Global real estate investors say COVID-19 continues to cast a long shadow, although the market remains fundamentally healthy.

REIT magazine spoke to four global real estate investors to record their views on the issues impacting the industry today, the regions and property sectors where they see potential for growth in the months ahead, and what is most likely to keep them up at night.

The continued impact of COVID-19 on the economy and consumer behavior remains top of mind for global real estate investors as they look ahead to 2022. While uncertainty remains a key theme, experts also say that fundamentals are solid and investment demand remains robust due to real estate’s attractive yields and inflation protection benefits.

How does your organization incorporate listed global real estate into your product offerings?

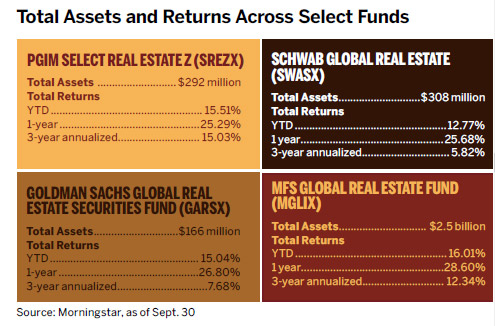

Rick Gable: MFS serves both institutional and retail investors through its real estate investment portfolios. We invest a majority of the assets in publicly listed securities. In the United States, we offer the MFS Global Real Estate Fund (MGLIX), a mutual fund, and we also can work directly with institutional clients through a separate account structure. Many of our multi-asset portfolios include dedicated allocations to real estate as well, including our target date and target risk asset allocation strategies.

Furthermore, MFS employs a global research platform of about 300 investment professionals who share information across regions, sectors, and subsectors, which may result in direct exposure to listed real estate securities in other MFS-managed portfolios based on our proprietary views on each individual opportunity.

Kristin Kuney: We (GSAM) have a mix of both retail and institutional investors and we offer all flavors of real estate strategies—U.S., international, and global—depending on what the end investors want access to. We also offer specialized strategies within each, as well as a global infrastructure strategy that has some crossover with real estate, like communication and technology-related real estate.

Wei Li: Charles Schwab Investment Management allocates to global REITs or domestic REITs in many of our multi-asset solutions used by both institutions and retail clients. Our $30 billion suite of target date funds allocates about 5% of equity assets to REITs, while our model portfolios have a strategic weighting to REITs of 7% of equity assets. Our target date funds are used by retail investors and are included in institutional 401(k) plans and other retirement plans. Our model portfolios are used by advisers serving their own clients.

Rick Romano: Our investor base at PGIM is both institutional and retail. We offer global listed real estate offerings in core listed, select listed, income listed, and completion strategies. We also have global listed strategies available as part of private real estate strategies.

What effect do you envision inflation having on real estate investment in the U.S. and abroad next year?

Kuney: Real estate historically has been a beneficiary of rising inflation, given that the majority of leases have either annual, fixed, or inflation-linked escalators. Also, inflation makes new supply more expensive to pencil for developers, which is inherently good for real estate. Less new supply gives existing assets greater pricing power, which increases the cash flow and value of the properties.

Li: Real estate investments can provide a long-term hedge against inflation. In the U.S. and globally, some property types have built-in, inflation-indexed lease structures, while others have short-term leases that allow landlords to adjust rates based on market conditions. We believe that the sector can provide good returns in a rising inflation environment when coupled with healthy economic growth.

Gable: The environment looks good for now in most markets, as inflation is above trend and borrowing costs remain low. This means property fundamentals should stay strong. Investment demand for real estate also continues to be robust, partly due to the high relative yield it provides, and because it provides good inflation protection.

I will grow more concerned next year if borrowing costs start to increase and inflation starts to decelerate, but remains above trend. This would indicate to me that real estate investors will need to get more conservative in their underwriting of rents and occupancy, as businesses and consumers could start to have problems absorbing the higher prices. I suspect that investors may seek out longer lease length assets if the U.S. economy shows signs of slowing in 2022.

As you look at global markets, which ones are you monitoring in terms of possible breakout growth?

Gable: We think India and Mexico both have potential for breakout growth, as the demand for institutional grade real estate continues to grow from domestic users, and from international tenants that are attracted to the countries for their abundant and cheap labor and, in the case of Mexico, the near-shoring opportunity.

Li: Real estate values have recovered nicely in the U.S. and Europe, although property types such as hotels and offices still lag. Values are still depressed in some regions, such as Asia and South America. Future pandemic developments will drive the direction of returns in the hardest-hit sectors and regions.

Kuney: We’re watching both Europe and Asia as they progress further out of the pandemic. Will travel resume as strongly by Asians and Europeans as we’ve seen from Americans when their populations feel it’s safe enough to do so? We believe consensus estimates for growth are likely too low across Europe if one believes the region will reopen and recover in a similar way that the U.S. has thus far.

Romano: We are finding the best growth opportunities in coastal residential properties in the U.S. due to some migration occurring to urban areas as cities open up and people more fully return to work. We also like urban retail in the United Kingdom as cities like London more fully reopen, and we like continental Europe industrial due to secular growth trends in e-commerce. In addition, we are watching Hong Kong retail and Japanese hotels as borders reopen.

How has the pandemic affected global real estate investors so far, and what sort of impact do you think it will have in 2022?

Romano: COVID-19 may have permanently shifted the demand curve for office space globally. There will continue to be a headwind to office demand as hybrid work adoption increases, and next year some tenants may make more permanent decisions on space needs. This is likely to negatively affect office globally and resize the office footprint.

Gable: Investors have done amazingly well so far, as long as they didn’t panic at the depth of the pandemic sell-off. Most of the themes that were well-established before COVID-19 are still in place today: secular concerns about the future demand for retail and office space, and very strong demand tailwinds in towers, data centers, and industrial.

I think the impact will lead to even more divergence in fundamental performance between companies in all property types because the pandemic effectively accelerated existing trends, like retail store closures, supply chain reconfiguration, and hybrid office structures.

Li: The shift from the office to work from home is probably one of the biggest long-lasting changes from the pandemic. According to The Economist, 77% of jobs posted to a tech job board now mention the word “remote.” As the pandemic continues to subside, we will see if this becomes permanent and how it affects the office real estate space, although a lack of new supply could provide a cushion to the lack of growth there.

Looking ahead to 2022, which issues might be keeping global real estate investors up at night?

Romano: The big question for us is: When will COVID-19 truly be in the rearview mirror, and when will we get to a fully operational global reopening? The timing of that will have a major impact on what property types outperform in 2022.

If we continue to see new COVID variants stall a full reopening, that will hinder global economic growth and, in particular, the recovery-focused property types like hotels. Additionally, if we were to see a sharp spike in interest rates, that may have a negative impact on asset pricing, particularly for long-lease duration property types.

Kuney: First and foremost, the pandemic and its effects continue to be top of mind, as well as its continued influences on consumer behavior, political matters, and such. Given the wide disparity in global vaccination rates, we are monitoring how the various markets reopen or must at least partially roll back re-openings. These factors affect most areas of the property markets, with residential, retail, office, and industrial being the biggest ones.

Globally, we’re also spending more time evaluating the political landscapes and how the rise in populism may influence various countries and markets. In the U.S., we are paying attention to tax changes and incentives that may affect business and resident “friendliness” and desirability.

Li: As with the equity market, inflation trends and interest rate moves would have significant impacts. There are pockets in the real estate market that are trading at rich valuations, making them vulnerable to higher interest rates.

Gable: I think there are a lot of ESG-related issues that will keep investors on their toes in 2022 and beyond because they impact every aspect of a real estate company’s business, like asset management, leasing, capital markets, underwriting, development, acquisitions, operations, corporate overhead, and capital expenditures.

While a lot of focus has been placed on real estate and non-real estate companies achieving operational emission reduction targets via actual emissions reductions and/or carbon credits, my sense is that embodied carbon will be a more important issue for real estate investors going forward. The commercial real estate industry can and should play a critical role in reducing embodied carbon.

Which real estate sectors are you watching in terms of potential growth in 2022?

Romano: One property type that we are keeping a close eye on in terms of potential growth in 2022 is hotels. While leisure and pleasure travel bounced backed nicely in the summer of 2021, corporate travel remains troubled. If we can move beyond the delta variant and other variants and get to a more robust reopening, then hotels could be a big beneficiary in 2022.

Gable: Due to a lack of supply and strong demand, we think multifamily, single-family rentals, and manufactured housing will stand out. The high-quality companies in those property types will be able to push rents with the help of high levels of occupancy, and we also think they have a great opportunity to control costs and expand margins with the help of technology. Strong pricing power should continue to exist for industrial landlords as well, driving above-average growth.

Li: Self-storage REITs and single-family rental REITs have experienced the highest net asset value (NAV) growth since the end of 2019. Going forward, we see sustained growth in tower REITs, supported by secular tailwinds such as 5G deployments and increasing use of mobile data. We expect industrial and warehouse REITs will continue to benefit from rising e-commerce trends, as well as better sales and inventory management by retailers.

Kuney: We believe technology-related real estate sectors should see accelerating growth in 2022 after a more subdued year in 2021. We also see a rebound in growth for parts of health care like senior housing, as well as the lodging sector—barring any setbacks with COVID-19. Multifamily should also produce strong organic growth, given the speed and sharpness of the sector’s rebound this year.

Which aspects of ESG are being watched most closely in terms of their impact on global asset performance?

Gable: Governance-related metrics for public real estate companies have been the most topical, as there is a clear relationship between underperformance and measures of excess compensation and a lack of diversity.

Carbon emission targets have received a lot of attention, as company-level and portfolio-level targets have been set, and disclosure has increased. However, many companies are just starting to report detailed information for the first time, let alone make improvements toward science-based targets, so I am not putting much faith yet in the link between those metrics and the impact on global asset performance since the measurement period is so short.

Kuney: A greater focus on being green and lower emission targets are the primary standards we’re seeing on the environmental front. This is being driven by not just landlords, but also and likely more so by the larger corporate tenants who also need to make progress on this front and have set goals for themselves and/or their investors. Governance and being socially responsible also continue to be top of mind for investors globally.

We actively engage with our companies globally on practices that we believe should be implemented and/or enhanced on the stewardship side. We have our own set of policies on this front. In the U.S., we vote against the full board of directors if there are no women on the board. We also vote against the nominating committee if there is not one woman and one additional diverse director, such as a second woman, a racial/ethnic minority, or an LGBTQ individual.