REIT IR professionals offer insight into what it takes to keep their companies in touch with the investment community.

Stephanie Krewson-Kelly, vice president for investor relations at Corporate Offices Properties Trust (NYSE: OFC), likes to use a baseball analogy to describe the responsibilities of investor relations (IR) professionals at REITs.

“No two IR jobs are the same,” she says. “IR really tends to be the utility infielder position of every company. The array of responsibilities is fairly broad.”

But that doesn’t mean they’ve been relegated to their employers’ sidelines. Far from it, according to Peter Majeski, manager of investor relations and finance at lodging REIT Hersha Hospitality Trust (NYSE: HT).

“There is so much competition out there for capital,” he says. “Proactive IR is absolutely critical today, more so than it’s ever been.”

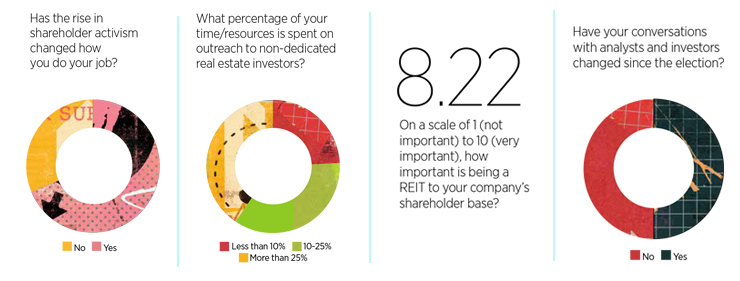

In early 2017, NAREIT polled IR chiefs at REITs about the ins-and-outs of their jobs. They say they are now engaged on multiple fronts as they work to showcase their companies in a time of political and economic change.

Conducted in March, the anonymous survey of more than 50 REIT IR professionals shows they are busy fielding questions about the outlook for growth; discussing the potential impact of the new administration’s policies; and educating generalist investors, among other things. REIT magazine also spoke on the record with a number of IR executives from different sectors across the industry to add some insight to the survey results.

Politics & Policy

Aside from obvious questions about companies’ prospects for growth, REIT IR professionals say the policies of the Trump administration and a Republican Congress factor heavily into their conversations with investors and analysts.

“The impact from policies that are likely to be enacted by a Republican congress and president are important questions that come up in every meeting,” one survey respondent remarked. Another respondent noted that there has been “significant interest in the effect of Trump administration policies on our business, primarily protectionist trade and tax policy.”

Talk of interest rates abounds after the completion of a major round of financing by data center REIT Equinix (NASDAQ: EQIX), according to Katrina Rymill, the company’s vice president of investor relations. Questions on immigration policy have also come up, she notes.

Meanwhile, Krewson-Kelly says COPT investors are most interested in any details the company can provide on the impact on future leasing from potential increases in defense spending. COPT focuses on providing real estate solutions primarily to U.S. government tenants and defense contractors in the information technology sectors of defense, most notably cybersecurity.

One comment from a survey respondent seemed to sum up the feelings of the group: “Whether it’s higher interest rates, lower regulations, tax reform, energy policy or the cabinet in general, most investors are very interested in what the new administration will mean for REITs and our business.”

On the other hand, David Bujnicki, senior vice president for investor relations and strategy at Kimco Realty Corp. (NYSE: KIM), says he spends considerable time countering the perception that Kimco is suffering from headwinds as a member of the retail REIT sector. His task is to “bring a sense of reality” to investors by showing that the company enjoys healthy operating fundamentals.

Traditional Communication Methods Preferred

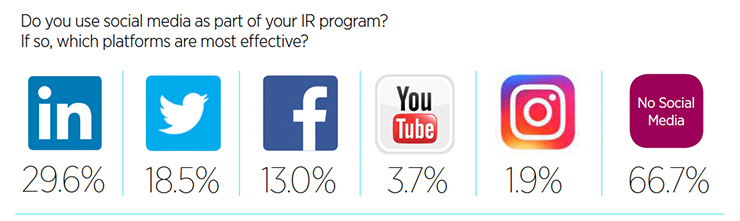

In terms of being proactive, REIT IR teams appear to prefer more traditional methods of communication to social media platforms. According to NAREIT’s survey, 67 percent of IR professionals are not using social media as part of their IR messaging.

Bujnicki says social media isn’t as “meaningful” a tool for IR as it is for the operating side of the company. While Kimco does use Twitter to disseminate financial information, Bujnicki highlights the importance of “continuing to meet with investors and analysts and articulating the strengths of our portfolio in any given economic environment.”

For Hersha, property tours are particularly effective, according to Majeski. “Any time that we can show investors our properties, it gives them a great opportunity to see how we differentiate the assets that we own and the operations that we run,” he says.

While Equinix has been looking at expanding the use of social media for IR purposes, Rymill says face-to-face meetings still “tend to be very effective in establishing relationships.” She cites the company’s Analyst Day event as “the best way to get people up to speed,” particularly with the complexities of data centers.

Brendan Maiorana, senior vice president for finance and investor relations at office REIT Highwoods Properties (NYSE: HIW), explains that for investors already familiar with the company, meetings with local property management teams are important.

“A big driver of the appeal of our company is our portfolio and the teams we have in the markets where we operate,” he explains.

More Time with Non-Dedicated Investors

An increasing number of IR conversations are being conducted with non-dedicated REIT investors.

NAREIT’s survey shows that 41 percent of REIT IR professionals spend more than 25 percent of their time and resources on this group. Maiorana sees the elevation of real estate to a separate sector in the Global Industry Classification Standard (GICS) and the maturation of the REIT market as catalysts for their increased participation. As a result, “we’re trying to do more work to garner interest from that constituency of investors,” he adds.

Krewson-Kelly said interest from non-dedicated investors increased “materially” at the beginning of 2016, prior to the GICS carve-out in September. The company is splitting its time about evenly between dedicated and investors, she notes, which isn’t necessarily a big change for COPT. “Our IR outreach has always embraced non-dedicated generalist investors.”

Bujnicki says he has also seen many more non-dedicated investors start to reach out and have discussions, although he notes that the situation has been “harder of late” due to generalists’ fears about the impact of rising interest rates.

For Equinix, which converted to a REIT in 2015, the emphasis has been in the other direction. “We’ve gone from spending zero time with REIT investors to trying to dedicate as much as we can,” Rymill notes.

Keeping a Close Eye on Activists

A majority of survey respondents said the rise of activist investors hasn’t changed how they do their jobs. Yet, as they meet with both dedicated and non-dedicated investors alike, that doesn’t mean they’re not paying close attention to potential challenges.

“You’d be foolish for it not to be on your radar,” states Majeski. Even without an activist investor involved with your company, “it’s always good to regroup and recalibrate and make sure you’re telling the right story to your investors.”

According to one survey respondent, “everyone is more aware of activists and what can happen to companies that do not listen to shareholders.” One respondent whose company had been targeted by activists commented, “We are mindful of making sure we are always pushing our story out.”

“We spend much more time on governance issues than we did 10 years ago,” another respondent noted.

Equinix’s Rymill says she monitors whom the company meets with and pays attention to shareholders who tend to have an activist nature. “Internally, we make sure we are prepared and run through those different scenarios,” she points out.

Importance of Being a REIT

On a scale of one to 10, with 10 signifying “most important,” REIT IR professionals ranked the importance of being a REIT at eight.

Krewson-Kelly thinks the compulsory dividend component of the REIT structure will always carry weight with investors. “The global demand for passive fixed income that comes from a dividend-paying stock has only grown. With the aging demographics in the U.S. and other countries, it’s very important,” she says.

For his part, Maiorana sees many advantages to being a REIT in the eyes of shareholders. “It’s a very effective corporate structure,” he says.

Bujnicki rates the importance for Kimco of being a REIT at 10.

“Being a publicly traded REIT, there tends to be greater transparency, better disclosure and greater access to capital. Publicly traded REITs also own the highest-quality properties,” he states.