. “Certainly, there is demand for more data and we’re looking at what additional data we can provide our clients,” Yoshimoto says.

Another emerging theme is that market participants want to cap certain exposures to comply with their investment mandates that limit certain constituent weights. In response to that demand, the partners launched the FTSE EPRA Nareit Developed Europe UCITS Daily Capped Index in 2020 that is a capped index monitored daily for breaches of UCITS target thresholds, and re-capped intra-quarter. In addition, as U.S. companies have grown to be a larger percentage of the global indexes, FTSE Russell is working on launching a series of indexes within the global series that will cap the U.S. weight for those that want to keep the U.S. weight below a certain percentage.

FTSE Russell is also looking at providing additional data that clients can use for screening within the index series. Those additional data sets pertain to how constituents are included or excluded from an index. “Clients really want to interrogate the data more,” Yoshimoto says. “So, they want more data points to be able to do that themselves, and really test the data and understand the data.”